Bitcoin Price Prediction as BTC Blasts Past $23,500 Resistance, Here’s Where BTC is Headed Next

Bitcoin has recently surged past the $23,500 resistance level and is now headed for new highs. With the price of Bitcoin continuing to rise, many investors are wondering where it will go next. In this article, we will explore some of the factors that could affect its price in the near future and make predictions on where it could be headed.

On January 30, Bitcoin opened trading at $23,746 and has seen some fluctuations over the past 24 hours. It has dropped by approximately 0.92% at the moment and is being traded at $23,238.

The highest value reached by BTC/USD was of $23,784 in the same period while its lowest point was recorded as $23,110. Nevertheless, it has still witnessed an overall increase of over 2% within the past week.

Bitcoin Difficulty Just Hit A Record High: What Does This Mean For Crypto Investors?

On 29th January, the difficulty of Bitcoin mining surged to an unprecedented level. This 4.68% increase in difficulty occurred at a block height of 774,144 with the total difficulty rising from 37.59 trillion to 39.35 trillion – a new all-time high.

💥BREAKING: NEW #BITCOIN DIFFICULTY ATH! 👇🔥 pic.twitter.com/GH8xkonb4k

— Crypto Rover (@rovercrc) January 30, 2023

Recently, the difficulties posed by Bitcoin mining have seen a substantial increase of 48 percent. This can be attributed to the 26.64 trillion difficulty measurement recorded on January 21 of last year.

A blockchain is made more secure by increasing its difficulty level as it makes it much harder for attackers to succeed in their attempts. Also, when the mining difficulty increases relative to the global hashrate, new blocks become harder to be mined.

On January 29, the difficulty of Bitcoin’s entire network increased by 4.68%, and the hashrate continued to increase to 295 EH/s. The price of Bitcoin has risen by 40% since January, Antminer T17+, Whatsminer M20, etc. have also returned to above the shutdown price.

— Wu Blockchain (@WuBlockchain) January 29, 2023

The mining difficulty of Bitcoin increases as the security of its network becomes stronger, even though miners need to put in more effort. Moreover, whenever there is an increase in the number of miners, it ultimately leads to a larger network size with an improved long-term value for BTC/USD.

Core Scientific Submits a $6 Million Bitmain Coupon Sale Request

On January 25, Core Scientific, a bankrupt Bitcoin mining corporation, filed an emergency appeal in court to sell Bitmain coupons worth $6.6 million as per the records.

Core Scientific has approached the court to get approval to sell off Bitmain vouchers, which are not relevant to their business anymore. For this, they have filed an application with the Southern District of Texas Bankruptcy Court in Houston Division.

Core Scientific has $6 million worth of Bitmain coupons, but they are facing some difficulties. It is not possible to convert these product-specific coupons into cash with Bitmain. It is only possible to use their coupons to purchase S19 miners from Bitmain. Unfortunately, the current circumstances don’t make these coupons useful due to the various conditions specified.

Bitmain’s coupons were set to expire in March/April 2023, when the company expects to have completed its Chapter 11 bankruptcy reorganization. The firm also stated that it will not purchase any more S19 miners throughout or after the completion of Chapter 11.

On 21st December 2022, Core Scientific, a leading American cryptocurrency mining company, was forced to file for bankruptcy due to the high energy costs they were incurring, reduced profit margins, and decreasing BTC/USD exchange rate.

Get Ready For Interest Rate Hikes

A working paper by Daniel Ringo, recently referenced by Fortune Magazine on Twitter, suggests that the Federal Reserve’s aggressive rate hikes in its effort to contain inflation may be contributing to the growing inequality gap.

Investors are keeping a close eye on Jerome Powell’s press conference post the policy meeting to get an idea of how interest rates may move in the future and at which point will the Federal Reserve pause its rate hike.

There are a number of economic events to pay attention to this week:

— LunarCrush (@LunarCrush) January 30, 2023

– Consumer Confidence (TUES)

– Fed Rate Hike (WED)

– Jobless Claims (THURS)

– Unemployment Rate (FRI)

Watch how these events unfold live, in real-time with Level 5 on LunarCrush: https://t.co/ScCiRvR9ni pic.twitter.com/ylAfdLdhSf

At the Federal Reserve meeting on February 01, investors anticipate a 0.25% boost in the federal funds rate to 4.5%-4.75%, which will result in a gradual rise for the second consecutive time.

According to the Labor Department’s report, which is set to be released on February 3rd, an estimated 185,000 jobs will be added in January, which is lower than the 223,000 recorded in December.

Positive economic developments are expected to have a positive effect on the prices of BTC/USD.

Bitcoin Price

Currently, the price of Bitcoin is $23,258 and has lost over 1% over the last 24 hours. Its market volume is estimated to be at $26 billion while its market cap stands at an impressive $488 billion and holds the first position on CoinMarketCap’s rankings.

On the 4-hour timeframe, the BTC/USD price is struggling to break above the $24,000 resistance level and has fallen to retest the $23,000 support level.

A break below this level has the potential to send Bitcoin’s price down to $22,600 or $22,350. The $23,000 support zone is driven by the 4-hour timeframe’s 50-day moving average, and closing candles above this level has the potential to drive a bullish reversal in the BTC/USD price.

Consider looking for buying positions over $23,000 with a target price of $23,550 or $24,000. Alternatively, sell positions can be taken if the $23,000 support zone is breached.

Bitcoin Alternatives

CryptoNews recently published a list of the 15 most promising cryptocurrencies for 2023. If you want to invest, there are alternative ventures that can provide a good return if you do your research.

Cryptocurrency investors and traders are constantly monitoring altcoins and ICOs in the digital asset arena to stay on top of all emerging trends and opportunities.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

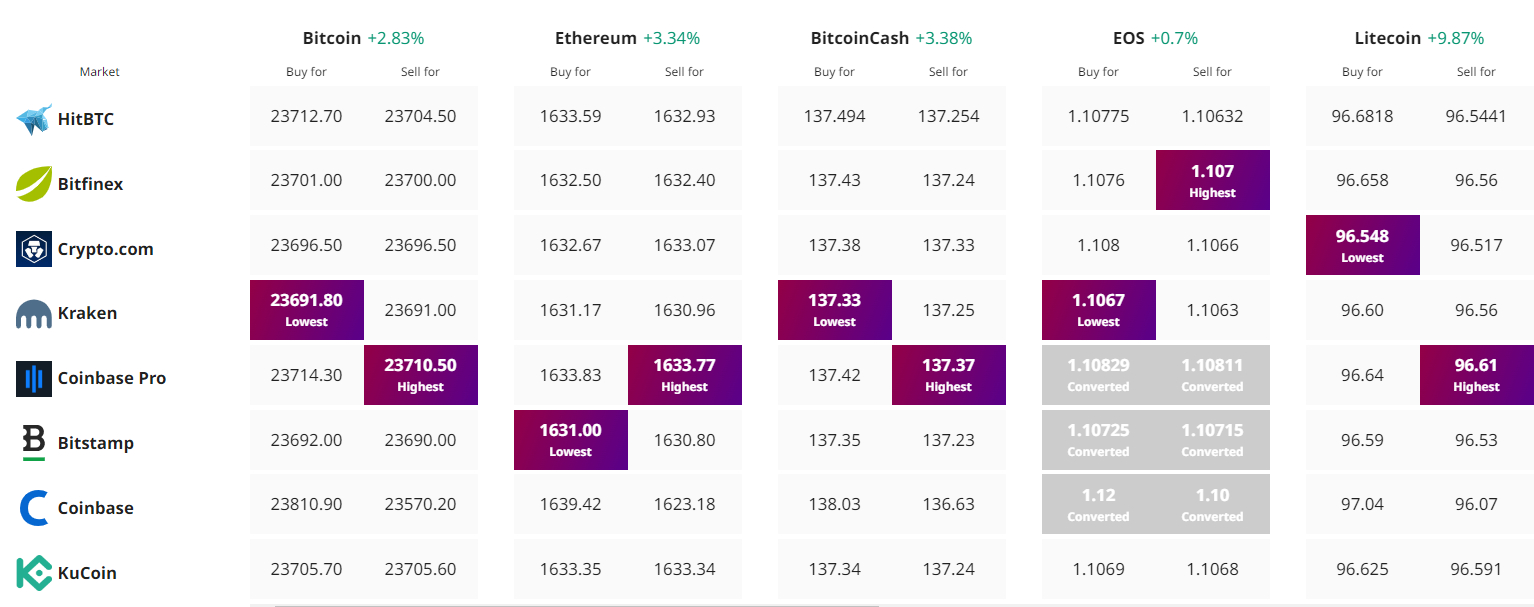

Find The Best Price to Buy/Sell Cryptocurrency