Bitcoin Price Prediction As BTC Approaches Key Support Level – Where Is the Next BTC Target?

Bitcoin has been experiencing a volatile period, with the cryptocurrency dropping by nearly 4% over the past week. As of the time of writing, BTC is approaching a key support level, with analysts closely monitoring the market to determine where the next target for the digital asset will be.

In this context, it is essential to explore the factors that could impact the price of BTC in the short and long term.

How Rising Interest Rates Affect Bitcoin And Other Digital Assets

In January, inflation rose 5.4% compared to the previous year, according to the Personal Consumption Expenditures (PCE) report released by the Bureau of Economic Analysis (BEA) on February 24.

Core inflation, which the Federal Reserve prefers to use for measuring inflation, increased by 4.7% since January 2022. The US Dollar Index (DXY) reached 105.26, its highest level since January 6, reflecting the impact of rising inflation.

The Federal Reserve has set 2% overall inflation as its target, and it is anticipated that more interest rate increases will occur to address inflation. As a result of the potential rate hikes, the majority of the market anticipates the Federal Reserve to continue increasing interest rates.

When the PCE data revealed a 5.4% increase in inflation in January, BTC/USD decreased, indicating Bitcoin’s sensitivity to rising interest rates.

Cryptocurrency Investing And The Cautionary Stance Of The IMF

During the G20 conference in Bengaluru on February 25, IMF Managing Director Kristalina Georgieva suggested that banning private cryptocurrencies could be an option. The IMF has also proposed new guidelines for its member countries on regulating cryptocurrencies, outlined in a February 23 report.

The agency’s nine-point action plan emphasizes the need to avoid recognizing cryptocurrency assets as official money or legal tender, while implementing tighter regulations on virtual currencies to improve financial stability.

The IMF’s strict stance on cryptocurrencies could result in increased oversight and regulation, which may impact the acceptance and value of BTC/USD.

What Is Bitcoin Mining Difficulty And How Does It Affect Profitability?

On February 24, 2023, the difficulty of mining bitcoin reached an all-time high (ATH). According to on-chain data, the mining difficulty climbed to 43.05 in the most recent recalculation at block 778,323.

Over the last two weeks, the difficulty of mining bitcoin has increased by 9.95% to a new all-time high, indicating that more miners are entering the market to profit from the rise in BTC price.

The mining difficulty measures how many iterations miners must perform to obtain the hash of a Bitcoin block. As a result, the complexity of solving a block increases with its size, reducing mining profitability.

While mining difficulty does not directly affect price, an increase in difficulty results in a higher energy requirement to mine one BTC, making it more expensive for miners to stay profitable.

A firm yet rangebound BTC is a positive indication for bulls. Despite the current dip in Bitcoin price, the asset has the potential to recover. Miners are also bullish about the BTC/USD price rebound.

Bitcoin Price

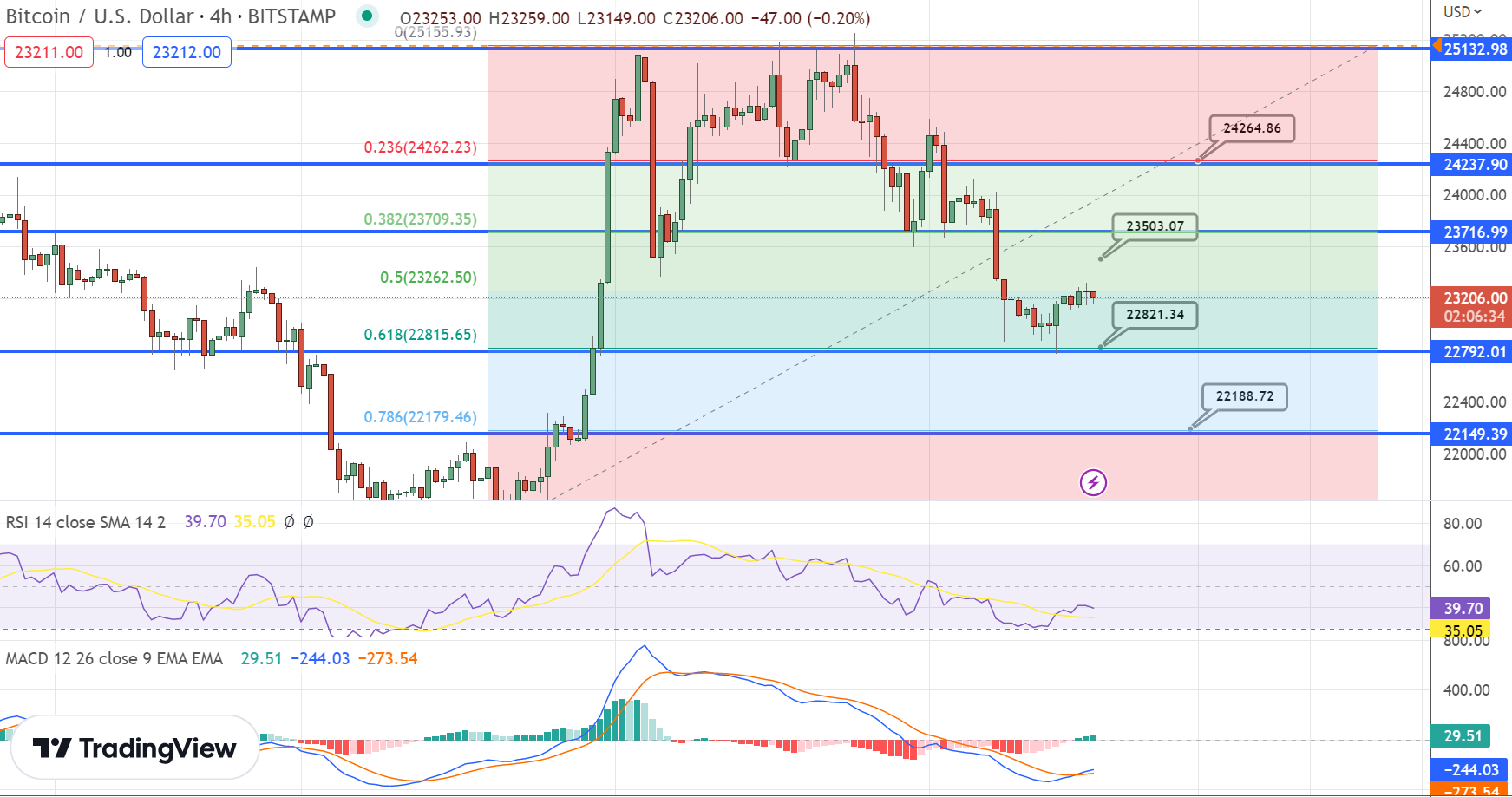

On February 26, BTC/USD began trading at $23,177.00. Currently, it is trading at $23,245.00, marking a 0.78% increase in the last 24 hours. The highest value of BTC/USD in the last 24 hours was $23,302.00, while the lowest value was $23,083.00. However, the value of BTC has decreased by over 5.5% in the past week.

The BTC/USD pair’s immediate support level is at $22,800, and if it breaks below this level, it could potentially expose the price of BTC to the next support area at the $22,150 level.

Bitcoin is still facing resistance at the $23,500 level, while its immediate support level remains at $22,800. A break below the support level could expose BTC to the next support area at $22,150.

However, since the BTC/USD pair has entered the oversold zone, there is a chance that BTC may rebound and break through the resistance level at $23,500, potentially resulting in a price of $24,250.

Bitcoin Alternatives

Investors looking to buy into Bitcoin may want to consider alternatives with more room for growth in the short term. Cryptonews has released an in-depth analysis of the top 15 cryptocurrencies that investors may want to consider for 2023. Click below to find out more.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

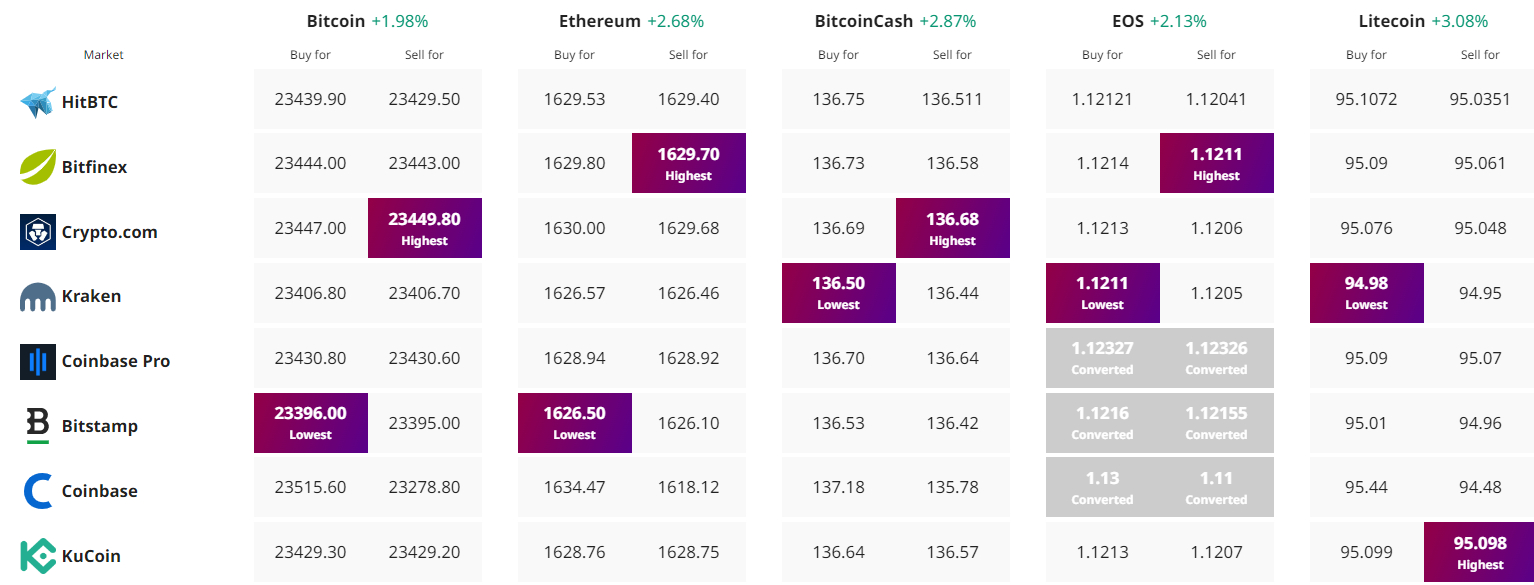

Find The Best Price to Buy/Sell Cryptocurrency