Bitcoin Price Prediction as BTC Approaches $31,000 Resistance Zone – Can it Blast Up Higher?

As Bitcoin (BTC) swiftly approaches the critical $31,000 resistance zone, investors and traders alike are eagerly awaiting its next move. The world’s leading cryptocurrency has demonstrated remarkable resilience, with its value continuing to surge despite various market challenges.

Will it manage to blast up higher, shattering expectations and setting new milestones, or will the resistance prove too formidable to overcome?

In this analysis, we will delve into the factors influencing Bitcoin’s price trajectory and provide valuable insights into its potential future performance. Stay tuned to get a comprehensive understanding of the complex dynamics at play in this ever-evolving market.

US Retail Sales Slump in March: Winter Spending Frenzy Cools Down

In March, US retail sales experienced a 1% decline, signaling a loss of momentum from the previous winter spending spree. As consumers adjusted their spending habits following a period of heightened demand, the retail sector is now grappling with the impact of this slowdown.

Huge miss in US retail sales data!

— tedtalksmacro (@tedtalksmacro) April 14, 2023

Headline:

-1.0% vs -0.4% expected (prev. -0.2%)

Core:

-0.8% vs -0.4% expected (prev. 0.0%)

Again, a sign that disinflation is going to be faster than expected, which should be bullish risk – there’s still some juice left to squeeze in the…

This downturn in consumer spending could have broader implications for the economy and financial markets, including potential repercussions for the cryptocurrency market.

Recent developments have prompted traders to wager on a quarter of a percentage point increase in the central bank’s lending rate next month. Consequently, Bitcoin’s price experienced a 1.71% decline over the past 24 hours, as investors gravitated toward traditional investments like stocks.

Dollar bounces as retail sales drop, Fed governor hawkish https://t.co/G62IlPl2C3 pic.twitter.com/7G3f9ne4oE

— Reuters U.S. News (@ReutersUS) April 14, 2023

The Federal Reserve is anticipated to implement another rate hike in May before taking a pause, reaching the highest levels since the 2007 global financial crisis. However, market uncertainty persists due to the potential for higher-than-expected inflation, prompting investors to proceed with caution.

Fed’s May Rate Hike: A Turning Point for Bitcoin’s Bull Run

As the US Federal Reserve gears up for a highly anticipated interest rate hike in May, market participants are speculating on its potential impact on Bitcoin’s performance. Although a tightening monetary policy often leads to a stronger US dollar and increased pressure on risk assets, some experts argue that this rate hike may actually mark the peak of the tightening cycle.

If that proves to be the case, Bitcoin could potentially benefit from the ensuing period of monetary easing, as investors seek alternative assets to hedge against inflation and currency devaluation.

Check the latest Bitcoin price predictions on CoinCodex.

Exploring Tesla’s Bitcoin Investments and Dispositions: A Financial Overview

Tesla liquidated 75% of its Bitcoin assets in Q2 2022, securing a profit of $64 million. However, since that sale, Bitcoin’s value has surged by over 50%, which implies that Tesla could have potentially gained an extra $500 million had they delayed the sale.

In February 2021, Tesla initially invested $1.5 billion in Bitcoin and earned $165 million in profit from two separate sales. Despite this, Tesla’s residual Bitcoin holdings currently exhibit a loss of $56.6 million.

Tesla selling Bitcoin last year turned out to be a $500M mistake – https://t.co/Sxjer0Olkb pic.twitter.com/6Gds2HsWQ3

— discount24.com.de (@Discount24D) April 14, 2023

Tesla’s prior Bitcoin dispositions coincided with periods of weak free cash flows, suggesting that Musk utilized Bitcoin as a financial buffer during cash-strapped phases. Nevertheless, the influence of this information on Bitcoin’s market price remains ambiguous.

Bitcoin Price

In terms of technical analysis, the BTC/USD pair exhibits a clear upward trajectory as it approaches the $30,250 mark. If this barrier is surpassed, Bitcoin may face resistance at $30,600 before progressing to $31,000 or possibly even $32,250.

On the other hand, Bitcoin maintains solid support around the $29,600 level, and a downward break beneath this point could extend the bearish trend to the $28,900 mark.

Alternative Coin – Love Hate Inu (LHINU)

An intriguing new meme coin to explore is Love Hate Inu, a dog-meme-inspired social media polling platform that has recently gained significant online traction. Over the past few weeks, it has captured the attention of internet users worldwide.

Love Hate Inu is an emerging digital currency that blends the widespread appeal of meme coins, such as Dogecoin, with the practicality of Ethereum. It employs a vote-to-earn mechanism that allows users to stake their coins, vote, and subsequently earn additional tokens.

The presale commenced on March 8th, and within just two days, it had successfully generated more than $200,000. The presale of Love Hate Inu has experienced remarkable success, amassing more than $4.1 million since its inception on March 7.

The community’s unwavering support has fueled this momentum, which analysts predict will persist until the presale’s conclusion. Presently, the presale price stands at $0.000115, and it is anticipated to reach $0.000145 by the end of the presale period in a few weeks.

Buy Love Hate Inu Now

Top 15 Cryptocurrencies to Watch in 2023

To keep up with the latest ICO projects and altcoins, it’s advised to regularly check the expert-curated list of the top 15 cryptocurrencies to watch in 2023. By doing this, you’ll stay well-informed about emerging trends and opportunities within the crypto market.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

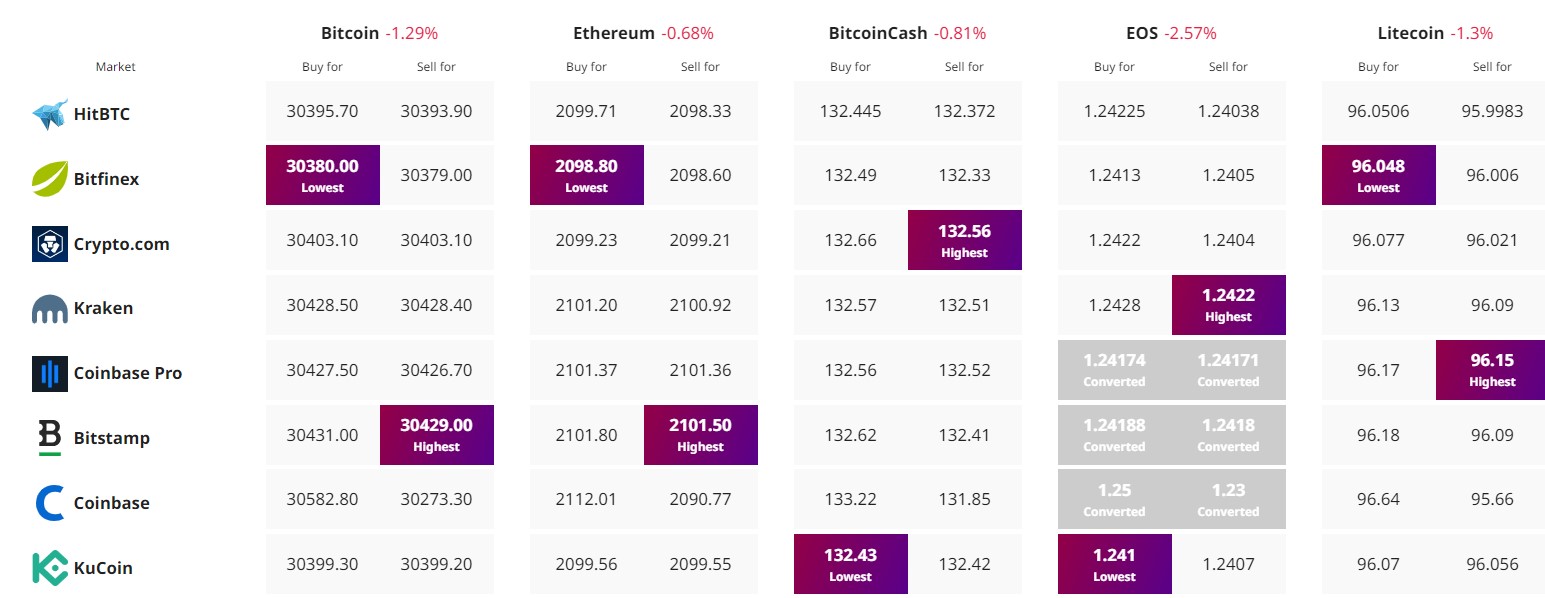

Find The Best Price to Buy/Sell Cryptocurrency