Bitcoin Price Prediction as $15 Billion Trading Volume Comes In – Are Whales Buying?

In the dynamic world of cryptocurrency, the recent surge in Bitcoin’s trading volume, which reached a staggering $15 billion, has captured the attention of market observers.

In the dynamic world of cryptocurrency, the recent surge in Bitcoin’s trading volume, which reached a staggering $15 billion, has captured the attention of market observers.

This substantial increase in trading activity raises questions about the involvement of whales, the influential players with significant holdings of Bitcoin.

As the market eagerly anticipates the direction of Bitcoin’s price, let’s delve into the factors influencing this surge in trading volume and explore whether whales are actively buying, potentially signaling a bullish sentiment in the cryptocurrency market.

Bitcoin’s “Sharks” and “Whales” Accumulate: On-Chain Data Reveals Investor Behavior

Bitcoin’s on-chain analytics indicate that the “sharks” and “whales,” referring to moderate and large holders, respectively, have accumulated Bitcoin since the market’s peak in April.

The supply distribution metric, which measures the total amount of Bitcoin held by different wallet groups, shows a decline in holdings during the March surge and subsequent accumulation during the downtrend in April.

🐳 Addresses holding between 10 to 10,000 #Bitcoin appear to be staying cautious as the price has fluctuated between $26k to $30k over the past month. Regardless, they have accumulated a combined 93K $BTC as prices fell from the local top in mid-April. https://t.co/wz5SVdOf1e pic.twitter.com/7D91TnVOtD

— Santiment (@santimentfeed) May 29, 2023

Since April, these investors have added approximately 93,000 BTC (equivalent to $2.6 billion) to their wallets.

However, their accumulation has slowed in recent weeks, suggesting caution as the cryptocurrency faces challenges.

The behavior of these large investors will likely influence the market sentiment and future price movements of Bitcoin.

ADP Non-Farm Employment Change

The May ADP National Employment Report shows a stronger-than-expected growth of 278,000 jobs in the private sector, along with a notable 6.5% increase in annual pay.

This is your weekly reminder that the US labor market remains secularly tight.

— Bob Elliott (@BobEUnlimited) June 1, 2023

CC in line with mid-3% UE and stable. IC stable and low despite uptick from '22 boom. ADP remains pretty strong.

Realtime 'actual' data are the best emp indicators & show nothing close to recession. pic.twitter.com/OLUne0CEgM

This positive outcome is seen as favorable for the US dollar, further contributing to the bearish sentiment surrounding Bitcoin.

Bitcoin Price Prediction

Bitcoin is currently trading at $26,858 on June 1st, marking a 1% decrease within the last 24 hours. The cryptocurrency has been downward for the fourth consecutive session, indicating a bearish trend.

This aligns with the mixed sentiments observed in the broader cryptocurrency market. Bitcoin’s price is exhibiting a slightly bearish sentiment, with its value hovering around the 26,850 level.

Analysis of the four-hour timeframe reveals that Bitcoin has already reached the 78.6% Fibonacci retracement level and subsequently declined toward the next support level at 26,650.

The significance of this support level was discussed in our previous update, as breaking above it has the potential to trigger a bullish reversal in Bitcoin’s price.

The market sentiment is currently dominated by bears, indicated by the presence of a bearish engulfing candlestick formation below the 50-day exponential moving average.

However, there is a possibility of a trend reversal as long as the price remains above the 26,600 level.

In such a scenario, we may witness an upward movement with potential resistance levels at 27,300, 27,500, or even 28,000.

On the downside, if Bitcoin breaches the 26,600 support level, it could signal further downside with a target around 26,000 for sellers.

Top 15 Cryptocurrencies to Watch in 2023

Get ready to explore a captivating lineup of cryptocurrencies handpicked by Cryptonews and Industry Talk for their promising prospects in 2023.

Brace yourself for the exciting possibilities and captivating opportunities that lie ahead in the world of these digital assets.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

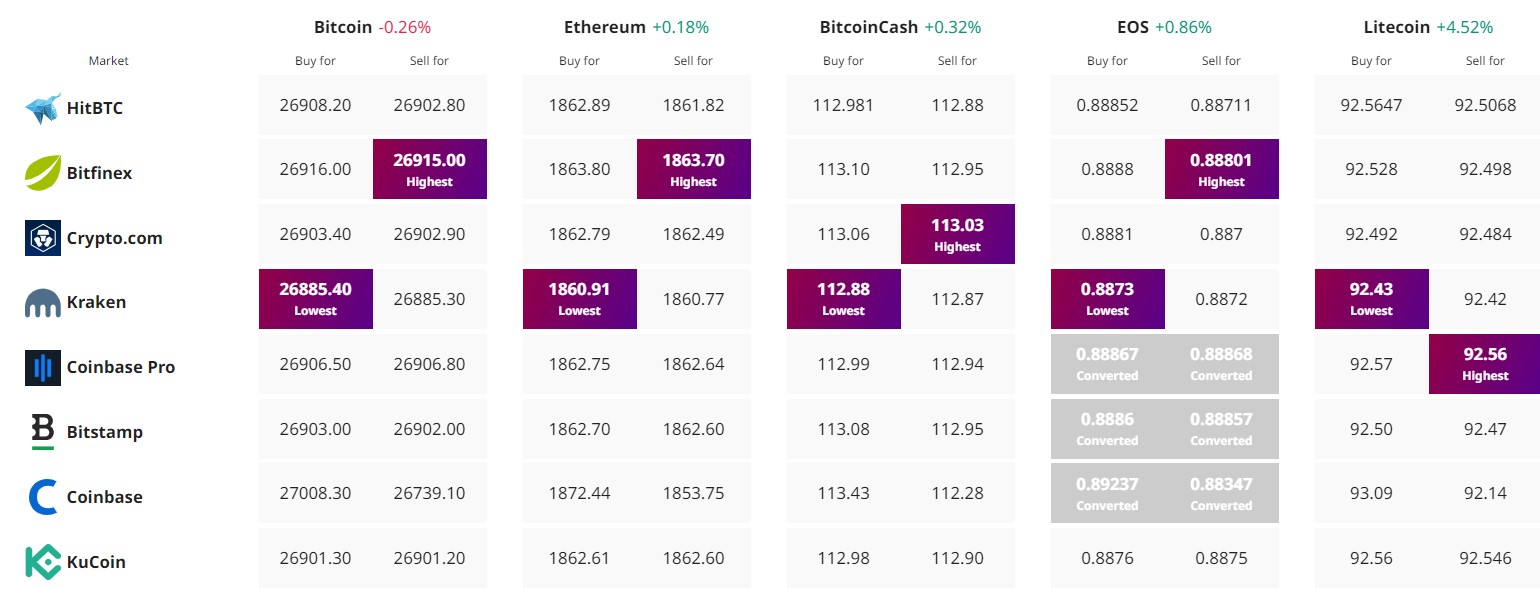

Find The Best Price to Buy/Sell Cryptocurrency