Bitcoin Price and Ethereum Prediction: Will BTC & ETH Sustain Their Gains After the FOMC Meeting Minutes Reveal?

Bitcoin (BTC), the largest cryptocurrency, reversed its modest losses from the previous day and regained traction above the $30,000 level once more. Meanwhile, Ethereum (ETH), the second-largest cryptocurrency, broke through the $1,900 barrier and outperformed Bitcoin.

In addition, other cryptocurrencies, such as Dogecoin (DOGE), Litecoin (LTC), and Solana (SOL), exhibited strong performance as well.

Woke up#BTC above 30k#ETH en route to 2k

— Kong Trading 🦍 (@KongBTC) April 13, 2023

IT'S GOING TO BE A GREAT DAY!!!🫡🚀🚀🚀

Nonetheless, the driving force behind the ongoing bullish rally can be attributed to positive inflation data and the Ethereum Shanghai upgrade, both of which are contributing to the sustained growth of the crypto market. The global cryptocurrency market has been demonstrating exceptional performance.

At the time of writing, the global crypto market capitalization stood at $1.23 trillion, marking a 1.20% increase over the past 24 hours.

BREAKING: Consumer Price Index data has just been released. Biden's anti-inflationary policies are WORKING despite what Conservatives claim about inflation. Here are the details of the data just released moments ago:

— Brian Krassenstein (@krassenstein) April 12, 2023

– CPI rose just 0.1% Month-over-month

– Annualized Consumer… pic.twitter.com/2Ytzj63cmn

As previously mentioned, Bitcoin is currently trading above $30,000, while Ethereum has risen by 2% to $1,908.20. Ethereum has outpaced Bitcoin, owing to a new update that enhances staking flexibility.

Consequently, this development is expected to boost market liquidity and bolster the security of the blockchain, ultimately contributing to an increase in Ethereum’s value in the future.

Upbeat Crypto Market – Impact of US inflation data on Bitcoin Prices

The global crypto market has been flashing green and rose moderately on Thursday, thanks to the release of lower-than-expected US inflation statistics, which fueled speculation that the Federal Reserve will likely finish its rate-tightening cycle sooner than expected, affecting the value of cryptocurrencies like Bitcoin.

According to statistics released on Wednesday, U.S. consumer prices increased by 0.1% in March. This resulted in an annual increase of 5.0%, the weakest 12-month growth since May 2021.

*GLOBAL STOCKS EDGE HIGHER AS U.S. INFLATION DATA LOOMS LARGEhttps://t.co/TUwUY5rYEk pic.twitter.com/OuQMaerOjU

— Investing.com (@Investingcom) April 12, 2023

The core CPI, which excludes volatile food and energy costs, rose 5.6% annually, up from 5.5% the month before, which was below the 5.2% forecast, although underlying inflation pressures remained high.

Therefore, the probability of an early end to the rate-tightening cycle might soon result in a rise in Bitcoin prices. In addition, the prospect of a small recession later this year, as predicted by the minutes from the March Fed meeting, may lead to the central bank lowering interest rates before the year ends.

This will likely have a long-term influence on the cryptocurrency market, including Bitcoin, because lower interest rates may lead to rising inflation, increasing the attraction of alternative assets like cryptocurrencies.

Zebedee and Bitnob’s Bitcoin Gaming Collaboration in Africa May Propel BTC Value

Zebedee, a fintech and payment processing company, has recently partnered with Bitnob to offer African gamers the chance to earn Bitcoin by playing popular games like Counter-Strike.

This move highlights the increasing adoption of the Bitcoin Lightning Network in gaming and its potential to transform how gamers are rewarded.

#Gamers in #Africa Can Earn #Bitcoin While Playing Classic Titles pic.twitter.com/i1NhMSQXcd

— Crypto News Update (@CryptoNewsLiveU) April 13, 2023

Thus, the partnership is expected to increase the popularity of Bitcoin in Africa, potentially leading to a surge in BTC prices. As more African gamers earn Bitcoin through Zebedee-powered games, the demand for BTC may increase, driving up its value in the long term.

Argentina’s First Regulated Bitcoin Futures Index Approved, Expected to Boost BTC Adoption

On the flip side, the launch of Argentina’s first regulated Bitcoin futures index on the Matba Rofex exchange in May has provided a safe and transparent way for qualified investors to gain exposure to Bitcoin in a market struggling with high inflation.

#Argentina Approves First Regulated #Bitcoin Futures Index pic.twitter.com/33I656D5lt

— Crypto News Update (@CryptoNewsLiveU) April 13, 2023

Hence, the move is part of the country’s strategic innovation agenda and follows Binance’s recent expansion into Argentina, highlighting the growing interest in cryptocurrencies.

It is also worth noting that the Bitcoin futures contract’s acceptance is likely to benefit Bitcoin’s price as it becomes more accessible to investors looking for alternative investment choices due to the pro-crypto position and greater popularity.

Bitcoin Price

From a technical standpoint, Bitcoin is facing substantial resistance near the $30,580 threshold. Should candle closes drop below this point, it may initiate a downward trend towards $29,500, and heightened selling pressure could potentially drive Bitcoin’s value even lower, reaching the $28,950 mark.

Bitcoin has exhibited a bearish engulfing candle, which generally indicates that the upward drive is losing steam and exposing a bullish tendency.

Ethereum Price

The price of Ethereum began a downward correction from the $1,940 region against the US Dollar. In the short term, ETH may revisit the crucial $1,840 support level.

Ethereum’s price attempted to secure further gains above the $1,925 and $1,940 resistance levels. However, similar to Bitcoin, ETH faced difficulty in consolidating its position above the $1,925 resistance zone.

A successful close above the $1,925 level, accompanied by a rise above $1,940, may propel the price towards the $2,000 resistance level. The next key resistance could be around $2,120. Any additional gains might set the stage for a test of the $2,200 resistance level.

Top 15 Cryptocurrencies to Watch in 2023

Keep abreast of the latest ICO projects and altcoins by frequently consulting the expert-curated list of the top 15 most promising cryptocurrencies to watch in 2023, as recommended by industry specialists at Industry Talk and Cryptonews.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

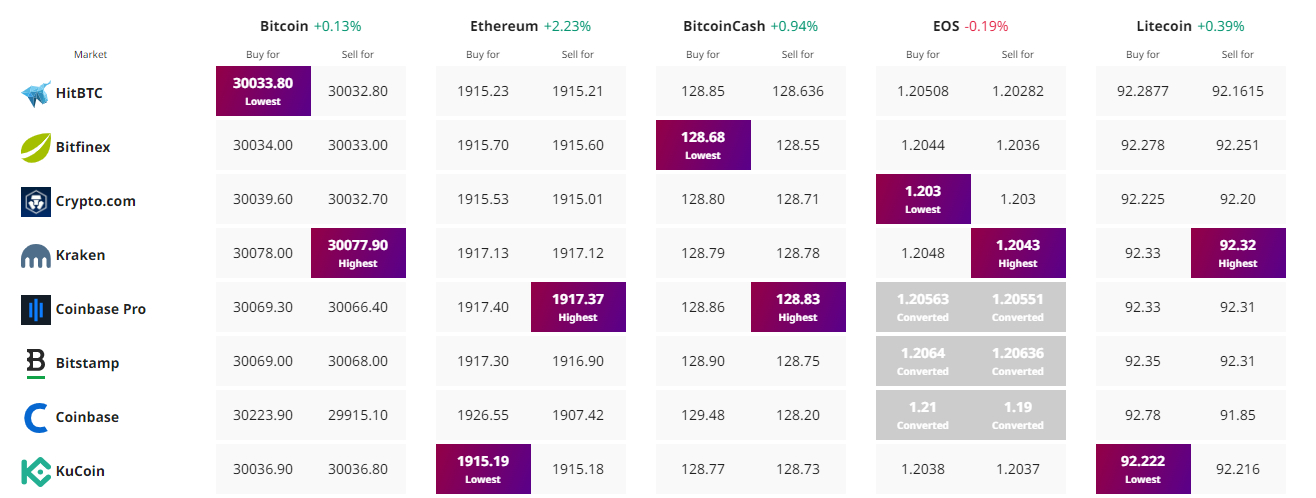

Find The Best Price to Buy/Sell Cryptocurrency