Bitcoin Price and Ethereum Prediction: Can US CPI Figures Trigger Big Gains?

In the past few days, most major cryptocurrencies, including Bitcoin and Ethereum, have experienced a decline in their prices. As a result, Bitcoin has now fallen below $22,000, continuing its downward trend, and the global cryptocurrency market cap is approaching the $1 trillion threshold.

As the day progresses, the primary focus of the market will continue to be the US CPI figures, which have the potential to cause significant price movements in the cryptocurrency market.

Can US CPI Figures Trigger Big Gains?

The latest US CPI (Consumer Price Index) figures have the potential to trigger big gains for Bitcoin and Ethereum. As inflation rises, investors often seek out alternative assets like cryptocurrencies as a hedge against inflation. This can lead to an increase in demand for Bitcoin and Ethereum, driving up their prices.

Additionally, as more people become aware of the potential benefits of cryptocurrencies, we may see an influx of new investors entering the market, which could further boost prices.

However, it’s important to keep in mind that the cryptocurrency market is highly volatile, and there are many other factors that can influence prices, so predicting their exact trajectory can be challenging.

Understanding the Impact of US CPI Figures

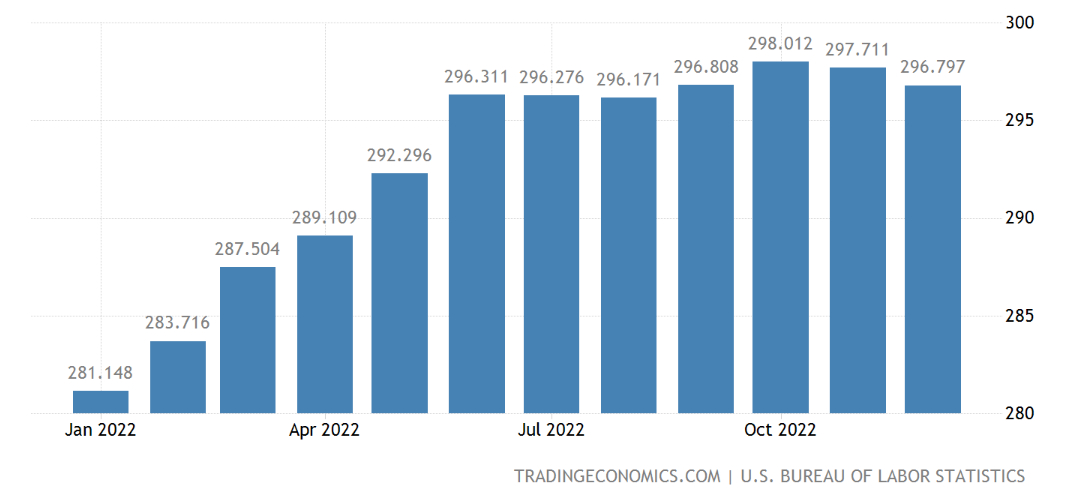

The annual inflation rate in the US is expected to fall for the 7th consecutive month in January by 0.1% to 6.2% from 6.5% in December, marking a decline from last year, and the lowest reading since October of last year. Core inflation decreased to 5.4% this month, which is the lowest it has been since October 2021. The fall in core inflation is probably due to other economic indicators such as a lower unemployment rate and the weakness of foreign currencies.

However, on an annualized basis, the CPI is likely to have risen 0.5% in January, following a 0.1% gain in December and tracking the increase of prices for gasoline and used cars. Core prices are seen growing by 0.4%.

Although inflation peaked at 9.1% in June, the Fed’s 2% target remains above the inflation rate and the price level is showing to increase. In December, the CPI in the US was 296.

Headline US CPI is expected to come in +6.2% YoY on Tuesday.

— tedtalksmacro (@tedtalksmacro) February 13, 2023

Truflation are expecting headline US CPI @ 5.8% YoY, which is significantly lower than consensus.

They've been quite good recently 👀 pic.twitter.com/lrNEzyCIyA

Consumer prices declined for a sixth consecutive month in December and were at the lowest level since October 2021. Inflation is expected to decline in January. This would be the lowest decrease in inflation in recent history & especially noteworthy because CPI has not gone below 6% since September.

Bitcoin Price

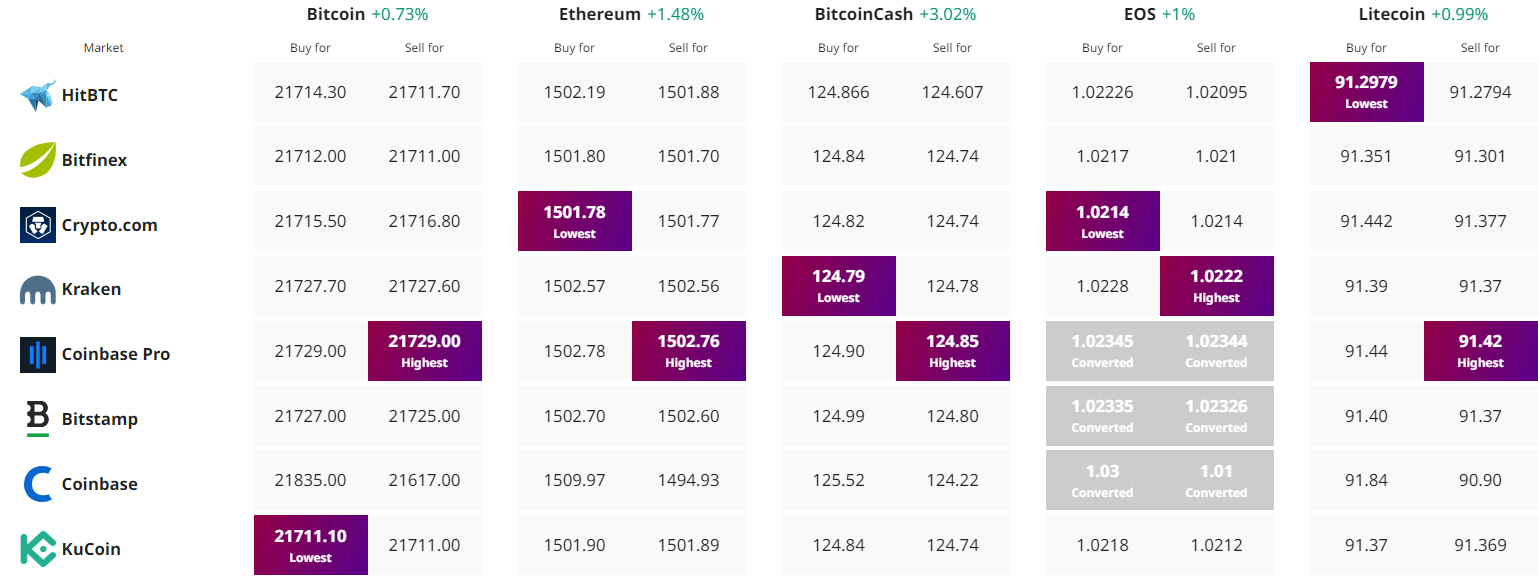

As of today, the live Bitcoin price is $21,700 with a 24-hour trading volume of $22 billion. Bitcoin is down 0.14% in the last 24 hours and its ranking on CoinMarketCap is 1. Its market cap is $418 billion dollars.

From a technical perspective, Bitcoin has breached a critical support level of $21,700 and is currently moving downward toward the next support zone at $21,290. If the price continues to drop, it may encounter resistance at the 38.6% Fibonacci retracement level of $21,290.

However, if the bearish trend persists, Bitcoin could potentially fall even further to the 50% Fibonacci retracement level of $20,300.

However, there is potential for a bullish bounce for BTC price if candles close above the $22,375 level. If buyers step in and increase buying pressure, BTC could reach the next resistance of $24,260.

Ethereum Price

Today’s live Ethereum price is $1,500 with a 24-hour trading volume of $8.1 billion. The current CoinMarketCap ranking is 2 and the live market cap is $183.78 billion dollars.

Ethereum is currently trading slightly above its 38.2% Fibonacci retracement level of $1,500, which is also functioning as a double-bottom support level. If the candles close above $1,500, there is a chance for an uptrend to reach the $1,560 level.

The current resistance level is due to an upward channel that was broken previously. If ETH breaks above $1,560, it could potentially reach the $1,600 or $1,680 level.

Breaking above the $1,560 level would help maintain Ethereum prices and provide better profit-making opportunities for ETH traders. Failure to do so could result in a decline in ETH prices, with a potential drop to the $1,435 level.

Bitcoin and Ethereum Alternatives

We have listed the top 15 cryptocurrencies for 2023 based on their projected market capitalization, but there are many other promising options to consider if you are looking to invest in cryptocurrencies. It’s worth noting that new cryptocurrencies and ICOs are emerging regularly.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

Find The Best Price to Buy/Sell Cryptocurrency