Bitcoin Price and Ethereum Prediction – BTC to Hit $23,000 Soon?

During the Asian session, the Bitcoin price is trading near $20,480, struggling below the 61.8% Fibonacci retracement level of $21,000. Similarly, Ethereum has plunged over 2% to $1,579.

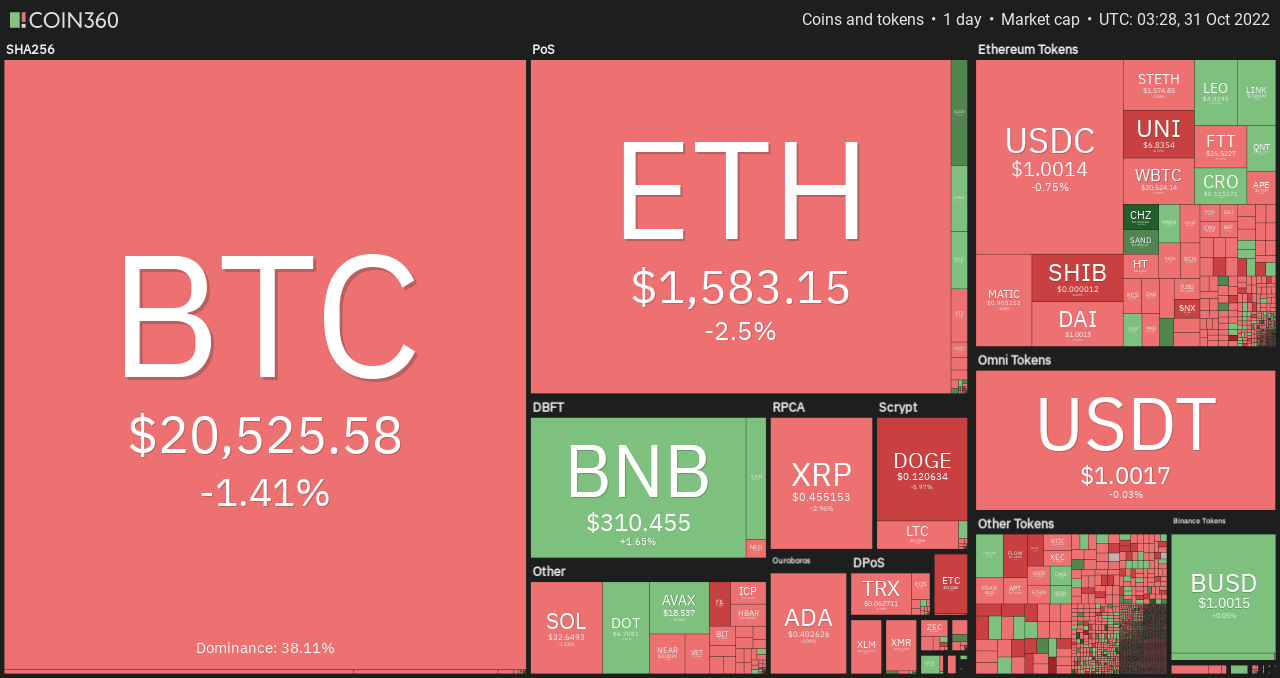

Early on October 31, major cryptocurrencies were trading in the red. However, the global crypto market cap is still above $1 trillion, with a trading volume of $72 billion, down from $91 billion.

This week, investors’ major focus will stay on the US Federal Reserve monetary policy, which is coming out on November 3.

Top Altcoin Gainers and Losers

The top performers in the last 24 hours were Chiliz (CHZ), Algorand (ALGO), and The Sandbox (SAND).

The price of CHZ has increased by more than 15% to $0.2298, while the price of The Sandbox (SAND) has increased by nearly 10% to $0.89.

At the same time, ALGO has increased by more than 7% to $0.36.

Shiba Inu (SHIB) fell more than 7% this week to $0.000012, while Lido DAO (LDO) fell more than 8% to around $1.5.

Professor Steve Hanke: US Economy Was Flat Last Year, but ‘It’s Going to Hit South’

Johns Hopkins University professor of applied economics Steve Hanke predicts a “quite big recession” in 2023 due to the economy’s current state of disarray, which is characterized by central bank interventions, supply chain problems, and soaring inflation.

On October 28th, in an interview, Hanke indicated that he now gives a 90% risk of a US recession, because he feels the money supply has tightened at an “unprecedented” rate.

Johns Hopkins University’s applied economics professor continued:

We had the money supply being goosed in early 2020, when COVID hit, we had the money supply growing, on average, about three times faster than it should have been growing to hit a 2% inflation target. As a result, we had a lot of inflation.

High Rate of US Inflation

A problem for the United States is its high rate of inflation. The price index for personal consumption expenditures (PCE), the primary inflation indicator used by the Federal Reserve, rose 0.5% in September.

Plus, according to the CPI report for September, prices for common goods and services increased by 8.2%.

#US #inflation rate:

— Chintala Bvss (@Chintala_Bvss) October 27, 2022

2022: 8.2%

2021: 7%

2020: 1.4%

2019: 2.3%

2018: 1.9%

2017: 2.1%

2016: 2.1%

2015: 0.7%

2014: 0.8%

2013: 1.5%

2012: 1.7%

2011: 3.0%

2010: 1.5%

2009: 2.7%

2008: 0.1%

2007: 4.1%

2006: 2.5%

2005: 3.4%

2004: 3.3%

2003: 1.9%

2002: 2.4%

. .

1930: -6.4%

1929: 0.6%

Professor of economics Hanke emphasized the importance of the topic of quantitative tightening during an interview.

Fed to Hike Rate by 75 bps

The volatility and price action in the cryptocurrency market depend highly on the US Federal Reserve policy rate. We will know more by the end of the week as to whether we are at the beginning of the end or the end of the beginning of the efforts by the major central banks to tame blazing inflation rates.

The #Fed will likely maintain its hawkish stance next week, raising the prospects of #US and global #recessions, economists say https://t.co/jxXPOLoTeb via @business II $SPX #inflation #economy #fintwit $TLT #bonds #BTC #Crypto #econtwitter pic.twitter.com/RURrbE3V1Z

— Grimm's FX Fairy Tales @GFXFTS (@GFXFTs) October 28, 2022

This week’s monetary policy meetings will see rate hikes from the Reserve Bank of Australia, the US Federal Reserve, and the Bank of England. What they might say about future rate hikes is more interesting than by how much they would raise rates in the near future.

The Federal Reserve is expected to raise the federal funds rate by 75 basis points, but market participants will be more interested in hearing whether Chairman Jerome Powell will signal a smaller increase of 50 basis points in December or maintain the hawkish tone he has displayed in previous comments.

Officer David Solomon last week said the U.S. Federal Reserve could hike rates beyond 4.5-4.75% if it does not see "real changes in behaviour." #FED #FOMC #SPYhttps://t.co/Rjw9GAmRZc

— IWillBeKnown (@_IWillBeKnown_) October 30, 2022

There has been a slight turnaround in financial markets as a result of the Fed’s softer tone in recent weeks.

Despite a severe sell-off in the big technology stocks, the US stock market is up about 9% in the past two weeks. The cryptocurrency market is supported by the positive correlation between stocks and cryptocurrency.

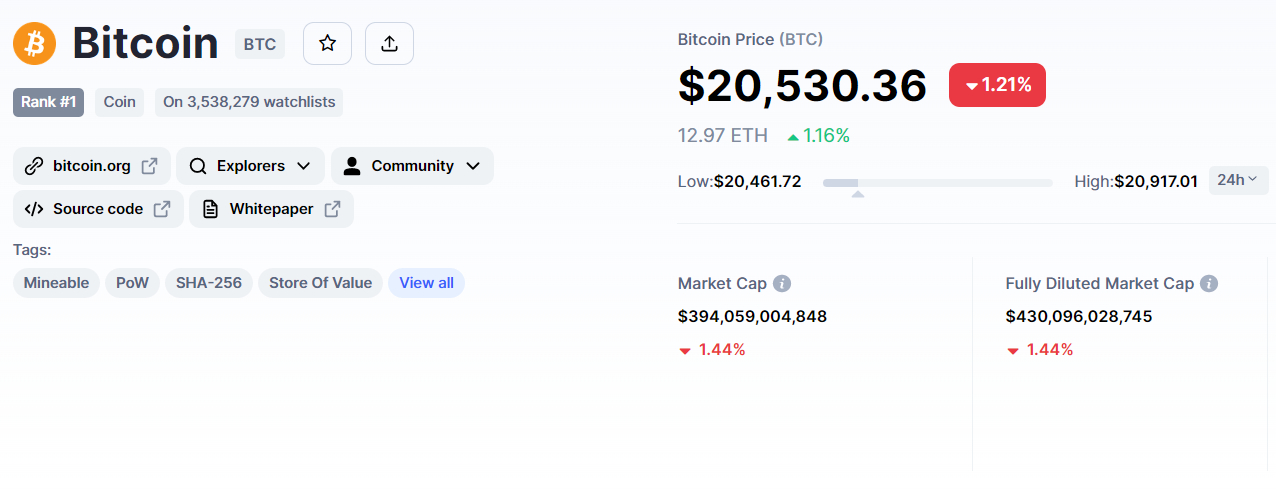

Bitcoin Price

The current Bitcoin price is $20,530, and the 24-hour trading volume is $32 billion. Bitcoin has surged over 5% in the last seven days. CoinMarketCap currently ranks first, with a live market cap of $393 billion, down from $400 billion on Sunday.

The BTC/USD pair is currently consolidating in a broad trading range of $20,000 to $21,000, which is spanned by Fibonacci retracement levels ranging from 38.2% to 61.8%. However, the overall trading environment remains positive.

The RSI and MACD remain in the bullish zone, indicating that the upward trend is likely to continue. Furthermore, the 50-day moving average suggests buying above $19,700.

As a result, a break of the 61.8% Fibo level ($21,000) could push the buying trend all the way to $21,900. If the current upward trend continues, Bitcoin could reach $22,500.

On the negative side, Bitcoin’s immediate support level remains near $20,250. Today, investors may look to buy if a bullish breakout of $21,000 occurs, and vice versa.

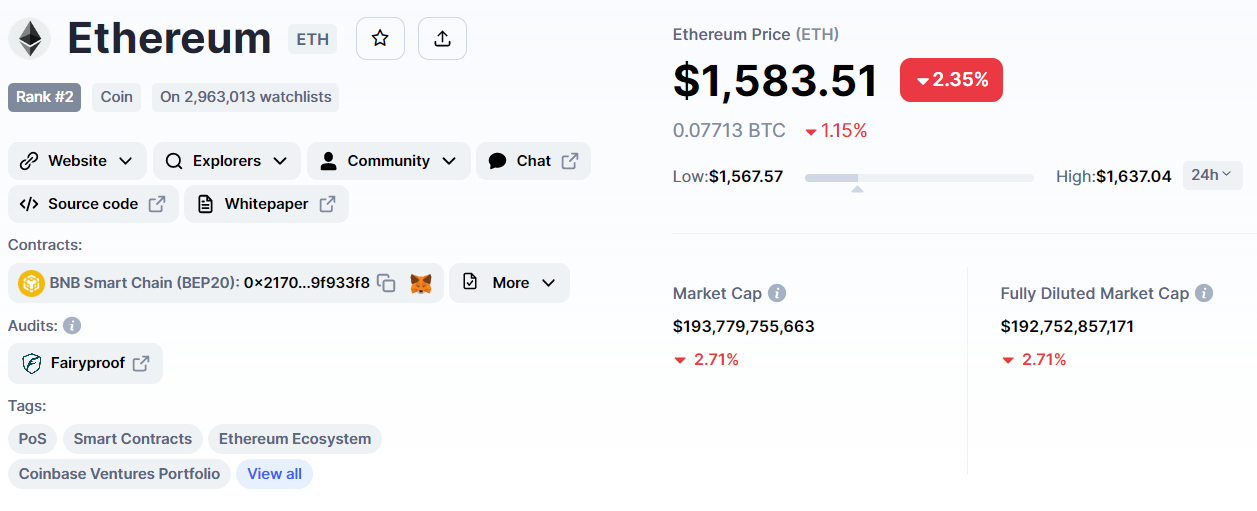

Ethereum Price

Ethereum’s current price is $1,583, with a 24-hour trading volume of $14 billion. In the last seven days, Ethereum has increased by more than 17%. CoinMarketCap is now ranked second, with a live market capitalization of $192 billion, down from $199 billion on Sunday.

On the technical side, Ether is consolidating in a narrow range of $1,545 to $1,650 level which is being extended by a 61.8% Fibonacci retracement tool. If the price of ETH exceeds $1,650, it might hit $1,700 or $1,810.

The RSI and MACD, leading technical indicators, still remain in the buying zone. As a result, the chances of a bullish bounce-off remain strong above $1,550. At the same time, support continues to stay at $1,404 today.

New Crypto Presales

Aside from Bitcoin and Ethereum, other coins on presale are performing well and garnering attention. Dash 2 Trade, for example, is an Ethereum-based platform that seeks to give real-time analytics and social trading signals to its users; the amount generated thus far reflects a strong vote of confidence in the platform.

Following the presale, the network plans to launch its platform in the first quarter of 2023, with its D2T coin expected to be listed on numerous markets.

In less than a week, the Dash 2 Trade presale has raised over $3.4 million, putting it on course to become one of the year’s largest token sales. The Dash 2 Trade presale is still going on; D2T tokens cost $0.05 USDT.

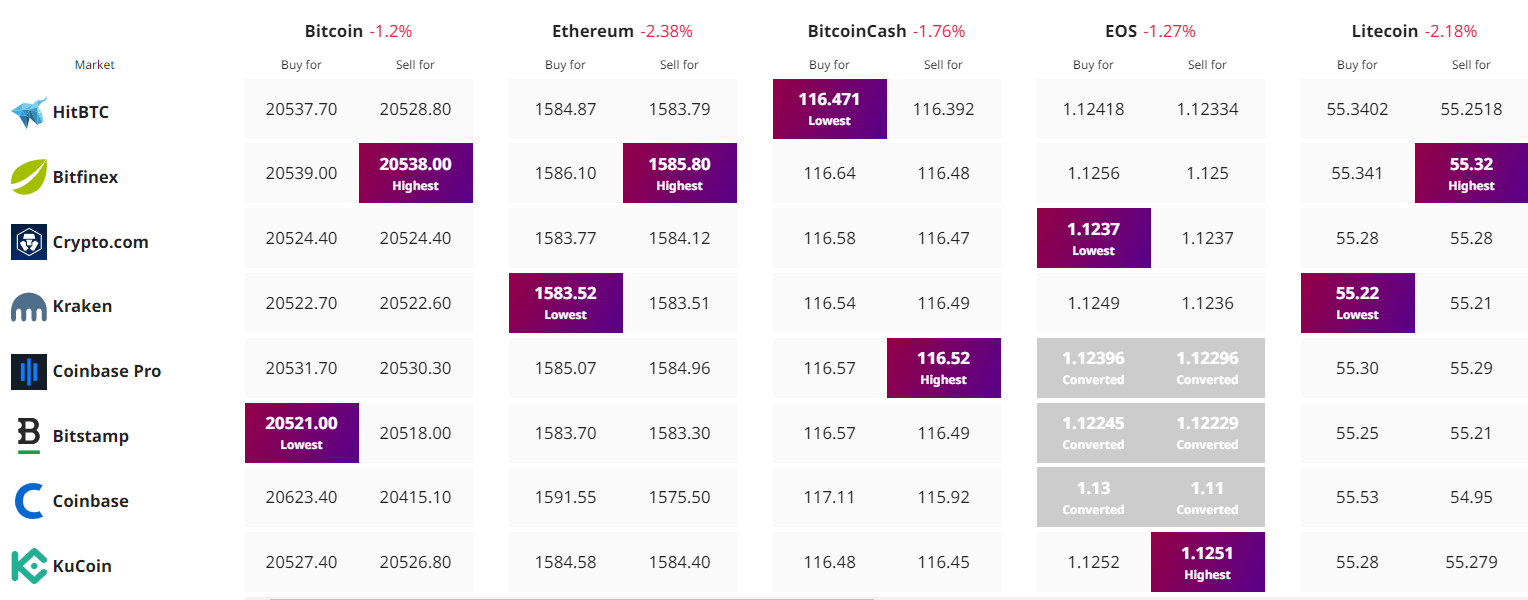

Find The Best Price to Buy/Sell Cryptocurrency