Bitcoin Price and Ethereum Prediction – BTC to Hit $21,000 Before FOMC and Fed Rate?

The Bitcoin price is trading in the green during the Asian session, near $20,534 after bouncing off the $20,265 support level. Similarly, Ethereum has increased by less than 0.50% to $1,594 and is on its way to the 78.6% Fibonacci retracement level.

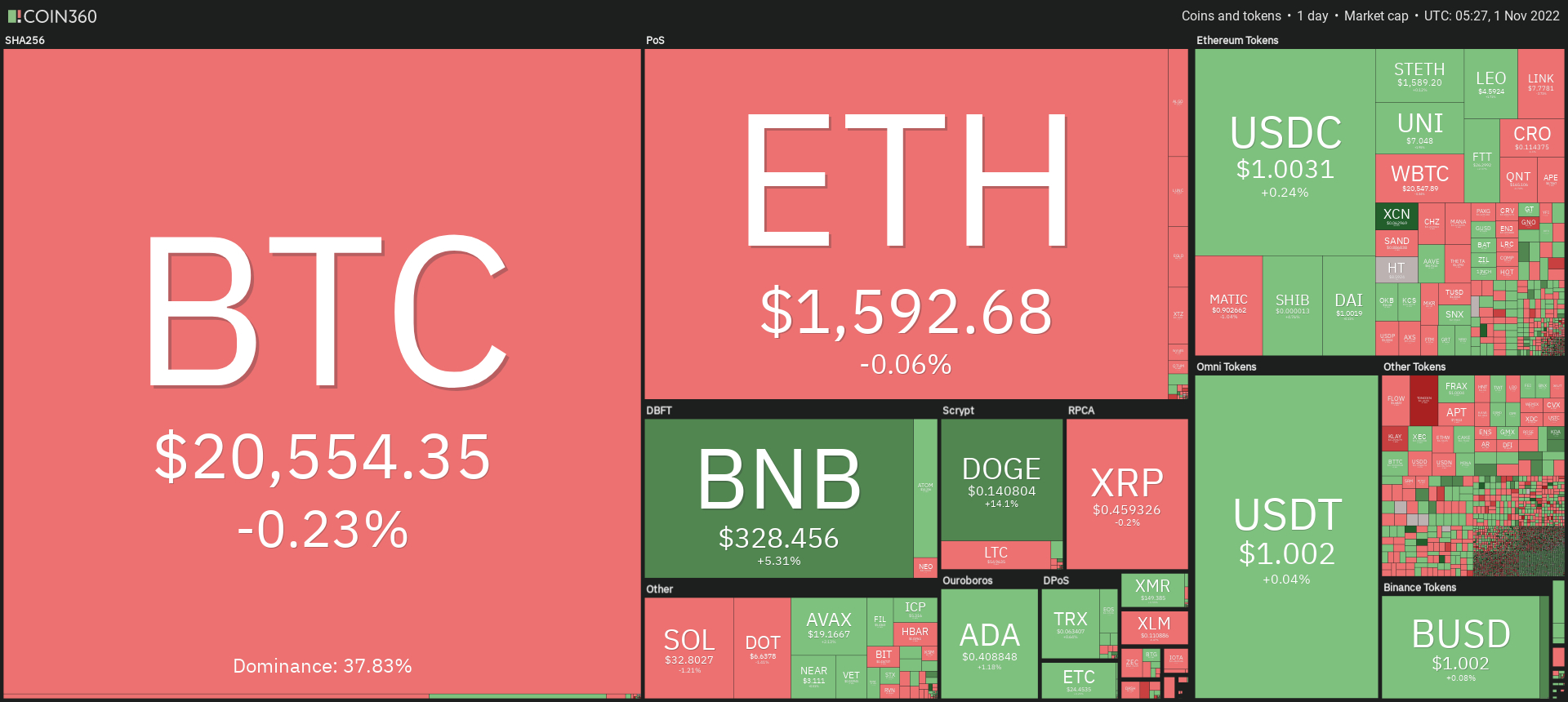

The worldwide crypto market cap gained over 0.50% to $1.01 trillion in the previous day, putting major cryptocurrencies in the green early on November 1. Over the last 24 hours, overall crypto market volume climbed 22% to $87.63 billion.

The overall volume in DeFi was $4.01 billion, accounting for 4.50% of the total 24-hour volume in the crypto market. The entire volume of stablecoins was $81.34 billion, accounting for 92% of the overall 24-hour volume of the crypto market.

Overall, the market is trading risk-on ahead of the US Federal Reserve’s monetary policy and rate decision later this week.

Top Altcoin Gainers and Losers

Chain (XCN), Dogecoin (DOGE), and Shiba Inu (SHIB) were the top performers in the last 24 hours. XCN price has increased by more than 25% to $0.06, while DOGE’s price is up by nearly 15% to $0.14. At the same time, SHIB has gained more than 5% to trade at $0.000012.

Toncoin (TON) has dropped more than 8% to $1.50 this week. Klaytn (KLAY) is down more than 5% to around $0.26, and Algorand (Algo) is down about 4% to $0.3479.

Fear & Greed Index Signals “Fear”

Investors in the risky bitcoin market frequently exhibit excessive emotional reactions. Affluence might encourage people to act in ways they later regret when the market rises (fear of missing out). Furthermore, the sight of red numbers frequently motivates people to sell their coins for illogical reasons.

The Fear and Greed Index exists to keep you from making irrational judgments based on your feelings.

The cryptocurrency market remained in “fear” mode on Tuesday, with the fear & greed index shifting from extreme fear to fear, Typically, investors eschew riskier assets in favor of safe-haven assets such as the US dollar, gold, and government bonds. The shift from extreme fear to fear indicates chances of a bullish reversal in the crypto market.

Fed Set for Fourth Consecutive 75bp Hike

This week is all about the FOMC and Fed interest rate decision which is due to be released tomorrow on November 2. A rate increase by the Federal Reserve of 75 basis points (bp) is widely anticipated by the market. If the hawks’ concentration on core inflation momentum implies a fifth 75bp hike in December, that would be big news.

US #fed decision about 75bps rate hike will be announced on the 2 Nov . The next step is to identify whether #US CPI number of existing 8.2% could be significantly lower to be announced 10 Nov ?? If not, shall we see another 75bps rate hike in Dec '22 ?https://t.co/tNg6TYsLNc

— CF CryptoTech (@Cfhau1) November 1, 2022

The Federal Open Market Committee (FOMC) seems likely to approve a fourth consecutive 75bp rate hike at its meeting next week.

Despite two consecutive quarters of decreasing GDP, the economy has returned to growth, and job creation is proceeding at a rapid clip, with the number of job openings currently outpacing the number of unemployed Americans by a factor of four.

Contributions to #US #GDP: pic.twitter.com/Hka7Fs94Xy

— Crypto Brickell (@Crypto_Brickell) October 29, 2022

To bring inflation under control, the Fed maintains its conviction that inflation risks are “weighted to the upside,” that continued rate hikes are “appropriate,” and that a “sustained period of below trend growth” is necessary.

The financial markets have fully priced in a 75 basis point rate hike. As a result, while tomorrow’s rate hike may not have a significant impact on crypto demand, the Fed’s stance on future rate hikes will be significant.

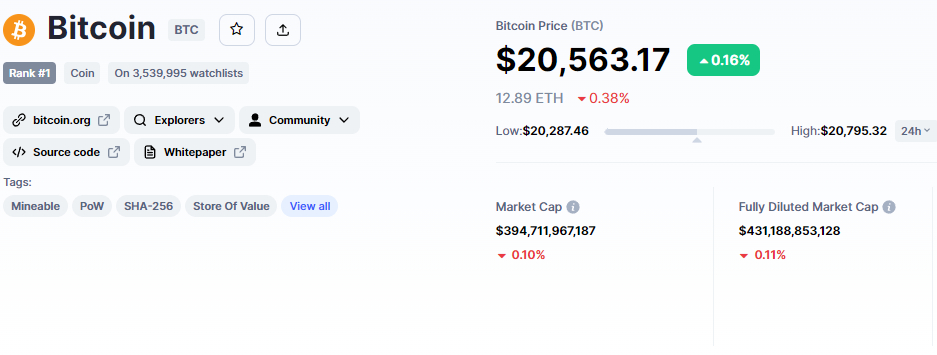

Bitcoin Price

The current Bitcoin price is $20,553, and the 24-hour trading volume is $44 billion. Bitcoin is consolidating with near 0% gains during the Asian session. In the last seven days, the BTC/USD has gained over 6% as investors await the US Federal Reserve’s rate decision.

CoinMarketCap currently ranks first, with a live market cap of $394 billion, down from $400 billion yesterday.

Bitcoin’s technical outlook remains mostly unchanged as it continues to trade in line with our European session’s Bitcoin price prediction.

The BTC/USD has been consolidating within a wide trading range of $20,000 to $21,000, defined by Fibonacci retracement levels of 38.2% to 61.8%. BTC’s trading bias is still bullish, though.

The relative strength index and moving average convergence divergence (RSI and MACD) remain in bullish territory, suggesting that the current uptrend will most likely continue. Furthermore, if the price is above $19,750, the 50-day moving average suggests buying.

A break above the 61.8% Fibo level could therefore see the current buying trend continue to a new high of $21,900. If the current trend for Bitcoin continues, its price could reach $22,500.

On the downside, Bitcoin’s immediate support level remains near $20,250. Today, investors may look to buy above $20,250 whereas, further buying can be seen upon a bullish breakout of $21,000.

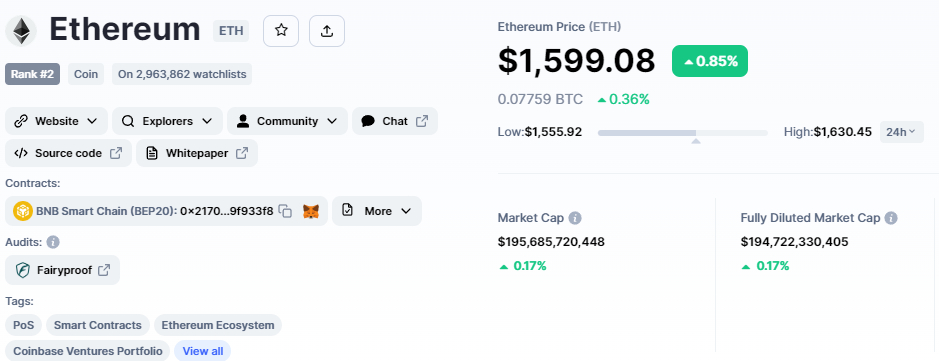

Ethereum Price

Ethereum’s current price is $1,494, with a 24-hour trading volume of $44 billion. In the last seven days, Ethereum has increased by more than 18%. CoinMarketCap is now ranked second, with a live market capitalization of $195 billion, down from $199 billion yesterday.

The ETH/USD pair has formed an upward channel on the 4-hour chart, which is supporting it around the $1,550 level. Today, Ethereum is forming a “three white soldiers” candlestick pattern, indicating significant upside potential.

A bullish trend is typically initiated by an upward channel, which may lead ETH to the $1,660 resistance level. A bullish crossover above $1,656 could push the price of ETH to $1,720 or $1,805.

Leading indicators like the RSI and MACD are still in the buy zone. As a result, the chances of a bullish correction above $1,550 remain high. At the same time, a break below this could expose ETH to $1,404 today.

New Crypto Presales

Dash 2 Trade is a fresh new cryptocurrency signaling platform that has generated $3.7 million in its presale to create its trading tool, which is focused on enrolling a large number of retail traders and providing them with some of the most powerful trading tools in the business.

Rather than allowing the trading world’s hegemons to continue to dominate due to their monopoly on superior knowledge, Dash 2 Trade enables average retail traders to compete on a level playing field.

The company intends to launch its platform in the first quarter of 2023, following the presale, with its D2T token expected to be listed on multiple exchanges. The Dash 2 Trade presale is still ongoing; D2T tokens can be purchased for $0.05 USDT.

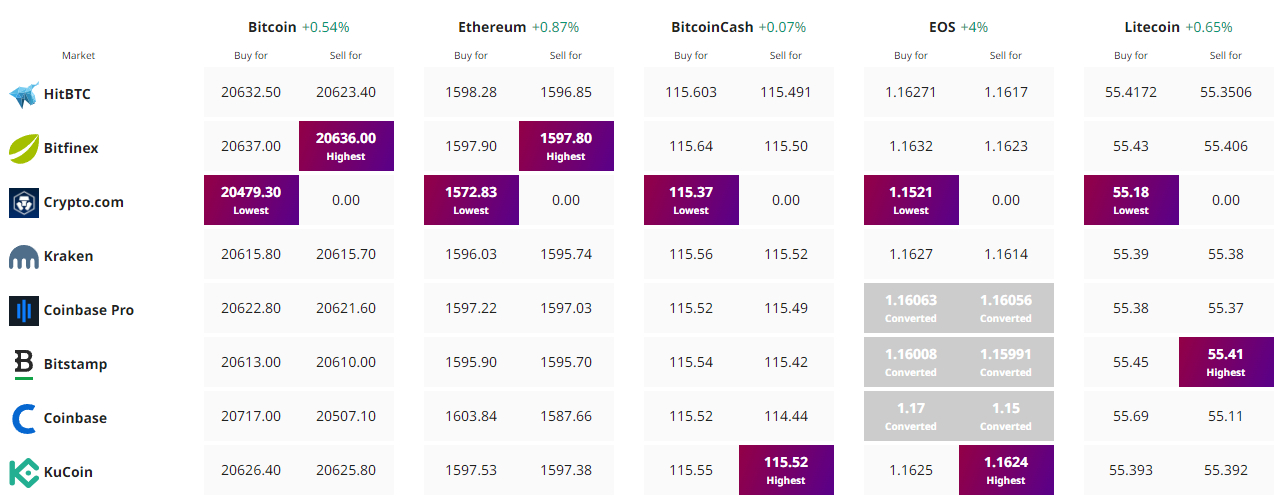

Find The Best Price to Buy/Sell Cryptocurrency