Bitcoin Price and Ethereum Prediction: BTC and ETH Take a 5% Dive, but How Low Can They Go?

The cryptocurrency market has taken a hit as both Bitcoin (BTC) and Ethereum (ETH) experience a 5% dip in their value.

As the two largest cryptocurrencies by market cap, this downward trend has left many wondering how low BTC and ETH can go.

Bitcoin (BTC) prices have experienced a significant drop, falling over 5% from $23,500 to $22,240 in recent hours. Similarly, Ethereum, the second most valuable cryptocurrency, has also plummeted by over 5%.

This decline has resulted in a loss of approximately $22 billion from Bitcoin’s total market value, which currently stands at $430.9 billion.

#Bitcoin down 5% after a 40% climb to start the year

— Mohegan ₿TC 🟠 (@MoheganBTC) March 3, 2023

Bears : pic.twitter.com/RAmQvInC6v

The ongoing fallout of Silvergate Bank may be the reason for the sharp decline in BTC’s value, as it has heightened uncertainty surrounding the fiat on-and-off ramp.

In addition, US authorities seek to sever more financial ties between cryptocurrency firms and FDIC-insured institutions, which is also seen as a significant factor in the drop in Bitcoin’s value.

#Bitcoin #BTC price slides below $22,300 amid the Silvergate "Crypto bank" uncertainty.

— CryptoBusy (@CryptoBusy) March 3, 2023

That's about $1,100 drop in about an hour! pic.twitter.com/VFNGwfyAca

The losses in BTC prices were also bolstered by growing concerns about interest rate hikes.

The global crypto markets have been experiencing a decline due to a series of positive US economic data, which signals that the Federal Reserve may need to raise interest rates higher and for a longer duration.

As a result, the crypto markets have been flashing red, contributing to the drop in BTC prices.

Probability of 50 bps interest rate hike by #Fed in next meeting on 22 MAR has now increased to 30.6% due to strong weekly jobs report indicating strength in labour market! pic.twitter.com/hNV9Jg7YqI

— Anish Nanda (@anish_nanda) March 2, 2023

Silvergate Uncertainty Undermines BTC

As previously mentioned, BTC’s price has experienced a significant drop of 5% in recent hours, resulting in a $22 billion reduction in its market capitalization.

The concern surrounding the crypto-friendly bank, Silvergate Capital, has contributed to the fall in Bitcoin’s price from $23,500 to $22,240.

#Bitcoin (BTC) has fallen over 5% from $23,500 to $22,240 in just over 60 minutes, amid a wave of uncertainty concerning crypto-friendly bank Silvergate Capital. pic.twitter.com/migVH2QR8b

— ₿ ⚡️ (@btc1crypto) March 3, 2023

Markus Thielen, the head of research at digital asset exchange Matrixport, suggests that the recent decline in BTC prices is likely due to the controversy surrounding the delayed 10-K financial report filing of Silvergate Bank.

There have also been increased efforts by US regulators to limit relationships between banks and cryptocurrency firms.

Additionally, it should be noted that Silvergate Capital (SI) announced on Wednesday evening that the filing of its annual report would be delayed due to losses resulting from the FTX collapse in November and regulatory probes on various fronts.

As a result, Silvergate Bank’s uncertain situation has caused major partners to sever ties, with the bank itself expressing concern about its ability to continue operations – leading to its stock price falling dramatically by more than 55%.

#Silvergate

— Vitaly (@l8q1eWY91F82zte) March 2, 2023

Silvergate Bank shares fell by almost 45% after the Coinbase crypto exchange abandoned its services.

Silvergate Capital Corporation on Wednesday delayed filing its 10-K annual report with the US Securities and Exchange Commission, saying it "needs additional time" pic.twitter.com/S8J1XphSj3

In addition to this, the cryptocurrency markets have dropped back to mid-February lows, which are currently acting as support levels.

However, the markets are still trading within a range-bound channel that has consolidated over $1 trillion in the past six weeks.

Fed Rate Hike & Bearish Crypto Mood

The cryptocurrency market is expected to close this week on a negative note due to the recently released robust US economic data, which has fueled speculation that the Federal Reserve may aggressively increase interest rates to combat persistent inflation.

In terms of statistics, US jobless claims decreased to 190,000 in the week ending February 24, which is lower than the market expectation of 195,000 and the 192,000 reported the previous week.

Fed officials share sentiments on future interest rate hike goals. pic.twitter.com/XnQgdyGljd

— Yahoo Finance (@YahooFinance) March 1, 2023

Although unit labor costs increased from 1.6% to 3.6% to 1.1% in the previous quarter, nonfarm productivity for the fourth quarter (Q4) fell to 1.7% from 3.0% in the previous quarter and 2.6% in the market expectation.

As a result, the higher likelihood of interest rate hikes tends to decrease cryptocurrency values and is considered another factor that has played a significant role in weakening BTC prices.

US Dollar Lost Some Ground

The US dollar initially climbed on Thursday following positive unemployment claims data and other indicators suggesting labor costs were rising, fueling speculation that the Federal Reserve may need to raise interest rates to tackle inflation.

However, the gains were short-lived, and the dollar retreated from a 2-1/2-month high against the yen on Friday, putting it on track for its first weekly loss against major currencies since January.

#Dollar index below 105 level

— Markets Today (@marketsday) March 3, 2023

The US dollar eased back from a two-and-a-half-month high versus the yen on Friday and weakened toward its first weekly loss since January against major peers as traders tried to gauge the path for Federal Reserve policy.

As a result, some experts believe that the weak US dollar may help prevent steep declines in cryptocurrency prices.

Bitcoin Price

The current trading price of Bitcoin is $22,396, with a 24-hour trading volume of $26 billion. The technical outlook for the BTC/USD pair indicates a violation of a symmetrical triangle pattern at the $23,250 level, with a breakout exposing the BTC price to the $22,046 support zone.

On the lower side, an additional breakout of this level could lead BTC toward the $21,450 mark.

The formation of a bearish engulfing candle suggests a strong selling bias. However, if candles close above this level, there is potential for a bullish bounce-off, with a target of $22,800 or even higher, towards the $23,750 mark.

Ethereum Price

The current market price of Ethereum (ETH) is $1,560, and its 24-hour trading volume is $9 billion. In terms of technical analysis, the ETH/USD pair has broken a symmetrical triangle pattern, indicating the potential for further selling until it reaches $1,560.

If this level is breached, ETH could be exposed to the $1,500 mark. However, there is strong resistance around $1,620 or $1,680.

Top 15 Cryptocurrencies to Keep an Eye on in 2023

Check out the top 15 altcoins to watch in 2023, curated by Cryptonews’ Industry Talk team. The list is updated regularly with new ICO projects and altcoins.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

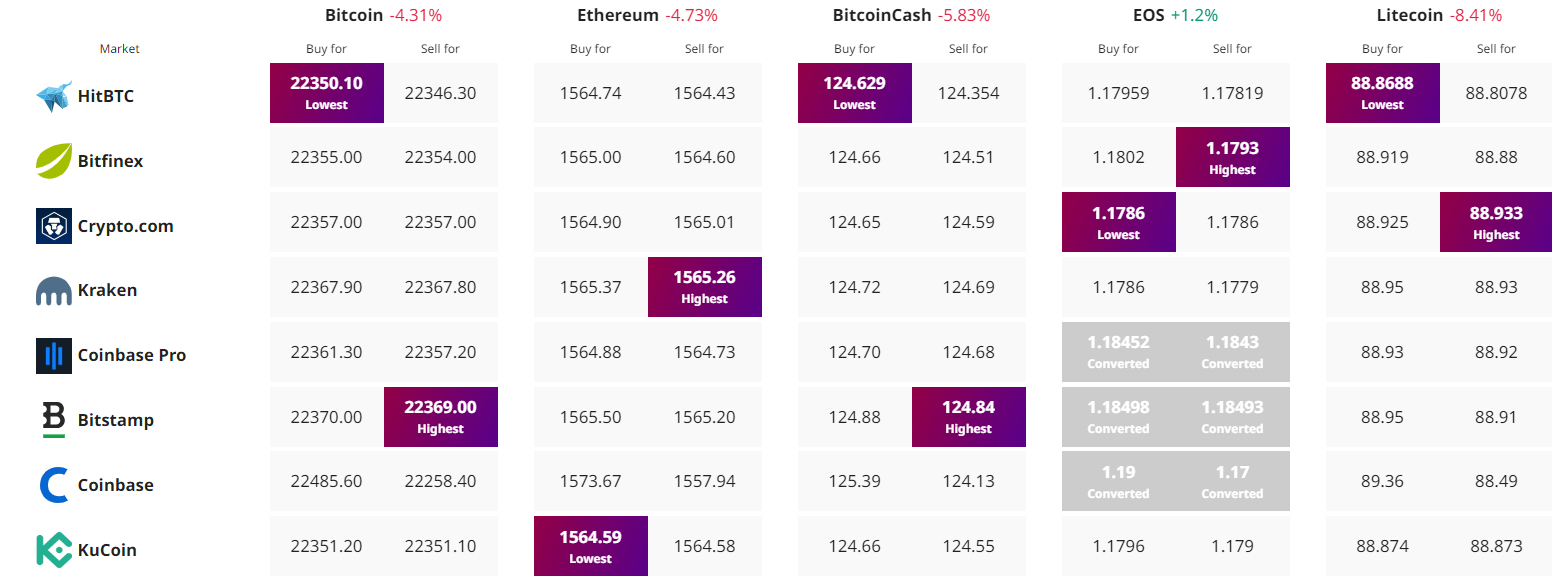

Find The Best Price to Buy/Sell Cryptocurrency