Bitcoin and Ethereum Fail to Recover, NEAR and ZEC Turn Green

- Bitcoin price failed to recover above the USD 42,500 resistance.

- Ethereum is struggling near USD 3,100, XRP dropped below USD 0.75.

- NEAR and ZEC are up over 5%.

Bitcoin price failed to gain strength above the USD 42,500 level. BTC started a fresh decline towards the USD 41,500 level. It is currently (11:30 UTC) showing bearish signs and might extend losses.

Similarly, most major altcoins might start another decline. ETH failed to clear USD 3,200 and there is a risk of a move below USD 3,000. XRP is moving lower below USD 0.750. ADA is still trading below USD 1.20.

Total market capitalization

Bitcoin price

After a minor upside correction, bitcoin price faced resistance above USD 42,500. BTC started another decline and traded near the USD 41,500 level. If the bears remain in action, it could slide below USD 40,500. The next key support is near USD 40,000, below which the price extend losses towards the USD 38,000 level.

On the upside, an initial resistance is near the USD 42,200 level. The first major resistance is near USD 42,500, above which the price might start a stronger recovery wave.

“Despite the crypto market being in oversold territory, it is widely impacted by global markets and economic conditions. Plans declared by the Federal Reserve for rate hikes in 2022, as well as reducing the rate of monthly bond purchases, have contributed to bitcoin’s selloff so far,” Marcus Sotiriou, Analyst at the UK based digital asset broker GlobalBlock, wrote in an emailed note.

Meanwhile, on Wednesday, US inflation data will be released.

“The market expects the consumer price index (CPI) to rise 7.1% for the year through December and 0.4% over the month. If the figure released is larger than expected we can expect further sell pressure for bitcoin, as the markets are forward-looking and high inflation leads to more action from the Federal Reserve to control it,” Sotiriou said, adding that the downside is limited in the short term, even with higher-than-expected inflation data on Wednesday.

Ethereum price

Ethereum price also struggled to gain strength above the USD 3,200 level. ETH started a fresh decline below the USD 3,150 level. It seems like there is a risk of more losses below USD 3,000. The next major support is near the USD 2,880 level.

On the upside, the bears might remain active near the USD 3,200 level. The next major resistance on the upside is near the USD 3,320 level.

ADA, BNB, SOL, DOGE, and XRP price

Cardano (ADA) is trading well below the USD 1.20 level. It is even struggling to stay above the USD 1.15 level. If the bears remain in action, there is a risk of a move towards the USD 1.12 level.

Binance coin (BNB) is trying to recover above the USD 525 level. It is now facing resistance near the USD 440 level. The next key resistance is near USD 450, above which the price might start a move towards USD 475.

Solana (SOL) is still stuck near the USD 140 level. A downside break below the USD 135 support level might start another decline. The next major support sits at USD 120.

DOGE is moving lower below the USD 0.150 support level. The next major support is near the USD 0.132 level. If there are additional losses, the price might test the USD 0.120 level.

XRP price traded below the USD 0.750 support level. The next major support is near the USD 0.720 level, below which the price could test USD 0.700. On the upside, the bears might remain active near USD 0.765.

Other altcoins market today

A few altcoins are down over 5%, including GNO, YFI, ONE, BORA, RVN, LUNA, AAVE, and XTZ. Out of these, GNO declined over 10% and there was a break below USD 420. Meanwhile, NEAR and ZEC are up over 5%, reaching USD 14 and USD 145, respectively.

To sum up, bitcoin price is struggling to recover above USD 42,200 and USD 42,500. If BTC slides below USD 40,000, the bears could gain strength.

_____

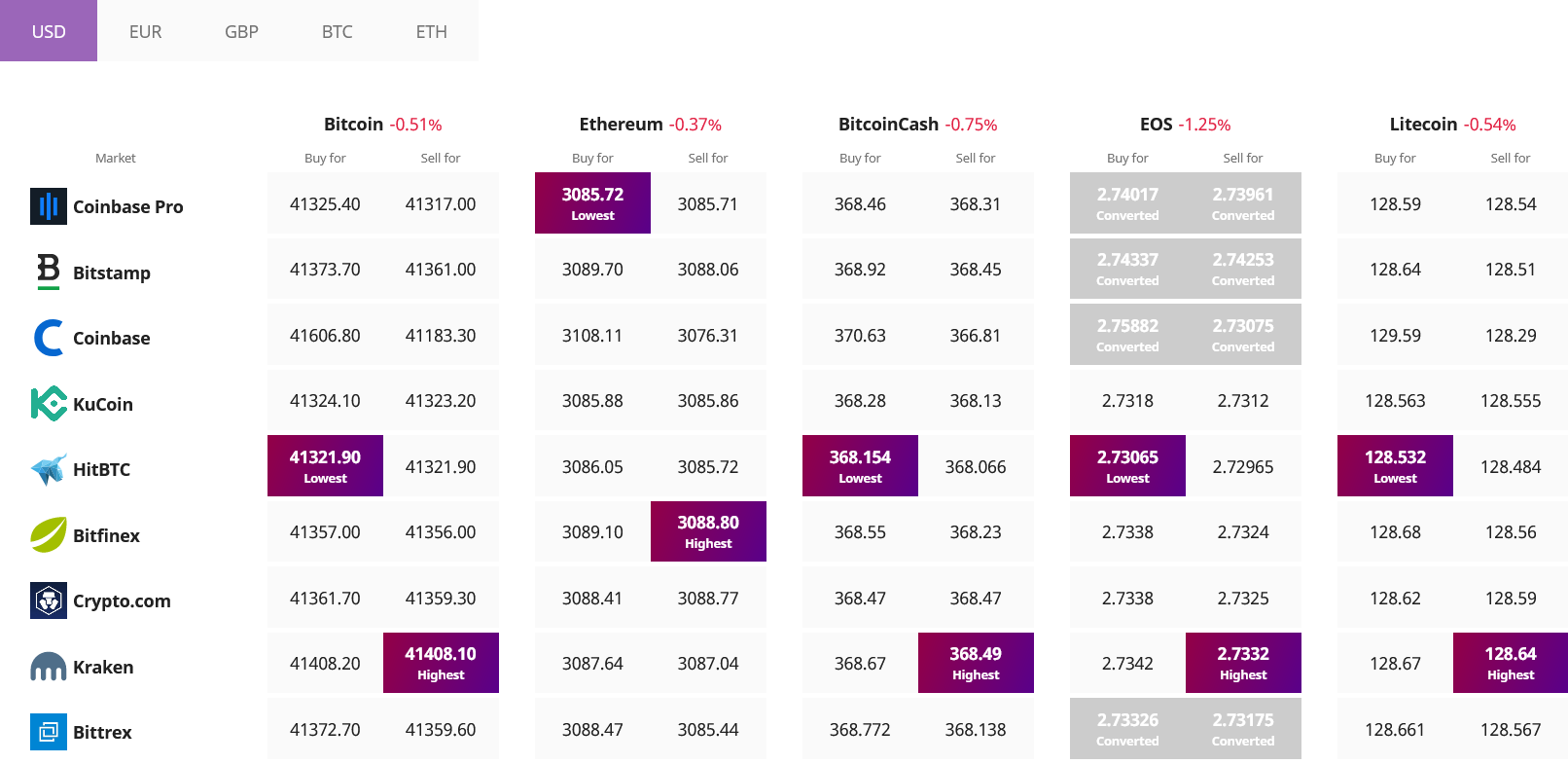

Find the best price to buy/sell cryptocurrency:

____

(Updated at 12:21 PM UTC with a comment from Marcus Sotiriou.)