Bitcoin and Ethereum Price Predictions: BTC Dips to $23,000 – How Much Further Can BTC and ETH Fall?

Bitcoin has been unable to break its losing streak and is poised to end the week on a bearish note as investors steer clear of riskier investments due to growing macroeconomic uncertainty exacerbated by higher-than-anticipated inflation figures.

The significant losses come in the wake of the Personal Consumption Expenditures (PCE) data, which revealed a more significant than expected price increase from the previous month.

Additionally, Bitcoin options contracts worth approximately $1.8 billion are due to expire today, which may trigger volatility in the short-term price movement of BTC.

https://www.twitter.com/DropTownSaloon/status/1629346598244188161?s=20As of now, the price of Bitcoin is $23,070.20, with a trading volume of $25,828,731,350 over the past 24 hours. Bitcoin has experienced a decline of 3.57% over the past 24 hours.

The current price of Ethereum is $1,598.62, with a trading volume of $8,619,530,362 over the past 24 hours. Ethereum has declined by 2.85% over the past 24 hours.

Crypto Market Bearish as Inflation Concerns Rise

The global cryptocurrency market is currently showing a downward trend and is expected to end the week on a negative note as investors avoid taking risks due to increasing macroeconomic uncertainties, which have been compounded by higher-than-anticipated inflation figures.

According to the PCE price index from the US Bureau of Economic Analysis, the annual inflation rate in the country rose to 5.4% in January from 5.3% in December.

As a result, the core rate of PCE inflation increased, reaching 4.7% for the first time in the past four months.

For the Fed's concerns about inflation this is a critical point. This level of nominal spending has recently been *sustainable*. it is wage driven. It is coming at a time of *rising* savings rates. pic.twitter.com/py296HxCZj

— Bob Elliott (@BobEUnlimited) February 24, 2023

These statistics support the notion that the Fed may have to maintain higher interest rates for an extended period to counter inflationary pressures.

Both core and total PCE inflation increased by 0.6% from one month to the next. The markets have factored in a 75% likelihood that interest rates will increase to over 5.25% by the end of the Fed’s June meeting.

Bitcoin Options Contracts Worth $1.8 Billion Expire: What Could Be the Impact on Bitcoin’s Price?

Bitcoin options contracts valued at over $1.8 billion expired yesterday. However, the expiration of a significant number of Bitcoin options has a detrimental effect on the short-term price movement of BTC.

This is because the Bitcoin market may become more volatile as traders rush to execute their transactions if they have established a position that requires them to buy or sell Bitcoin before it expires. This can result in a brief change in price, either upward or downward.

Breakfast News 🥘

— The Bull's Journal (@thebullsjournal) February 24, 2023

RATING: 📙📙📙

Today will see the expiration of Bitcoin option contracts worth about $1.8 billion. pic.twitter.com/ltocKkFxxn

It’s important to note that the impact on the overall market can vary depending on several factors, such as the number of contracts, the positions taken by traders, and the general sentiment of the market. Options expirations are a frequent event in financial markets.

Increase in Bitcoin Mining Difficulty Reported by BTC.com

BTC.com has reported that Bitcoin’s mining difficulty has risen by 9.95% following the latest adjustment, according to a Friday update. However, the increase in BTC mining difficulty suggests that it is becoming more challenging to mine new Bitcoins, which could have both positive and negative effects on the Bitcoin price.

#Bitcoin #mining difficulty increased by 9.95% to 43.05T, a new record high! The average computing power of the whole network is 301.02EH/s#BTC #mine #POW @BTCTN @BitcoinMagazine @Bitcoin pic.twitter.com/8GiRtkxMrR

— Megan_web3 (@citexpixie) February 25, 2023

On the other hand, the increase in mining difficulty may signal a surge in demand for Bitcoin. As more people attempt to mine Bitcoin, the network adjusts the mining difficulty to maintain a steady block generation rate.

This can create a sense of scarcity and increase demand for Bitcoin, leading to a rise in prices.

Regulatory Crackdown on Binance: SEC and NYDFS Oppose Binance.US’s Proposed Acquisition of Voyager Digital Assets

The US Securities and Exchange Commission (SEC) and the New York financial regulatory authority have opposed Binance.US’s plan to purchase the assets of the bankrupt Voyager Digital for $1 billion, citing potential violations of several laws.

This is viewed as another negative factor affecting the cryptocurrency industry, as the SEC’s regulatory crackdown could have a significant impact on the cryptocurrency market.

The SEC and New York's top financial regulator have opposed BinancedotUS's $1 billion deal to buy defunct crypto lender Voyager, according to court filings, the latest in a string of regulatory moves against crypto firms https://t.co/mpTXrubUj6 pic.twitter.com/sCaSZSoWtg

— Reuters Legal (@ReutersLegal) February 23, 2023

Essentially, the SEC is responsible for overseeing the securities markets in the United States and has been closely scrutinizing the cryptocurrency industry in recent years.

Bitcoin Price

The current Bitcoin price is $23,150, having dropped from the $23,400 mark. From a technical perspective, Bitcoin is expected to gain immediate support around the $22,700 level, and if it breaks below this level, it could potentially expose the BTC price to the $22,400 level.

On the bullish side, a breakout above the $23,400 level could push the BTC price toward the $24,100 or $24,600 mark.

However, the RSI and MACD indicators are still in the selling zone, so it is important to monitor the $23,000 to $23,400 range closely. Closing above this range could present potential buying opportunities.

Ethereum Price

The current live price of Ethereum stands at $1,600, with a 24-hour trading volume of $8.3 billion. In the last 24 hours, Ethereum has plunged by nearly 3%. According to CoinMarketCap, Ethereum is ranked #2, with a live market capitalization of $196 billion.

The ETH/USD pair is currently facing a significant resistance level at $1,620, reinforced by the 50-day EMA, on the technical front. If the pair closes below this level, it could trigger a selling trend in ETH.

On the downside, Ethereum’s immediate support is at the $1,570 level. A break below this level could expose the Ethereum price to the next support level of $1,515.

On the other hand, a break above the $1,625 resistance level could push the Ethereum price toward the next resistance level of $1,674. Above this, the next resistance level prevails at the $1,740 level.

Top 15 Cryptocurrencies to Watch in 2023

Investors in the cryptocurrency market have many options beyond Bitcoin (BTC) and Ethereum (ETH). The Cryptonews Industry Talk team has compiled a list of the top 15 altcoins to watch in 2023.

The list is regularly updated with new ICO projects and altcoins, so make sure to check back frequently for the latest additions.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

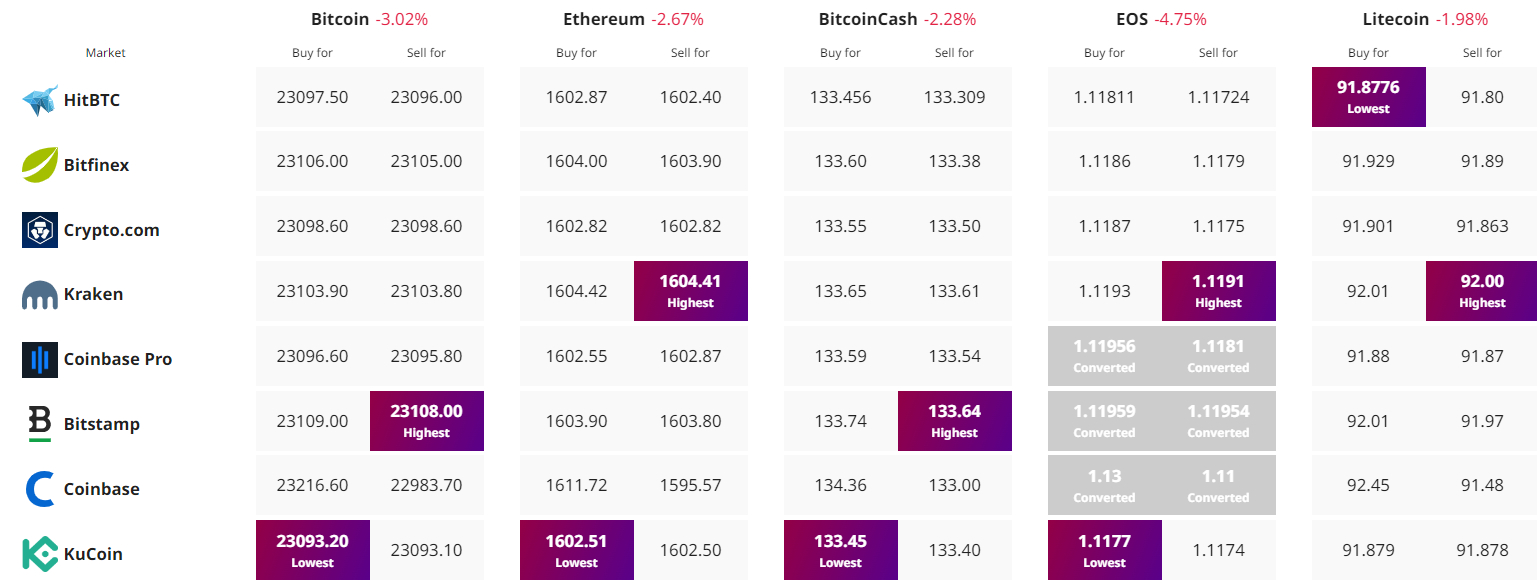

Find The Best Price to Buy/Sell Cryptocurrency