Binance Smart Chain Dethroning Ethereum as Backbone of Defi Ecosystem

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

The blockchain ecosystem witnessed explosive growth in 2020, thanks to the surging popularity of DeFi and NFTs. The growth has amplified the limitations of Ethereum. Users are frustrated with the high gas fees and the ridiculously long time it takes to process transactions. Ethereum has become an unsustainable choice for small investors and traders.

Launched in September 2020, Binance Smart Chain (BSC) might be the new kid in town but it is stealing Ethereum’s thunder. It handles far more transactions than Ethereum. The Binance Smart Chain allows for smart contract functionality and provides a staking mechanism for the Binance (BNB) token.

BSC is a hard fork of the Go Ethereum (Geth) protocol, which is why you’ll see a number of similarities between Ethereum and BSC. In fact, Dapps and tokens built on BSC are fully compatible with the Ethereum Virtual Machine (EVM). You might also have noticed that the public wallet addresses are the same for both Ethereum and BSC.

However, the BSC developers have made a few key changes such as a new consensus mechanism to overcome the issues that haunt Ethereum. Unlike Ethereum’s Proof-of-Work (PoW), the BSC uses a Proof of Staked Authority (PoSA) consensus mechanism to offer faster and cheaper transactions. The low transaction costs reduce the barriers to entry for many enthusiasts.

BSC vs Ethereum in Numbers

The broader crypto market has witnessed a major decline in recent weeks. But when the markets recover, the Binance Smart Chain could give Ethereum a run for its money.

A large number of DeFi projects are leaving Ethereum for BSC. At the end of June 2021, there were more than 2,800 Dapps on the Ethereum blockchain compared to only about 810 projects on BSC. Considering the Binance Smart Chain is less than a year old, it’s a strong and growing ecosystem.

According to data from the crypto research firm DappRadar, the BSC registered strong growth to become the dominant blockchain in the second quarter of 2021 while Ethereum was struggling with the scalability issues.

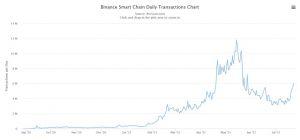

– Daily transaction volume

If you look at the daily transaction volume, you’ll notice a huge difference between BSC and Ethereum. On May 14, the BSC witnessed a record 11.8 million transactions. It has been regularly clocking over 4 million daily transactions.

By comparison, Ethereum has never recorded more than 1.75 million daily transactions. Users who want to move small amounts regularly seem to prefer BSC over Ethereum.

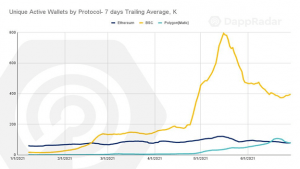

– Unique active wallets

During Q2, 2021, the Binance Smart Chain had 421,854 unique active wallets (UAW), up a staggering 409% from the previous quarter. It clocked 1.02 million unique active wallets (UAW) on May 12, 2021. BSC was the most used blockchain in the second quarter. It also generated 7.29 billion USD in Q2 sales, up 134% from the previous quarter.

Meanwhile, the BSC-based DeFi project PancakeSwap has 5 million unique wallets and it handled a staggering 1 trillion USD in transaction volume. It makes PancakeSwap the most-used Dapp in the blockchain ecosystem during the quarter.

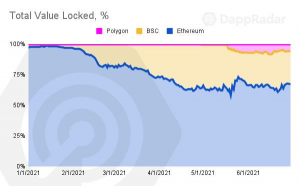

– Total value locked (TVL)

In terms of the total value locked, Ethereum still dominates the market. But BSC has emerged as a strong challenger.

The total value locked in Binance Smart Chain jumped 28% QoQ to 25 billion USD despite numerous challenges including the liquidation of Venus and the crypto crash in May. PancakeSwap alone accounted for 28% of the total value locked in BSC.

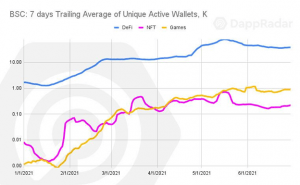

– DeFi dominates BSC, but NFTs rising

The Binance Smart Chain has become the favorite network for DeFi projects. That probably explains why DeFi dominates the scene in BSC. However, NFTs and games have also been growing steadily in recent months.

NFTs and related marketplaces on BSC generated a staggering 123 million USD in the second quarter of 2021, a QoQ jump of 993%. In June, Binance also launched the Featured by Binance NFT Marketplace.

What’s Driving BSC’s Growth?

The Ethereum community is waiting for Ethereum 2.0, which would switch the network from the Proof of Work (PoW) to Proof of Stake (PoS) mechanism to overcome scalability issues. Completing a transaction on the Ethereum blockchain currently takes between 30 seconds and 16 minutes.

But the BSC is already attracting developers and users to its ecosystem because of its low cost and faster speed. It is also compatible with popular crypto wallets like Metamask and Trust Wallet.

DeFi protocols that use cross-chain technology to connect with different networks are also making it easier for users to switch.

For example, Premia Finance is an Ethereum-based decentralized protocol that supports options trading and staking for a variety of native Ethereum and Binance Smart Chain tokens. It supports many new tokens specific to the BSC ecosystem.

Projects like Premia Finance enable users to interact with the BSC ecosystem and experience its advantages first-hand.

Wrapping It Up

Binance Smart Chain (BSC) is undoubtedly a cheaper and faster alternative to the Ethereum blockchain. It also supports the porting of Ethereum Dapps to BSC because it’s compatible with the Ethereum Virtual Machine (EVM). Given the pace at which BSC has been growing in popularity since its launch, it could easily overtake Ethereum by the time the Ethereum 2.0 arrives.

{no_ads}