Beginner’s Guide: POFID-DAO, a Production Tool for Private Stablecoins

The text below is an advertorial article that was not written by Cryptonews.com journalists.

Foreword

In 2019, DeFi became one of the most talked about topics in the field of blockchain and, based on this concept, decentralized stablecoins have come to occupy half of the DeFi field. Why have stablecoins, which have always had a relatively low-key existence, come to have such an important position?

It has become evident that stablecoins are essential for the development of the entire cryptocurrency ecosystem, since they guarantee the high liquidity that is needed in the market. If you are a believer in the blockchain industry, then stablecoins will inevitably become your favorite type of cryptocurrency. Yes, you read that correctly! Today, I will introduce to you a killer application—the decentralized privacy stablecoin production tool POFID DAO. This awesome project was initiated by an anonymous team of programmers in Europe. Before we talk about POFID DAO, let’s talk about Decentralized Finance (DeFi) and decentralized stable currencies.

What is DeFi?

DeFi, or Decentralized Finance, in its narrow definition is the use of smart contracts to remove financial intermediaries and reduce transaction costs. A broader definition would be the creation of new forms of financial products in an open-source, barrier-free blockchain ecosystem, with the goal of creating a more competitive financial system that achieves borderless transactions in a global marketplace.

The basic characteristics of DeFi can be defined as: 1. the use of blockchain technology, 2. the control of assets by individuals, 3. the minimized dependence on trust, as a result of the reduction of the cost of trust between individuals.

Current popular DeFi products include decentralized stablecoins, exchanges, and tokenized tangible assets, such as gold, derivatives, options markets, payment networks and insurance. According to DEFI PULSE data, as of press time, the decentralized stable currency project Maker DAO that based on this concept has locked in some $317.3 million, accounting for 52.07% of the entire DeFi ecosystem. We can understand DeFi in terms of MakerDAO: its vision is a kind of decentralized stable currency without borders, one that can benefit all kinds of enterprises and individuals in maximizing financial inclusiveness.

Speaking of stablecoins, there are currently three types of stablecoins on the market: stablecoins with fiat currency as collateral (e.g. USDT), stablecoins with cryptocurrencies as collateral (e.g. DAI), and collateral-free/algorithmic stablecoins (e.g. Basis). Why is the current stablecoin market generally most optimistic about the second kind? Simply put, this is a result of the scarcity of type and value.

What is cryptocurrency stablecoin (DAI)

MakerDAO was established in 2014 as a decentralized lending platform on Ethereum. It uses a dual-currency mechanism, a stable currency DAI which is pegged to the US dollar, and another token MKR that works as an equity token. Through its dual currency mechanism, MakerDAO enables the operation of an entire, decentralized lending system.

Stablecoin DAI

Unlike centralized stablecoins such as USDT, TUSD, and GUSD, DAI acquires value by over-collateralizing cryptocurrencies. With centralized stablecoins, for every $1 of tokens issued, there is a $1 fiat currency as reserve. In contrast, behind every DAI token there is a digital asset that exceeds $1, and DAI’s operating mechanism is open and transparent. Not only is DAI transparent, but the value fluctuation and quantity of Ethereum used in exchange for DAI’s collateral are also transparent and open to the public.

The centralized stablecoin USDT has been criticized for its opacity. In 2019, there was an exchange crisis. This resulted from the fact that USDT is neither regulated nor transparent, and banks in which reserves are held were frequently changed, leading people to withdraw their tokens in fear that tokens were not backed up by real fiat reserves.

Maker (MKR)

This is the utility token of the MakerDAO platform, used by token holders to govern the platform. Maker tokens are not linked to any specific price, so the price fluctuates freely like other digital assets. The current total supply is 1 million: 61% is in circulation in the market, 39% is allocated to the foundation, and 15% is allocated to the core team.

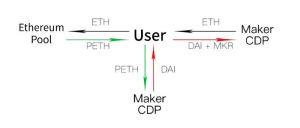

The Operation Mechanism of Maker DAO

Anyone can use Maker to open a wallet and lock up tokens such as ETH as collateral to generate DAI as a debt to the collateral.

Locking ETH in exchange for DAI: First, the user moves the ETH he holds into the ether pool to obtain PETH. After that, PETH is sent to the Maker smart contract CDP (Collateralized Debt Positions) to obtain DAI.

Withdrawing ETH: User enters the stability fee of DAI + system fee (this stability fee must be paid with MKR) into the Maker smart contract CDP to unlock the corresponding ETH.

Through the above text, I believe you now have a basic understanding of DeFi concepts and decentralized stablecoins. Although transparency, fairness, transaction speed, and ease of liquidation all give decentralized stablecoins a distinct advantage over their centralized counterparts, according to the 2019 Deloitte Global Blockchain Survey, 50% of companies still worry about privacy-related regulations – the intrinsic transparency of the blockchain is both a boon and a burden – so we have yet to see its widespread adoption in traditional finance.

To address this challenge, some industry leaders have begun to explore privacy protection mechanisms used in conjunction with distributed networks. These solutions are designed to take advantage of blockchain technology while adapting to growing regulatory requirements worldwide.

Introducing DeFi’s Next Unicorn

POFID is a DeFi project based on SERO, the world’s first anonymous Turing-complete smart contract public blockchain. POFID DAO stands for Privacy-Oriented Financial Instrument Distribution Framework & DAO, and provides a trusted decentralized financial asset-management platform with strong privacy protection. POFID DAO refers to the decentralized governance framework organization of the platform.

The SERO blockchain platform is well known for its privacy features. In some more complex business applications, users may need to have a fully trusted third party audit of all transactions they send. For auditing, users of the SERO ecosystem can make their own choices and decide whether to give a third-party permission tracking key to track specific transaction-related information to facilitate auditing permissions. The POFID team officially uses this feature to solve the 50% of companies that are concerned about privacy-related regulations.

POFID not only solves the problem of transparency of decentralized stablecoins represented by DAI, but also satisfies the complexity of business applications. It realizes privacy data protection/anonymous payment, and also solves the problem that decentralized stablecoins rely too much on Ethereum, compared with Maker DAO, POFID has stronger usability and scalability. It can be said to be a reform of global financial trade and currencies! Any organization wishing to use cryptocurrency as a universal stable currency can use POFID to build their own currency system and start issuing anonymous stablecoins. Its flexible mechanism settings also provide guarantees for the operation of the entire currency system. Simply put, the POFID platform does not itself issue anonymous stablecoins, but rather provides the governance solutions to allow users to do so.

Governance Mechanism of POFID DAO

From the user’s perspective, the governance mechanism of POFID DAO is very simple. The PFID platform token is not only a kind of revenue maker, but also a gateway to governance authority. It is also by default a universal asset on the platform. It can be said that PFID holders control the operation of the system in three main ways:

- Users can use PFID to participate in staking and obtain a PFID mining income.

- Users can participate in PFID’s staking and its platform governance decisions.

- Users can obtain a revenue income from the POFID ecosystem by staking PFID, for example income generated through a loan.

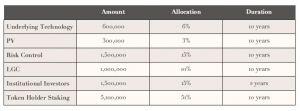

PFID Token Allocation

Operating Mechanism of POFID DAO

First of all, we need to understand the concept of the PV (Pledge Vault). This is the core smart contract of POFID DAO and is responsible for escrowing collateral. Through collateralized digital assets, you can borrow anonymous stablecoins pegged to multiple currencies. For example, you can borrow USROs pegged to US dollars or ESROs pegged to euros through collateralizing SERO. Of course, in addition to SERO, you can pledge any kind of digital assets recognized by the POFID platform, such as BTC, ETH, etc.

Pledge digital assets in exchange for stablecoins: Users put their digital assets into PV contracts, obtain stablecoins, and pay stablecoins as a handling fee.

Withdraw/unlock pledged digital assets: Users deposit stablecoins into the PV smart contract to withdraw locked digital assets.

It is worth mentioning here that when users borrow anonymous stablecoins, the platform will deduct the corresponding handling fee (2%). This portion of the handling fee collected will be divided into two, one part for user (staking) rewards and the other part will be burned. As more people use anonymous stablecoins, there will be more and more fees, more and more PFID burned, and PFID will become more valuable. In this sense, POFID can be regarded as being based on a deflationary economic system, with PFID holders benefitting from the widespread use of anonymous stable currencies, as well as from their own growth in value.

POFID DAO Regulation and Risk Management

Here we understand another concept – the Value Guard (VG). This is a smart contract library built by risk control managers to monitor and create warnings for the value of pledged asset types in PV on the POFID platform. The price of stablecoins and the price of fiat currencies are basically pegged, but the price of digital assets changes constantly. If the price of a digital asset goes up, everything is good. But if it goes down, what should you do? If it falls to a certain range, who will guarantee that the price of the stablecoin will still be pegged to the fiat currency? This requires someone to ensure that the excessively high risks in the system are cleaned up, leaving high-quality assets with high collateral rates, to maintain the stablecoin ecosystem. Of course, this “someone” cannot be a human, but rather a ruthless and rational smart contract, i.e., a VG contract.

When collateralizing, the system will display the stablecoin’s pledge rate, liquidation rate and fee rate. Entering the amount of the loan, the system will automatically calculate the number of digital assets that need to be pledged, and the fee to be paid. When the digital asset pledged falls below the minimum liquidation price of the system, the system will automatically sell the pledged asset to compensate for the unhealthy nature of the ecosystem caused by the devaluation of the pledged asset.

Example

I want to borrow 30 USRO and SERO’s real-time price is $0.06. The system’s pledge rate is 200%, the liquidation rate 150%, and the fee rate 2%. The system will automatically calculate that I need to pledge 1000 SERO, and pay 0.6 USRO as a fee. The liquidation price is $0.009. If the SERO price touches this liquidation price, the 1000 SERO I mortgaged will be liquidated by the system, i.e., it will be auctioned off by the system to compensate for the value of the stable currency lent. Of course, I can get my remaining assets back: I can choose to increase the collateralized digital assets or return the borrowed USRO in time, which can avoid the risk of liquidation.

Summary:

If DAI is a consumer-grade stablecoin that draws on market experience and the lessons of its predecessors, introducing blockchain technology into popular applications, then POFID DAO is a guarantee for the global use of this blockchain technology. Any business application based on blockchain technology requires currency with a much lower volatility than the 10-20% daily volatility we often see with common cryptocurrencies.

{no_ads}