Anyswap’s Decentralized Cross Chain Swap Protocol vs. Centralized Exchanges

The text below is an advertorial article that was not written by Cryptonews.com journalists.

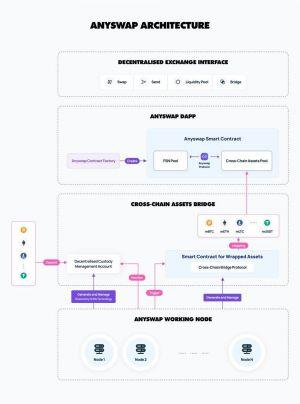

The long-awaited Anyswap decentralized cross chain swap protocol, based on Fusion ($FSN)DCRM technology, is due to be launched on July 20th. Anyswap will usher a new era of interoperability between finance and blockchain through innovation by the Fusion team. It arrives at a time when cryptocurrency exchanges are gradually changing their tact, moving from centralization to decentralization. However, most decentralization options available focus more on compatibility than true interoperability.

Once it’s up and running, Anyswap will offer arguably the best-decentralized exchange service in the market. Its strengths over current cryptocurrency exchange leaders such as Binance and Huobi lie in its extensive decentralization. Against other decentralized platforms, the Anyswap protocol stands high above the rest, gifting the market with crucial interoperable options.

The launch also comes at a time when talks of blockchain adoption are ripe across governments and institutions. Its successful launch may help convince institutions that are still on the fence to turn to blockchain technology for decentralized solutions.

But what makes the Anyswap protocol so good?

Let’s find out.

Anyswap Provides a New Level of Functionality

Blockchain has grown tremendously since its inception in 2009. The technology daily proves its importance in the technological ecosystem. Its growth over the years led to the success of various cryptocurrencies such as Bitcoin and Ethereum. The development of exchanges was inevitable, but the irony still is the centralization of these exchanges. Furthermore, exchanges created their blockchains, creating a disconnect in the market between the different platforms.

Currently, centralized exchanges are considering decentralization due to the many user benefits it offers. However, these exchanges are decentralizing from their centralized ecosystems. Full decentralization may never be achieved by these platforms unless new protocols are built from the ground up. This is where Anyswap comes in.

The entrance of Anyswap into the blockchain market negates all the drawbacks created as blockchain rose to prominence. The blockchains that currently exist will interact seamlessly on the protocol based on Fusion’s DCRM technology. Anyswap also enters the market with a host of advantages that were yet to be seen in the market. Expect Anyswap to disrupt the market hold by centralized exchanges once it is fully operational.

Swap Support

The Anyswap protocol supports swap features that are lucrative in the cryptocurrency exchange market. These features include the following:

- Cross chain swaps where users can immediately swap one coin for the other.

- Decentralized cross chain bridge. The feature allows users to deposit any coin, regardless of the blockchain, into the protocol. It also allows users to mint wrapped tokens from the network in a decentralized way.

Easy Swap

Token swaps via Anyswap are done simply. The process requires a user to select input and an output token. Once the amount of input token is selected, the Anyswap system calculates, including fees, how much of the output token the user will get.

In terms of support, Anyswap accepts tokens swapping for over 95% of available tokens in the market, including Bitcoin (BTC), Litecoin (LTC), and XRP. This is arguably better support than most of the centralized platforms in the market. The support allows users to swap as many pairs as available in the fusion platform.

Larger Pool of Traders

As stated earlier, the Fusion network is a representation of what interoperability is in the market. Most platforms are claiming interoperability is merely touting compatibility in their networks. Because of its interoperability, Fusion is expected to have a large pool of traders that includes governments, banks, individuals, stocks, and businesses.

Most, if not all, of these traders, will be dealing in several types of digital assets. The large pool of digital assets will create the liquidity necessary for supporting the seamless operation of the decentralized exchange.

Therefore, you are likely to get more output token options from Anyswap than from any other centralized exchange in the market. Further, you will obtain these tokens securely and safely through Anyswap’s fully decentralized system.

Fully Decentralized

Anyswap eliminates any presence of third-party controlling aspects of transactions within the network. They achieve this using their novel mechanism, the Distributed Control Rights Mechanism (DCRM). It is the key to their entire service, the solution that allows for seamless blockchain interoperability.

Being fully decentralized, Anyswap affords advantages over centralized cryptocurrency exchanges in the following areas.

Maximum Security

Anyswap is fully decentralized; thus, it is secured by the merits of blockchain technology. On the other hand, centralized exchanges have a single point of weakness, making them vulnerable to cyber-attacks. Because they hold funds and data from a central point, any form of infiltration in the system can cause massive losses. If hackers gain access to private keys, then the entire network can be compromised.

Further, the single point of failure makes centralized platforms vulnerable to any technical problems in the network. For example, a single technical problem could render centralized exchanges unusable.

With Anyswap and generally decentralized exchanges, there is no way a security fault will affect a large number of users. Anyswap holds no private keys or digital assets making them almost invulnerable to attacks. Its set up also discourages hackers as the reward is likely to be insignificant compared to centralized exchanges.

Another security advantage of the Anyswap system is in its demand for personal data. Very little personal data is required when using Anyswap as the transactions take place over a trustless system. This reduces the platform’s appeal to hackers as there are no promising rewards.

Safer Transactions

Unlike centralized exchanges, Anyswap negates the need for a middleman. The function of centralized platforms, as intermediaries introduce many points of weaknesses in centralized exchanges. With Anyswap, the feature only facilitates transactions without holding your currency or your key. You have full control over your digital assets in the Anyswap system. Thus, when carrying out transactions, only the trading parties are involved.

Another potential loss area when carrying out transactions on centralized exchanges is in the type of wallet used for the transaction. Centralized exchanges use a hot wallet, which poses a huge security risk. Given that the hot wallets are connected online, it is easier for hackers to gain access to wallets via compromised centralized exchanges.

When using Anyswap, transactions are possible through cold wallets. Cold wallets are kept offline, which makes gaining access to them an almost impossible task. Thus, transactions over Anyswap are safer.

Initially, Anyswap will offer support to Metamask and Ledger wallets. The support for Metamask, a hot wallet, is to support those who may not yet have cold wallets. Fusion plans to add support for more hardware wallets in the future. By providing its API, the Anyswap protocol can be easily integrated into any wallet.

Speed and Liquidity

These two describe the drawbacks that exist in decentralized exchanges. Why Anyswap will be superior in these regards is because, In terms of liquidity, the DCRM will pool together users from different blockchains, thus offering extensive liquidity in the ecosystem.

Another important feature by the Fusion team is the Time Lock feature. It also helps provide liquidity in the network. The feature allows owners of cryptocurrencies to give user rights to others within the network. Owners retain the ownership of the cryptocurrency while users get to utilize the digital assets for the specified period. The time lock feature can be employed in use cases such as staking. As the use of the time lock function grows, we are likely to see more complex use cases.

The time lock feature makes Anyswap stand out in the blockchain industry. Centralized exchanges may not have as elaborate a feature, such as Time Lock.

Endurance

Anyswap is likely to survive longer compared to existing centralized exchanges. Most of the centralized exchanges are regulated by government laws depending on their area of operation. Some governments also entirely ban crypto-related activities within their authority.

For decentralized exchanges such as Anyswap, their survival is almost assured because of their decentralization. They can continue operating as their function is mainly to link traders. They do not function as a third-party, as most centralized exchanges do; thus, they may not have any obligation to meet as set by some governments. In the case of governments completely banning cryptocurrency exchanges, Anyswap has a better chance of survival than any centralized exchange.

Convenience

Anyswap enables users to experience arguably the best convenience in the market. The platforms allow its users to carry out risk-free financial operations, in that, users can link two smart contracts for two different purposes. Once the first smart contract ends, the second one kicks in immediately. Therefore, users can plan numerous investments long-term by linking the smart contracts involved in those investments. Such convenience is rarely seen in centralized exchanges.

For businesses, Anyswap provides a fast, secure, and cost-saving ecosystem. Businesses will enjoy transacting between different blockchains at cost-effective rates all under one roof. Anyswap makes business transactions convenient by eliminating the need for multiple transactions through different platforms for payment purposes. Businesses can easily swap their tokens to make payments via Fusion.

A New Status Quo of Blockchain Architecture Begins

The main merit of Anyswap lies in its total decentralization. The platforms remain dedicated to the blockchain vision by ensuring that it delivers fully decentralized financial solutions in the blockchain industry. It also delivers just what the market needed at a time when blockchain adoption is increasing globally.

After months of eagerly waiting, the release of Anyswap on July 20th will bring all the decentralized exchange benefits into light. Expect to see Fusion growing in value post Anyswap release!

{no_ads}