Ad Watchdog Warns Crypto Companies Not to Mislead the Public

UK advertising watchdog, the Advertising Standards Authority (ASA), sent a signal to all crypto companies not to overhype crypto and to clearly indicate all risks to the consumers.

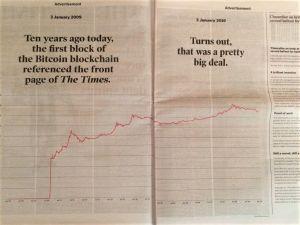

Following a newspaper ad for the cryptocurrency trading platform BitMEX from January 2019, the ASA received four complaints that the ad might’ve been misleading from those who believed it exaggerated the return on the investment and failed to illustrate the risk of the investment.

According to the ASA ruling on the Seychelles-based HDR Global Trading Ltd that owns and operates BitMEX, which was upheld today, “the ad must not appear again in its current form”. The ASA states that they’ve told the company to make sure that “financial information in their ads was set out in a way that allowed it to be readily understood by the audience being addressed and that the risks of investments were sufficiently clearly signposted.”

BitMEX defended itself saying, among other things, that:

- it was a peer-to-peer crypto-products trading platform, that users have to already own Bitcoin before using the exchange, and that it had no direct financial interest in the value of BTC

- while the ad stated “advertisement” at the top of the page it was not intended as a promotion of their products but as a commemoration of a landmark, as it was produced to commemorate the 10th anniversary of the mining of the initial block on the Bitcoin blockchain

- the purpose of the graph was to inform, not to sell or to advertise either Bitcoin or any product sold by HDR Global Trading

- the graph did not exaggerate the benefits of a Bitcoin investment or conceal the risks associated with such an investment.

However, the ASA stated that the ad contained a graph depicting the value of BTC against USD since January 2009, using a logarithmic scale, and though such graphs are useful for presenting data, a certain amount of “specialist knowledge” of the scale is needed to interpret the graph. The ASA concluded that “in the absence of clear explanatory information, the graph was unlikely to be familiar or readily understandable to the national newspaper audience to whom the ad was directed.”

Hence, the ASA believes that the readers would likely interpret the graph as showing “a sharp then steady rise” in BTC value up to its peak in November 2017, which was then followed by “a gentle decline” since – contrary to the dramatic fluctuations of BTC’s value in recent years.

“For those reasons we considered that readers of the ad were likely to be misled about bitcoin’s value and stability in recent years and therefore about what any investments they might previously have made would have yielded,” stands in the ruling.

Furthermore, the text that was placed along the graph did not mitigate “the overwhelming impression” about the value of BTC as created by the graph, and the full text was “a clear promotional statement of Bitcoin’s merits,” with very little warning to consumers about potential risks.

_________________________

_________________________

Therefore, the ASA concluded that the ad “misleadingly exaggerated the return on investment, failed to illustrate the risk of the investment” and was in breach of the CAP Code (the UK Code of Non-broadcast Advertising, Sales Promotion and Direct Marketing).

Meanwhile, just recently the Financial Conduct Authority (FCA), a financial regulatory body in the United Kingdom, issued the Final Guidance on Cryptoassets.

At pixel time (11:29 UTC), bitcoin trades at c. 10,510 and is down by 7% in the past 24 hours, by 9.5% in the past week. It’s still up by 2% in the past month and by 72% in the past 12 months.