Aave’s LEND Falls Further While Value Locked Grows

After seeing massive growth in its price over the past couple of months, LEND, the native token of decentralized finance (DeFi) platform Aave, extended its correction today with a fall of 6.6% over the past 24 hours, while the majority of top 50 coins are in the green today.

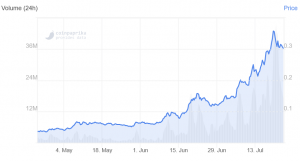

The latest fall in price for LEND comes as the token first saw a sell-off starting on Monday this week, after a parabolic rally of 6,200% in USD terms over the past year. Since the start of the correction on Monday, however, the price of LEND has now declined by more than 20% from its peak of USD 0.385, to a price of USD 0.298 as of press time (09:51 UTC).

LEND price chart:

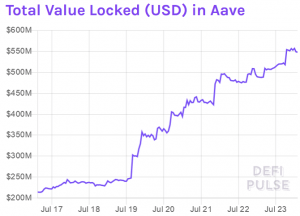

LEND is currently ranked as the 35th most valuable cryptoasset by market capitalization, while the Aave protocol itself ranks as the third-largest DeFi platform by total value locked (TVL), according to DeFi Pulse’s ranking.

Despite the falling token price, however, the Aave protocol’s TVL still continues to grow. According to data from DeFi Pulse, the USD value locked in Aave has increased by 12% over the past 24 hours to a level of USD 548 million.

The growth in TVL over the past day thus far outperformed major DeFi rivals Maker (MKR), Compound (COMP) which saw their TVL grow by 8%, 3%, and 2%, respectively, over the same period.

In addition to LEND, the highly volatile altcoin ampleforth (AMPL) has also seen strong selling pressure today, trading down by more than 30% over the past 24 hours, to a price of USD 1.79 per token, as of press time (09:51 UTC). The selling today comes after the altcoin saw strong gains last week, at one point positioning it as the best 7-day performer among the top 60 cryptoassets by market capitalization.