A New Threat to Utility Tokens – “Detokenization”

Some blockchain-focused companies with working products that have completed initial coin offerings (ICOs) are now accepting payments in fiat currencies alongside their own ICO tokens, thus diminishing the value of the tokens, according to a new study from accounting giant EY.

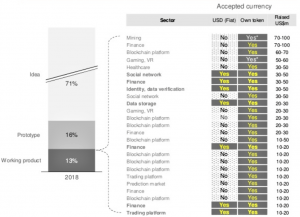

In the study, EY examined “the leading 86 ICO projects” that raised capital from token investors last year. Out of the 86 unidentified projects, only 25 now have a working product. Further, 7 out of the 25 unidentified companies are accepting other currencies than their own token as payment on their platform.

In one case, EY wrote, a company “abandoned ICO investors by no longer accepting their tokens,” a move referred to by EY as “detokenization,” effectively leaving the token worthless.

“One year after an ICO, Digipulse, a “crypto-inheritance” service, has announced it will detokenize its business, shifting exclusively to direct fiat currency payments,” according to the study.

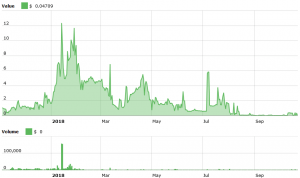

Digipulse price chart:

As investors should be aware by now, utility tokens are not shares of a company, and do not necessarily perform like shares. If they did, they would under most circumstances be considered securities. As a result, a utility token with no use-cases should over time be rendered worthless by the market.

As EY noted, users do not use utility tokens to store value, but rather to pay for services within a platform. When this is no longer exclusively possible for token holders, little incentive exists to continue holding the token.

“Despite the past year’s hype around ICOs, there appears to be a significant lack of understanding around the risks and rewards of these investments. In addition, there is a disparity between those who invest in ICOs and the ICO project developers regarding the anticipated timelines of ROI [Return on Investment],” said Paul Brody, Global innovation leader for blockchain at EY.

Overal, in the first half of 2018, 86% of the leading ICOs that listed on a cryptocurrency exchange in 2017 are below their initial listing price and a portfolio of these ICOs is down by 66% since the peak of the market at the beginning of this year, the study showed.

In conclusion, EY also noted that Ethereum for now remains the dominant platform for launching ICOs, and that it “shows the highest activity among developers and on social media.” It added that “there is no sign that the new ICO infrastructure projects have had any success in reducing the dominance of Ethereum as the industry’s main platform.”