How to Buy Litecoin (LTC) in 2024 – Step-by-Step

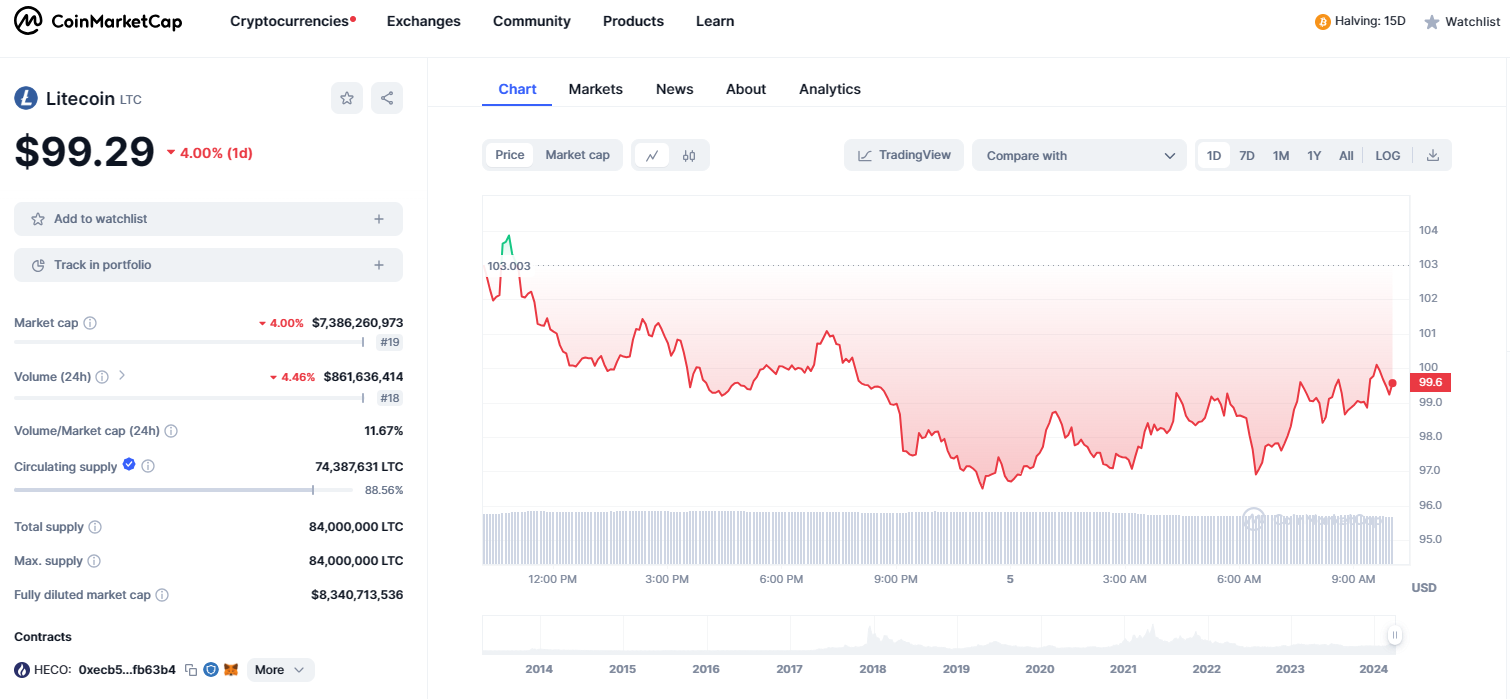

Litecoin has accumulated massive success since its creation in 2011. Its secure, fast, and low-cost network makes it a great altcoin for payments. Litecoin is one of the most stable and established cryptocurrencies regarding liquidity and transaction volumes and has a strong community of developers behind it.

In this guide, we will dive deeper into how to buy Litecoin, the safest way to store it as well as the best place to buy it.

What is Litecoin?

Litecoin is a decentralized peer-to-peer cryptocurrency that isn’t controlled by any central authority. It was adapted from Bitcoin’s open-source code but had several modifications to improve large-scale mining for investors.

Litecoin is one of the first altcoins to come into existence that diverged from the original Bitcoin blockchain. Every four years, a halving event takes place, which usually impacts the price of Litecoin.

Unlike Bitcoin, which uses Proof-of-work (PoW), Litecoin uses Proof-of-Stake (PoS), which differs from the PoW algorithm. This Scrypt-based approach is less energy-intensive and increases the speed of transactions. Litecoin is a crypto coin, not a token. This is because Litecoin has its blockchain network, unlike tokens which are built off existing blockchains.

Litecoin offers a wide range of user-friendly utilities that are beneficial when trading. Some of these include fast and affordable transactions, decentralization, peer-to-peer (P2P) payments, interoperability, and atomic swaps.

How to Buy Litecoin: Step-by-Step Guide

Now that we’ve explained what Litecoin is, we can move forward to our step-by-step buying guide. Read on to how to buy Litecoin crypto in five simple steps.

1) Pick a Crypto Exchange

Firstly, carefully choose a suitable crypto exchange that lists Litecoin. When trading, explore which fees will be charged and which deposit options are available. Furthermore, our top pick is eToro. It has a wide range of assets, low transaction fees, KYC, and AML checks. On top of this, users can buy Litecoin with a debit card, e-wallets, and local bank transfers.

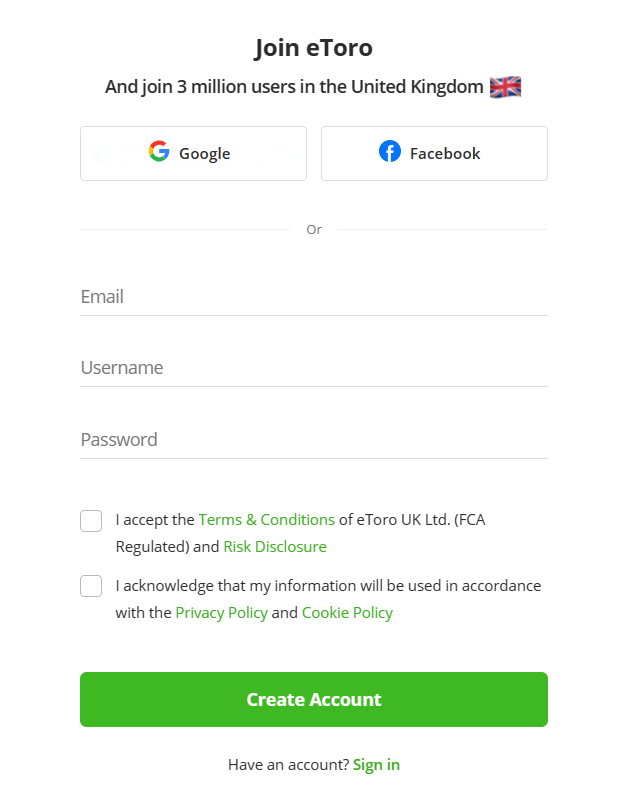

For this example, we’ll explore how to buy LTC on eToro. However, most sites have a similar process when buying crypto. Firstly, make sure to register for an account to buy Litecoin. To do this on eToro, click sign up and input the requested personal information.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

2). Verify Your Account

Users will need to verify their accounts on eToro with documentation such as ID. To do this, users can choose between uploading a copy of their driving license or passport. Proof of address within three months is needed, so a recent bank statement would be a good fit for this.

How long does the verification take?

3) Deposit Fiat or Crypto

Depositing funds into eToro is an easy process. It allows users to use a debit card to buy Litecoin instantly. However, the minimum deposit on eToro is $10.

Some additional payment methods that eToro supports:

- E-wallets like Skrill, PayPal, or Neteller.

- Credit card issued by MasterCard, Visa, or Maestro.

4) Choose a Litecoin Trading Pair

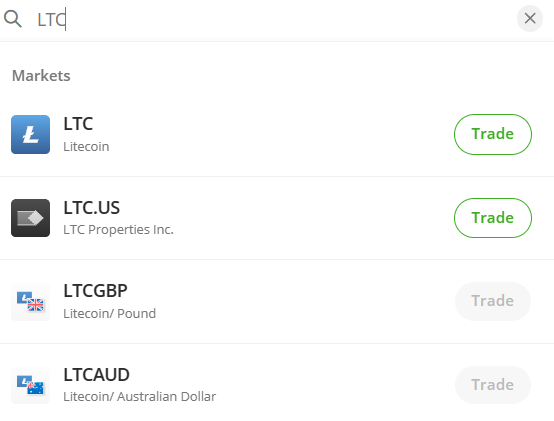

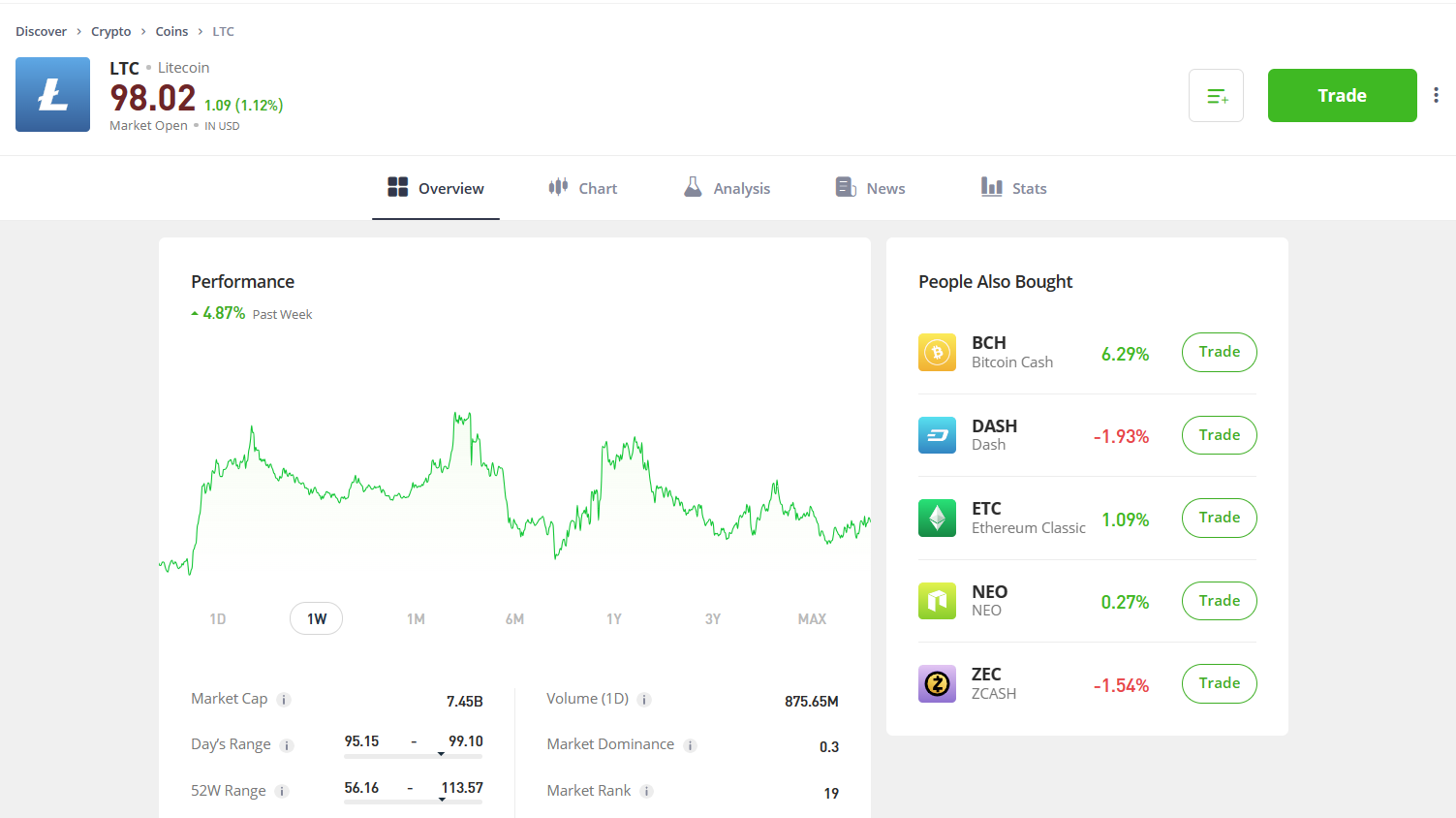

Litecoin has different trading pairs that users can trade, such as LTC/GBP and LTC/AUD. In this section, we will explain how to buy funds using GBP. eToro provides a search bar where users can type in LTC/GBP. This will provide a drop-down menu where the trading pair can be selected.

Users will be redirected to a page with the real-time chart and posts on LTC/GBP. In the top right, select trade and fill out the amount box.

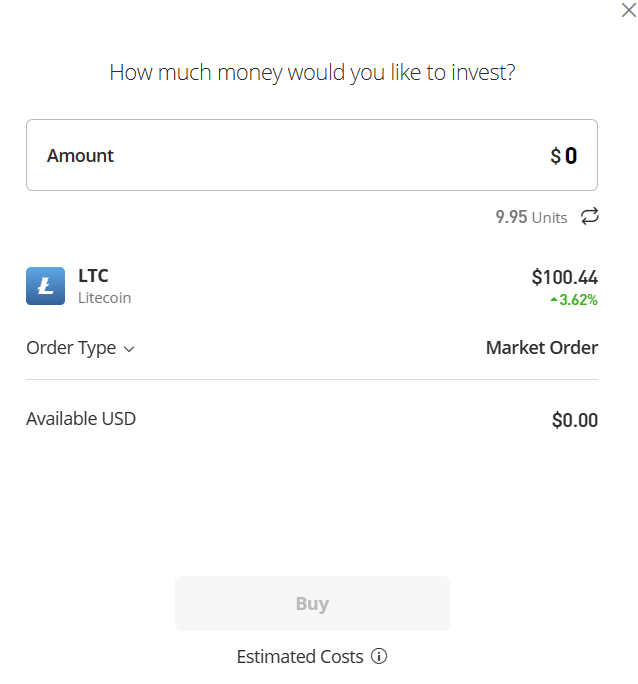

5) Place Litecoin Order

Once ready, select the ‘Buy’ button. The order will be processed immediately due to it being a market order. LTC will be added to the eToro wallet and the value of your investment will increase and decrease according to the real-time market price. In addition, LTC can be left in the eToro account and withdrawn to a private wallet when extra income is earned.

Where to Buy Litecoin in 2024? The Best Places

Deciding the best place to buy Litecoin is essential. Key factors to take into account are payment methods, regulation, wallet storage, trading commissions, and customer support.

After a thorough review of various crypto exchanges, we found that eToro, OKX, and MEXC are the top three options. Read on to find the most suitable platform for you to buy Litecoin on.

1. eToro – User-Friendly and Secure Trading Platform

eToro is our overall top pick for safety. Created in 2007, eToro is widely known for its range of digital assets and low exchange fees. One of their top features is copy trading, which allows users to copy previous investor trades, which works on Litecoin as well.

It includes two-factor authentication (2FA) and keeps users’ coins in cold storage wallets. On top of this, eToro stores clients’ fiat funds in top-tier bank accounts, which are segregated. KYC and AML checks are carried out to ensure no fraudulent accounts are made, and account activity is closely monitored.

Trading on eToro requires a trading commission of 1% when buying Litecoin. This is cheap compared to its competitor, Coinbase, which charges up to 5% to buy or sell any cryptocurrency. Moreover, eToro is accessible on web browsers and mobile apps. It supports iOS, Android and various browsers.

Exchange

Payments

Commission to buy Litecoin

eToro

Accepts e-wallets, debit/credit cards and local bank transfers.

1%

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

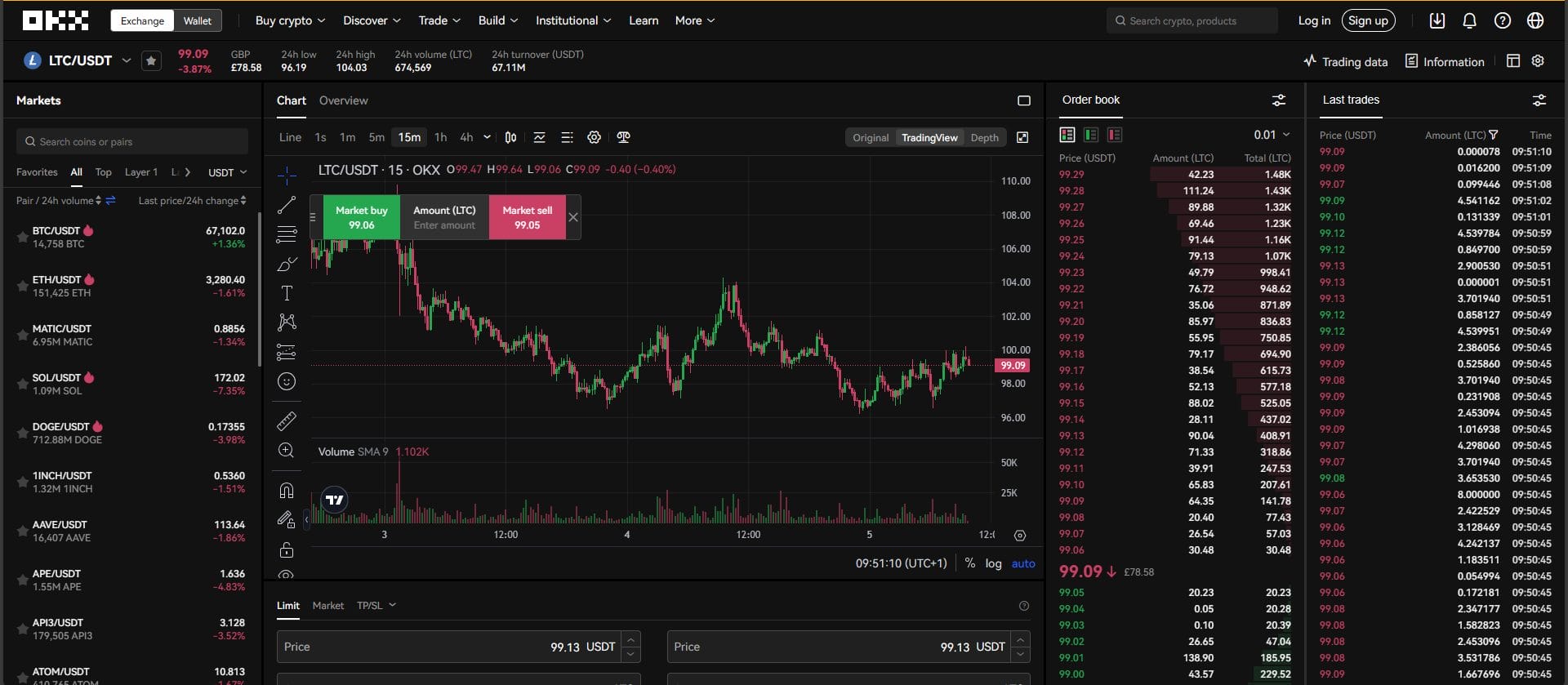

2. OKX – Comprehensive Exchange with Advanced Trading Options

OKX is an innovative cryptocurrency exchange that offers a variety of trading pairs and advanced financial services. It was founded in 2017 and has 20 million users. It provides margin trading, which allows users to trade borrowed funds to amplify potential profits.

OKX provides real-time charts for every cryptocurrency pair, different market pairs, order book history, and the latest trades. This site is great for intermediate to advanced users looking to primarily focus on trading. OKX offers robust security, such as offline storage for the majority of its crypto holdings, 2FA, anti-phishing codes, semi-offline multi-signatures, and secure private key storage.

Exchange

Payments

Commission to buy Litecoin

OKX

Credit/debit card or E-wallet.

0.1%.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

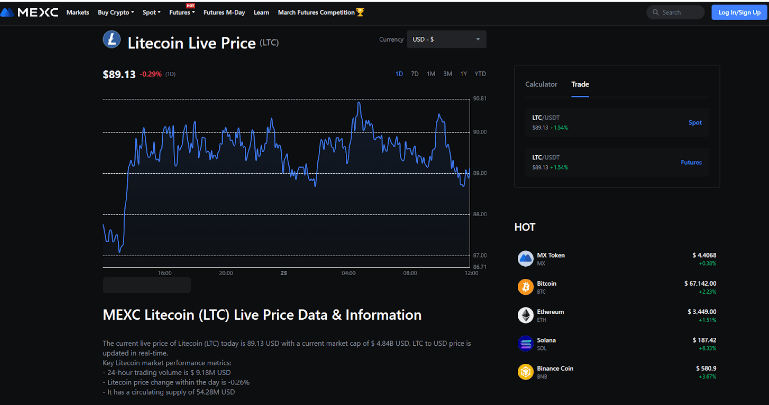

3. MEXC - Low Fee Exchange with Detailed Price Analysis

MEXC is one of the cheapest platforms to buy Litecoin, charging 0.1% on spot trading commissions. This means that for £100, £0.10p will be charged.

This exchange fee applies to all cryptocurrencies on the platform like Bitcoin, Ethereum, and Solana. It supports debit/credit cards with instant transactions. The fees vary depending on the provider, with an average fee of 3%. MEXC is great for making Litecoin price predictions as it provides technical indicators and real-time pricing charts.

MEXC offers a mobile app for iOS, Android, and web browsers. Its tools are best suited for intermediate to advanced traders. Users' accounts are protected by various features, such as IP device whitelisting, 2FA, and SMS verification.

Exchange

Payments

Commission to buy Litecoin

MEXC

Handled by third-party processors. Mastercard and VISA are accepted.

0.1%

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

How We Ranked The Best Places to Buy Litecoin

Here are the key factors to look at when deciding where to buy Litecoin.

Lowest Trading Fees

Low trading is one of the most important things for traders and investors for several reasons.

Firstly, low trading fees provide cost efficiency, which allows traders to maximize profits due to the reduced cost of overall trading. For investors who wish to hold long-term positions, it will help them accumulate fewer costs over time.

Furthermore, the low cost will increase participation from traders and investors. With more traders taking part, it will create smoother price movements due to higher liquidity. For investors, low cost can lead to a broader investor base where the markets will be healthier.

Comparing the three platforms we discussed earlier, we can see that MEXC is a great platform for low trading fees, with an additional cost of 0.1% per trade. After each trade has been executed, they will charge nothing for what they will make and only take 0.02% of the total trade value.

MEXC is the cheapest trading platform compared to leading platforms like OKX, Coinbase, and Binance. The OKX maker fee is 0.08%, and the taker fee is 0.10%. Binance typically charges a 0.1% maker fee and a 0.2% taker fee. Meanwhile, the Coinbase maker fee is 0.4%, and the taker fee is 0.6% with an added spread.

Ease of Use and Trading Features

Accessibility and ease of use play a vital role in Litecoin (LTC) trading, ultimately affecting the overall trading experience. Litecoin has high popularity means that your choice of platforms is quite broad. Each platform offers different features when trading Litecoin, including real-time charts, entering/exiting trades, and new information about the coin. Ultimately, buying Litecoin should be an intuitive experience with transparency surrounding fees and detailed information about the coin.

We found that eToro offers the best trading features for users who want to trade on the Litecoin blockchain.

Buying and selling assets is easy and efficient, allowing users to quickly take advantage of Litecoin liquidity. On top of this, it offers a wide range of Litecoin trading pairs, a real-time chart of each asset, copy trading features for previous trades on the Litecoin blockchain and news about Litecoin that other users have discovered.

Number of Litecoin Trading Pairs

The number of trading pairs is an important consideration. Diverse trading pairs allow the user to enter the market easily with both fiat and crypto. Some exchanges only support buying LTC with crypto, while others support both fiat and crypto purchases.

The more trading pairs available, the greater the chance of a successful trade and less chance of failure.

MEXC and OKX only offer crypto trading pairs such as LTC/USDT, LTC/BTC, and LTC/ETH. You'll need to already hold crypto to buy Litecoin on these exchanges. eToro offers a range of Litecoin trading pairs, including LTC/GBP and LTC/AUD.

Support for Most Purchase Methods

Litecoin can be easily bought using a range of different payment methods. The most commonly used payment methods by traders are debit/credit card, Paypal, bank transfer, and existing cryptocurrency that can be converted into Litecoin.

Having a wide range of payment methods can serve as an advantage for users. The flexibility of different transaction methods attracts more traders to the scene, as does the ability to store funds in different accounts. Transferring crypto to crypto provides lower cost and simplified use, as users won't have to keep depositing new funds into their accounts.

Earlier, we assessed the different methods eToro, MEXC, and OKX provide, but out of the three, we found that eToro is the best. This is because they accept E-wallets, debit/credit cards, crypto, and local bank transfers with a cheap transaction fee of 0.1%. eToro is a great place for traders to trade efficiently with their fiat wallet, allowing them to trade crypto directly on the platform.

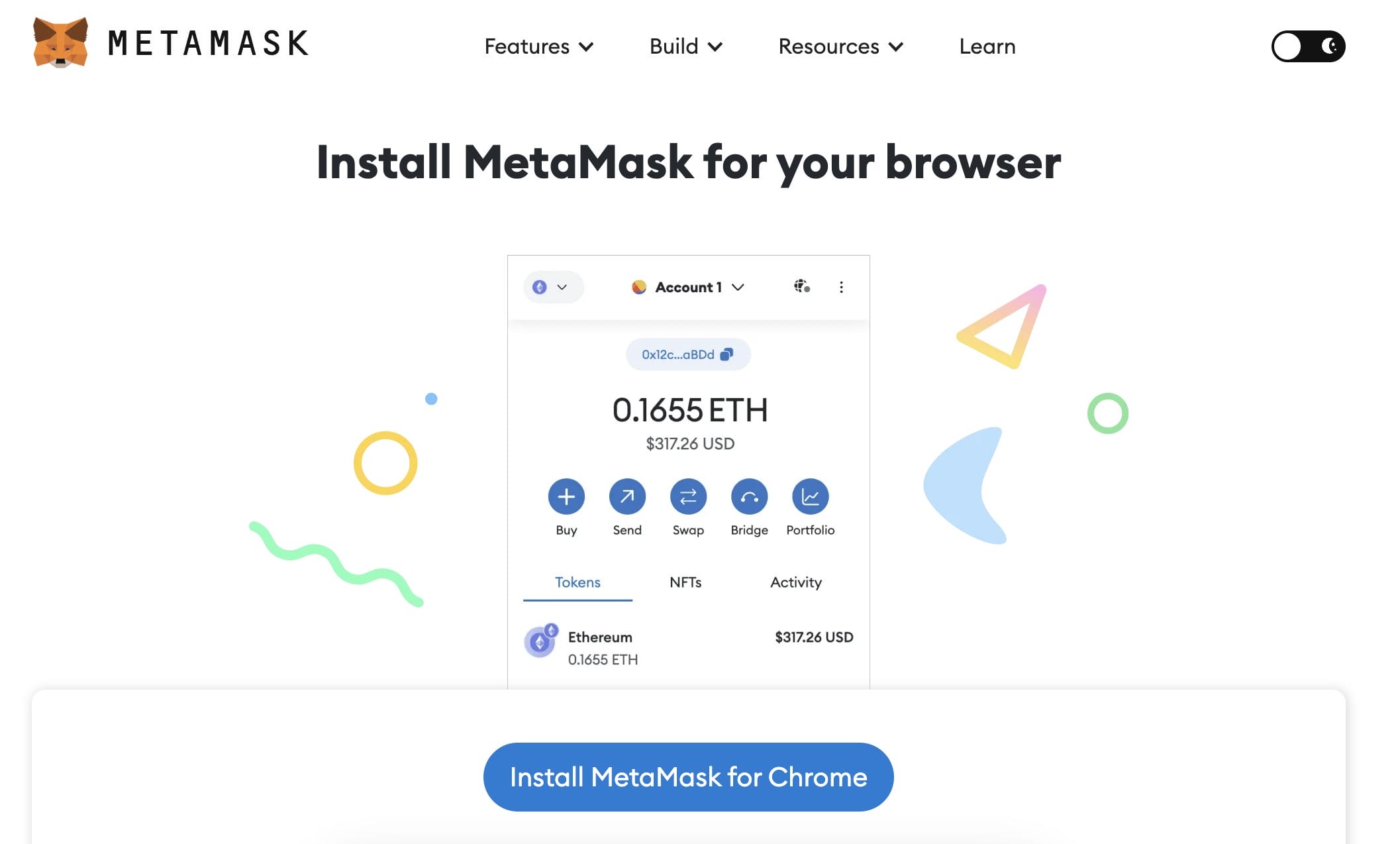

Holding Litecoin on a centralized exchange is usually the easiest option for active trading. However, centralized exchanges control assets held with them, which means that you could lose your funds in the event of a major hack or bankruptcy. Holding it outside of an exchange on a decentralized wallet will prevent a loss of funds and allow you to move assets around easily, with no exchange fee. All you will have to pay is the network transaction fee. Withdrawing Litecoin to a decentralized, private wallet grants you full ownership of the coins. You can choose between a hot wallet, which stores your funds online for easy access, and a cold wallet, which stores your funds securely offline using a physical device. Examples of cold wallets are Ellipal or Trezor. A good recommendation for a hot wallet is MetaMask. It can be used as a browser extension for Firefox, Chrome, Brave and Edge. On top of this, it can be used on mobile apps, allowing you to trade, send, and receive on the go. MetaMask is free to use and is easy to set up. Read more about how to set up MetaMask. How to Store Your Litecoin

Finding the best wallet to store it in may depend on your circumstances, prior experience, and financial goals.

What Can You Use Litecoin For?

Litecoin is mostly used as an investment. It’s similar to other cryptocurrencies as it profits if LTC increases. That said, Litecoin has several other features that can be used:

Peer-to-Peer Transactions

Litecoin is used as an open-source, decentralized global payment network. Users can pay Litecoin to other users easily and exchange it for another crypto. It's often used as an alternative to Bitcoin due to its cheap and fast transactions. On top of this, you can buy Litecoin using debit/credit cards, PayPal, bank transfers, and crypto payments.

Online Purchases

Litecoin is a very popular cryptocurrency that is accepted as a form of payment by many companies. It's exceptional to many companies due to its fast payment process and enhanced security.

Examples of these companies include Litecoin casinos, Travala, a travel company that allows you to book flights and hotels, RE/MAX, a real estate company that allows users to rent properties using Litecoin, and eGifter, a company that allows users to send gifts to others.

Remittances

Litecoin has experienced high usage as a means of payment. In 2024, it surpassed Bitcoin in Bitpay usage due to its various features. One of its standout features is the average transaction fee of less than $0.01, making it an exceptional choice for users.

Other features Litecoin provides are lightning-fast settlements, cross-border accessibility, friendly cost, and a secure option for sending and receiving funds internationally.

Its P2P payment feature allows users to send cryptocurrency directly and effortlessly to each other by a link or QR code, which is directly connected to the crypto wallet.

Investment

Litecoin is a great investment tool for short and long-term and new trades. This is due to its affordability and stability. Due to its low cost, more coins can be purchased, and its deep liquidity on exchanges can help traders reap significant profits through trading.

The Litecoin Foundation continuously works on adoption, partnerships, and use cases. For instance, it became the official coin for the Ultimate Fighting Championship (UFC), which will attract a new audience due to their interest in the sport.

Diversification

Litecoin has diverse trading pairs for investors and traders to use and is available on most exchanges. Examples of some of the more popular pairs include LTC/BTC, LTC/DOGE, and LTC/USD, but you can also trade LTC for lesser-known altcoins. This gives traders access to deeper liquidity on exchanges and enables them to easily tap into the next cryptocurrency to explode and diversify their portfolios.

Micropayments

Litecoin supports much smaller payments than those supported by major blockchains such as Bitcoin. They can be useful for tipping content creators, making donations to charity, or paying for subscriptions. On top of this, users can earn LTC using a crypto faucet, which rewards a small amount of Litecoin to users who complete tasks.

Smart Contracts and Decentralized Applications (DApps)

Litecoin has stepped up its game, launching OminiLite, a decentralized token creation platform. It introduces smart contracts, tokenized assets, DAOs and NFT functionality onto the Litecoin blockchain.

Developers can use this to create and profit from their altcoins due to Litecoin's quicker transactions and confirmation.

Conclusion

In conclusion, Litecoin offers high liquidity and a variety of trading pairs, including LTC/GBP and LTC/USD. Its wide range of utilities and low cost make it a great blockchain to invest in for users of all backgrounds.

To choose a platform to trade Litecoin on, eToro is our top pick. It’s home to 30 million active users and offers a range of deposit options, including a debit/credit card or e-wallet. Then, it’s just a case of typing the investment size and submitting the order.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

FAQs

Where can I buy Litecoin?

Litecoin can be found on most trading platforms, including eToro, MEXC, and OKX. These platforms offer cheap exchange fees and provide digital wallets for holding Litecoin.

How do you buy Litecoin instantly?

On eToro, type LTC into the search bar and select it. Click trade, enter the amount, and then submit the amount to submit into a trade.

What is the best place to buy Litecoin?

MEXC offers a range of trading pairs to trade Litecoin with. Their trading fees are only 0.1%, 0% Futures Maker Fee and 0.02% Taker Fee

Can you buy Litecoin with a debit card?

Most platforms support debit cards for Litecoin. In particular, eToro supports debit card payments for Litecoin, with a 1% commission fee.

Is it worth buying Litecoin?

Litecoin is a popular cryptocurrency to buy because of its fast, secure, and low-cost payments as well as its connections to Bitcoin.

Viraj Randev

Viraj Randev

Nick Pappas

Nick Pappas

Eric Huffman

Eric Huffman