Unique Ethereum TX Count Jumps 40% Ahead of Merge; Overtakes Bitcoin

Unique Ethereum transactions jumped by 40.3% between August 31 and September 4, as Ethereum developers completed the latest Bellatrix upgrade and prepared for next week’s Merge. And with yesterday’s transaction count residing at 368,463, it has overtaken the corresponding figure for Bitcoin, which stood at 351,285.

This isn’t the first time that unique Ethereum transactions have overtaken Bitcoin transactions. However, with the price of ETH as a ratio of BTC’s price reaching a high for this year, it hints at a possible ‘flippening,’ with Ethereum potentially overtaking its bigger rival on a number of dimensions.

Ethereum’s Unique Transactions Overtake Bitcoin’s

It’s perhaps no surprise that Ethereum’s transaction count has overtaken Bitcoin’s, since transaction volumes tend to be correlated with price. And over the past week, ETH’s price has risen by 7%, while BTC’s has increased by 4%.

In fact, since the lows of mid-June, ETH has risen by an impressive 80%. Meanwhile, BTC has risen by 14.5% across the same period.

This disparity underlines the numerous ways in which Ethereum appears to be catching up — or overtaking — Bitcoin. It chimes with the ETH-BTC price ratio, which CoinMarketCap data shows reached a high for 2022 yesterday, of 0.08514 BTC.

Other metrics in which Ethereum outstrips Bitcoin include total number of transactions per day, although Ethereum overtook Bitcoin on this front back in July 2017. More significantly, recent weeks have seen total volumes for ethereum futures overtake those for bitcoin, according to data from Deribit.

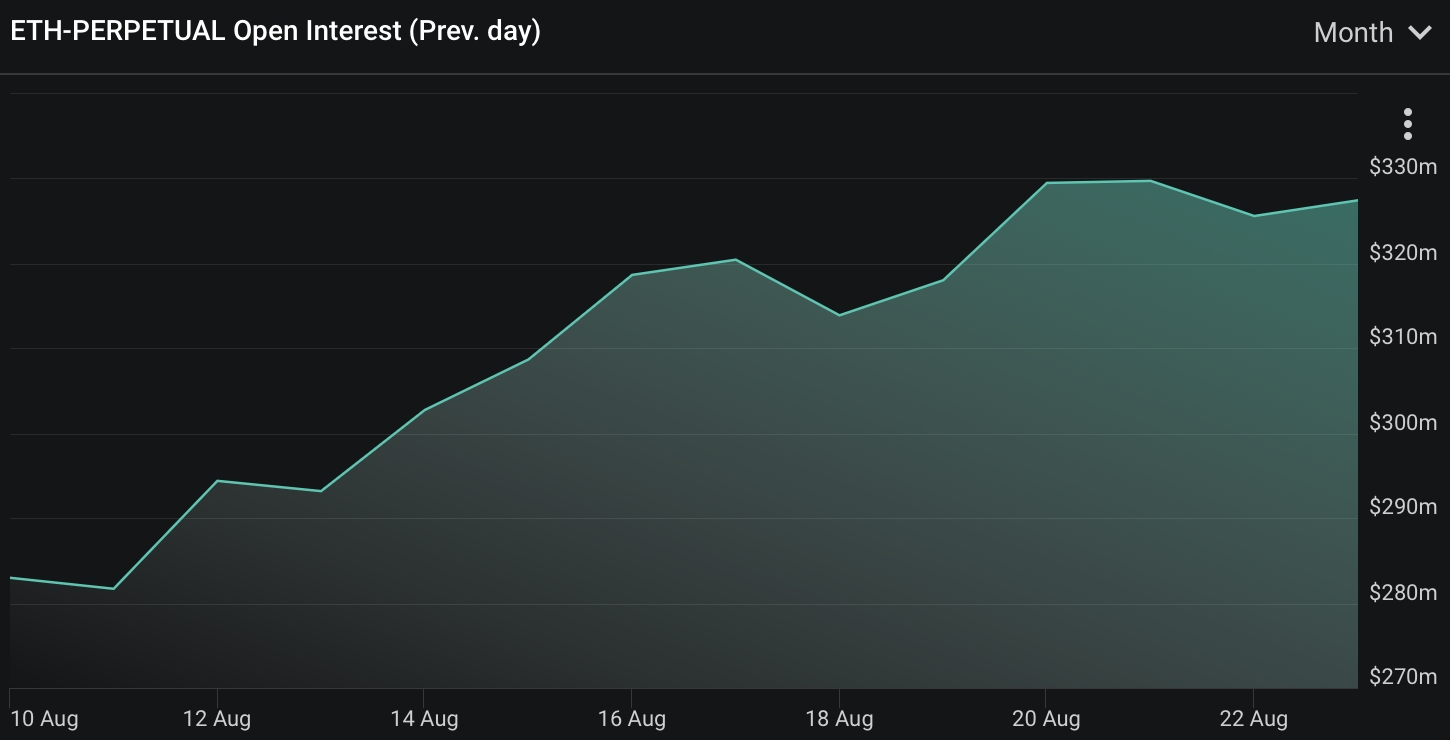

Importantly, Deribit’s data shows that increases in ETH futures have recently outpaced those for BTC futures, rising by just over 70% since mid-July, compared to 12.9% for Bitcoin perpetual futures.

This fits with reports that institutional investors have been increasingly turning their attention to ETH in the weeks leading up to the Merge, which is due to take place between September 13 and 15. For instance, a recent CoinShares report found that in the week to August 8, ethereum “saw inflows totalling US$16m and is enjoying a near 7 consecutive week run of inflows totalling US$159m.”

The Flippening?

Such increased interest in Ethereum hints at a possible future in which the near-mythical ‘flippening’ will take place, in that ethereum may overtake bitcoin in terms of its market capitalization, and/or other important metrics.

This needs to be put in some perspective, however. As stated above ETH’s price as a ratio of BTC is still only 0.0815, meaning that it would have to rise by over 1,000% — without BTC rising at all — for it to reach 1.

Similarly, ETH would have to double from its current price — again without BTC moving — for it to equal its rival’s market cap.

This is unlikely, given that BTC continues to attract more interest than ETH, even if the later has seen an acceleration in demand. Most notably, August saw BlackRock — the largest asset manager in the world — launch its own private bitcoin fund.

And while the market has witnessed faster increases in ETH futures in recent weeks, data from CME shows that absolute numbers still weigh heavily in BTC’s favor.

CNBC’s @KenzieSigalos just went live on TV talking about how the #Ethereum Merge is coming soon

— Crypto-Gucci.eth ᵍᵐ🦇🔊 (@CryptoGucci) September 7, 2022

She talks about how post-Merge Ethereum will consume less energy, become deflationary, and will be historic for the entire industry 🔥pic.twitter.com/UOYf7g4cDL

Nonetheless, a narrative has developed that Ethereum’s shift to a proof-of-stake consensus mechanism will result in it becoming marginally deflationary. This could potentially happen, given that staking rewards will be fewer than mining rewards, and given the token burns implemented last year with EIP-1559.

Assuming this is the case, then Ethereum’s unique transactions overtaking Bitcoin’s is really only the tip of the iceberg.