Taproot Adoption Remains Low, But Devs Say It Isn’t a Problem for Bitcoin

- It’s been five months, yet Taproot adoption by Bitcoin users remains glaringly low.

- A positive outlook appears to be the prevailing sentiment among coders as they expect adoption to gather steam soon enough.

- Bitcoin’s development community is undertaking ongoing longer-term work on a wide variety of new technical features.

Taproot is the biggest upgrade Bitcoin (BTC) has seen since SegWit (Segregated Witness), providing the cryptocurrency with a range of new features that make it more private and more versatile. These include support for complex transactions involving multiple signatures, as well as the ability to make Lightning channels look like normal Bitcoin transactions.

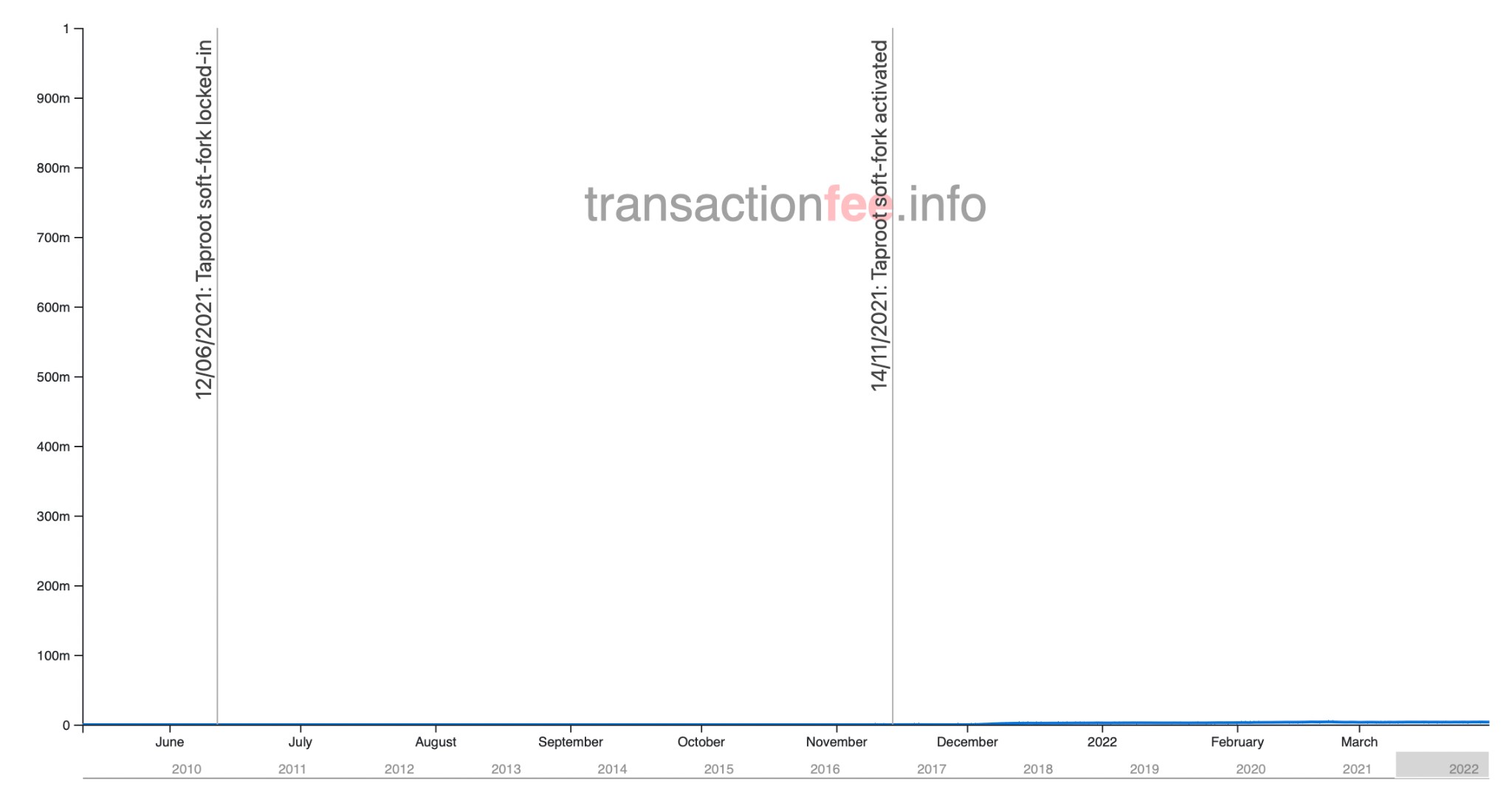

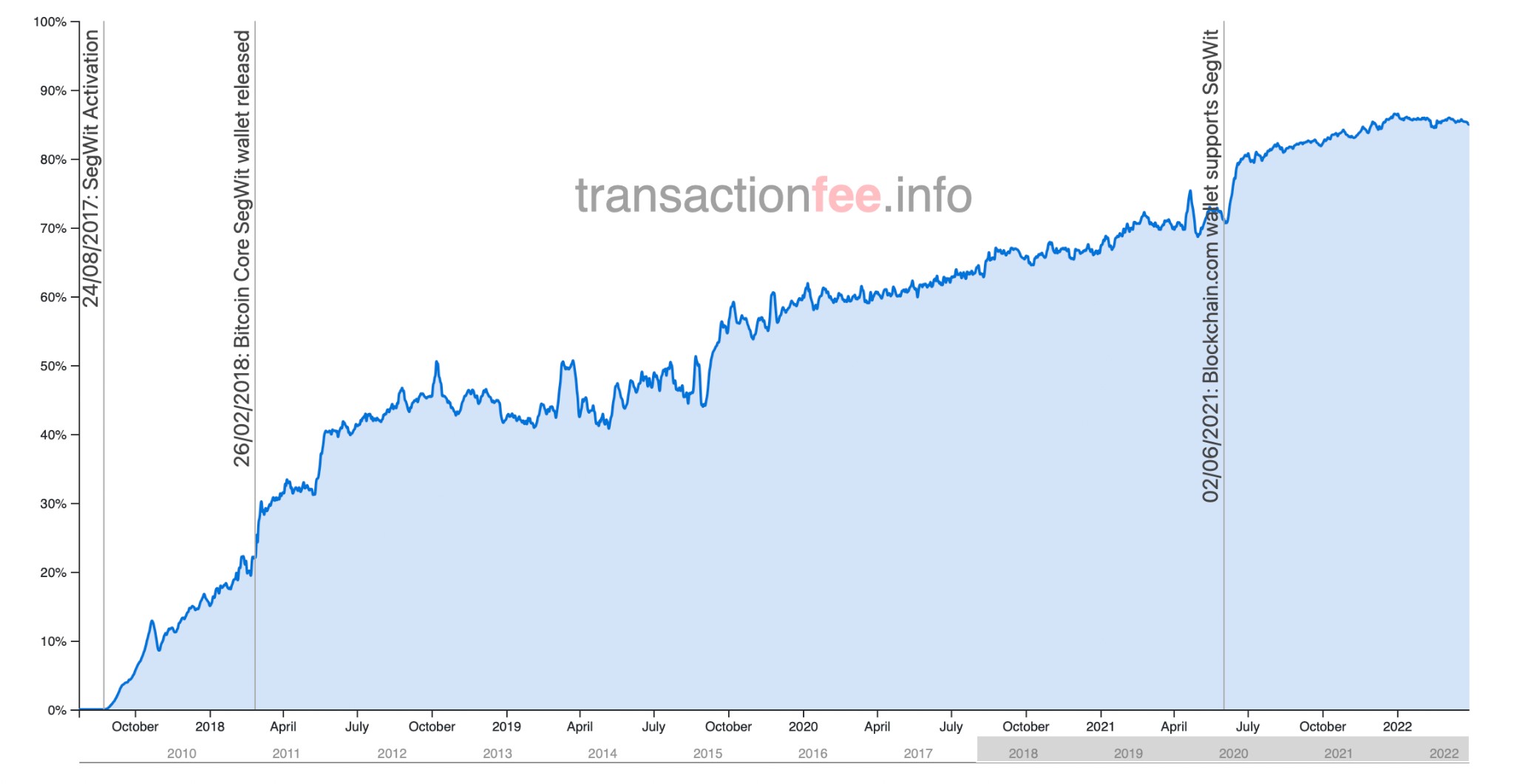

Activated in November 2021, Taproot adoption hasn’t exactly taken off, despite its benefits. Available data from transactionfee.info shows that around 0.37% of all Bitcoin transactions are using Taproot at the moment, compared to 85% for SegWit, which was activated back in August 2017.

However, Bitcoin developers speaking with Cryptonews.com say they’re confident that the use of Taproot will gradually increase over time, just as it did with SegWit. And while no further major upgrades for Bitcoin are on the immediate horizon, a big number of minor enhancements are regularly being worked on, which together are estimated to make Bitcoin more secure, efficient, and robust as Taproot makes it private and articulate.

Learning from the history of SegWit

It’s been five months, yet Taproot adoption by Bitcoin users remains glaringly low. So low, in fact, that various commentators have felt compelled to remark on it recently, including Arcane Assets Chief Investment Officer Eric Wall.

I can see >1k daily P2TR outputs.

— Eric Wall (@ercwl) January 17, 2022

Bitcoin has like ~850k outputs per day so it should be like 1/850≈0.12% of overall! pic.twitter.com/QqnivOOcwT

From 0.0048% of transactions using Taproot on November 14, the day of its launch, the total percentage has crept only very modestly.

Further info on the Bitcoin Wiki shows that implementation of P2TR (pay-to-Taproot) outputs by wallets, exchanges, and Bitcoin clients also remain low.

For example, of the 54 exchanges listed on the wiki, at the time of writing, only two have enabled P2TR transactions so far. Of the 34 software wallets, only five have adopted Taproot, while four are planning to adopt the upgrade soon.

The situation is somewhat better for hardware wallets, in that three out of 15 have enabled P2TR transactions, with a further three planning to do so. Still, given that there hasn’t really been a mad rush towards Taproot, it would beg the question as to whether most people really care about Bitcoin becoming a more complex and articulate blockchain protocol, and are happy for it to remain simply an investment vehicle and/or store of value.

This, however, would be a rash judgment, since Bitcoin developers say they are steadfastly confident that adoption and usage of Taproot will pick up with time.

“I think it’s still going to be a while before we see the entire industry adopting Taproot, but I’m optimistic that the adoption will continue,” said Bryan Bishop, the co-founder of Custodia Bank and a Bitcoin Core contributor.

This positive outlook appears to be the prevailing sentiment among coders, with one Bitcoin developer — who asked to remain anonymous — also expecting adoption to gather steam soon enough. He also points out that adoption of Taproot isn’t simply a matter of flicking a switch, but requires the prior adoption of other standards that make Taproot possible.

“Remember, SegWit happened in 2017 and adoption took years after that. It takes time for wallet developers and others to add support for Taproot and related technology, like using descriptor wallets and bech32 addresses,” he told Cryptonews.com.

This is an important point, and on the brighter side, the absolute number of Taproot transactions has increased steadily since activation in November. From 30 outputs on November 14, the number has risen to 1,940 per day (as of writing), with inputs rising from 13 to 1,426.

Obviously, it’s relatively easy to post big percentage gains when you’re beginning from zero, yet these figures have risen by 6,366% and 10,869%, respectively. This is good going, particularly when integrating Taproot is a more involved process than first meets the eye.

Still, it’s worth noting that, four months after its own activation, SegWit transactions had risen from 0% to 16%. We may therefore have to consider the possibility that the wider Bitcoin community and ecosystem may not go for Taproot with as much enthusiasm as it went for SegWit.

It’s arguable that some of what Taproot offers — such as smart contracts and enhanced privacy — finds itself in competition with other overlapping solutions.

For instance, the Internet Computer (ICP) is in the process of integrating with Bitcoin, achieving compatibility that would enable it to communicate with the Bitcoin network and use its smart contracts to transact BTC. Likewise, Stacks is a layer-one platform that aims to make Bitcoin programmable, and also plans to launch non-fungible tokens (NFTs) on the original cryptocurrency’s blockchain.

Given that a number of projects are already aiming to bring enhanced functionality to bitcoin, it’s possible that wider demand for Taproot may end up being less than it was for SegWit. Of course, only time will tell.

Ongoing Bitcoin development

Regardless of just how much traction Taproot gains in the near term, Bitcoin is continuing to evolve and undergo development, despite the impression — fostered largely by criticisms of its consensus mechanism — that it barely moves.

“Much of Bitcoin Core development (which is what I can speak about) isn’t so much about adding features as it is the behind-the-scenes work of finding and fixing bugs and making the software, protocol, and [peer-to-peer, (p2p)] network more robust, decentralized, secure, and resource-efficient. These along with fungibility and privacy are ongoing concerns,” said the anonymous developer.

The developer also notes that Bitcoin’s development community is undertaking ongoing longer-term work on a wide variety of new technical features. These include Miniscript, BIP324 encrypted p2p, Erlay, package relay, assumevalid/assumeutxo, as well as work to separate the various components of the large codebase, particularly the critical consensus code.

On top of this, “Bitcoin Core v23 will be out soon and contains changes to improve the robustness of the Bitcoin peer to peer network, adds support for nodes to use the CJDNS network in addition to Tor and I2P along with IPv4/6, makes progress on descriptor wallets and coin selection, and has a number of user/client-facing RPC [remote procedure call] and CLI [command line interface] improvements,” he added.

In other words, not only does Taproot find Bitcoin’s development outpacing and overtaking its users, but Bitcoin is also in the process of rolling out further changes that will continue to keep it ahead of its own adoption curve. Bitcoin undergoing updates that have scarcely been used to their full potential (yet) shows that, rather than resting on its laurels, it seems to be one of the most deceptively dynamic cryptocurrencies in the sector.

____

Learn more:

– Game Theory of Bitcoin Adoption by Nation-States

– Top Narratives About Ethereum and Its Merge with Its Proof-of-Stake Beacon Chain

– Elon Musk Should Listen to Cathie Wood on Bitcoin

– How Taproot Might Affect Bitcoin’s Competitiveness

– How to Use Bitcoin SegWit Transactions: a Guide

– Technically Capable Bitcoin Has Other Mass Adoption Challenges To Solve