Kyber Network Expects to Surpass USD 500 million in Volume This Year

Kyber Network (KNC), an open-source, on-chain liquidity protocol, expects to facilitate over USD 500 million in transaction volume in 2020, or 29% more than last year, Loi Luu, CEO and Co-Founder of Kyber Network, told Cryptonews.com.

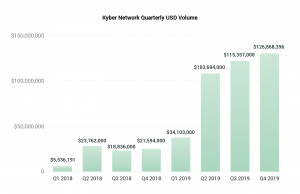

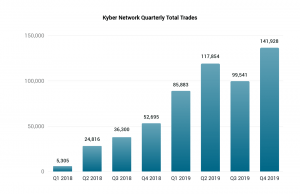

According to the CEO, Kyber facilitated USD 70 million worth of volume in 2018 and increased it to USD 387 million in 2019 thanks to the “explosive growth of DeFi [decentralized finance] space.”

“Factoring the speed of growth, we can expect to see at least over USD 500 million amount of volume in 2020,” Luu said.

Kyber is an on-chain liquidity protocol that aggregates liquidity from a wide range of reserves, powering token exchange in decentralized applications.

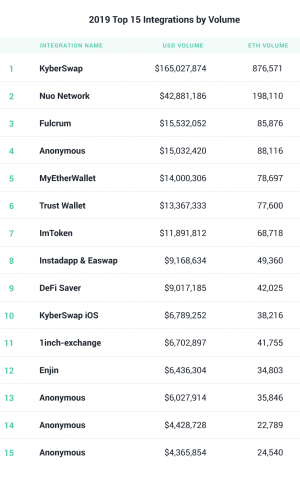

Kyber’s protocol is being used by almost 100 dapps (decentralized apps) on Ethereum and almost all popular DeFi projects for on-chain token exchange, says Kyber, so all these users collectively are expected to contribute over USD 500 million in trade value through the network this year. One of the dapps is KyberSwap – a crypto trading dapp that allows traders to swap ERC20 tokens. In 2019, reports Kyber, Kyberswap represented 43% of total volume, DeFi 21%, wallets 11%, and remaining 25% is arbitrage bots, unregistered users, games, and other unknown sources.

Major upgrade in Q2

Kyber as a network generates fees from trading activities, however, the fees are currently burned, said the CEO. Following the upcoming, major Katalyst protocol upgrade, that should increase liquidity and stakeholder participation, Kyber will reward Kyber Network Crystal (KNC) holders with the fees and incentivize top-performing reserves, and as Kyber and decentralized space grow, part of the fees can in the future be used for maintaining and developing the network.

“In the meantime, the funds raised from the ICO, and activities such as managing our reserves (market-making for profit from each trade), put us in a very healthy state to develop and grow Kyber towards our goals,” says Luu.

Kyber’s main goal in 2020, says its CEO, is to launch Katalyst and KNC staking, planned for early Q2. All the main technical details for the protocol and timeline are largely finalized, and Kyber is now working on the smart contract development.

KNC’s new model will allow KNC holders to receive part of the network fees by staking KNC and participating in the KyberDAO (decentralized autonomous organization), and they will be able to decide how the fees will be used.

Also, Kyber expects the “exponential growth in DeFi to result in a corresponding increase in demand for decentralized liquidity.” The network’s goal here is to be the provider of the single on-chain endpoint for all their liquidity needs to takers and dapps.

At pixel time (14:25 UTC), KNC, ranked 98th by market capitalization, trades at c. USD 0.34 and is up by 0.6% in a day, and 17% in a week. After jumping by 66% in a month, the price is now up by 194% in a year.