Here’s Why Decentralized Exchanges Are Growing So Fast Right Now

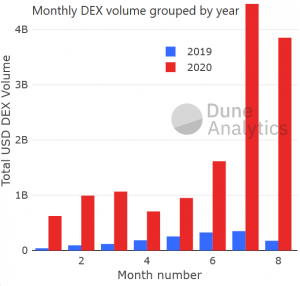

Trading volume on DEXs was just under USD 1bn in May and in July it reached almost USD 4.5bn. DEXs volumes are likely to remain tied to the popularity of the underlying set of assets available for trading.

Decentralized exchanges boast a monthly volume of only around USD 40m as recently as January 2019. This July they accounted for almost USD 4.5bn.

This is impressive growth, and it looks like many people within the crypto industry believe that decentralized exchanges (DEXes) will continue to grow in the future. However, industry players speaking to Cryptonews.com also said that DEXes are unlikely to overtake centralized exchanges (CEXes), in the near future at least.

From incompatibility with non-Ethereum (ETH) cryptos to scams and user difficulties, a number of factors may conspire to keep the majority of traders loyal to CEXes.

Fueled by DeFi, facilitated by stablecoins

One of the main drivers of recent DEX growth has been decentralized finance (DeFi). A spokesperson for Binance Research told Cryptonews.com:

“Due to the growth of DeFi on Ethereum, most of the top price performers in 2020 have been tokens running on Ethereum (e.g., LEND, REN). Since DEXes are one of the main components of the DeFi industry, it naturally makes sense that tokens issued on the Ethereum blockchain were also traded in decentralized exchanges.”

(Binance Research is the research arm of major centralized crypto exchange Binance that also launched Binance DEX, a non-custodial exchange, in 2019).

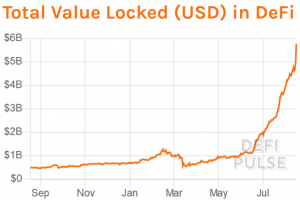

This hypothesis is supported by the fact that DeFi and DEXes have recently witnessed strong growth in parallel.

There is now (06:55 UTC) more than USD 5.6bn total value locked into DeFi platforms, according to DeFi Pulse.

Monthly DEX volume is also nearing USD 5 billion, according to Dune Analytics. It was just under USD 1bn in May and in July it reached USD 4.5bn, representing a 350% increase.

According to Binance Research’s spokesperson, another key ingredient has been the rise of stablecoins.

“Another important element of the growth of DEXes is the ability to not only have base, but also price-stable quote assets. As such, the growth of the stablecoin industry on Ethereum – which recently reached the important milestone of having USD 10 billion worth of stablecoins on Ethereum – could not be overstated.”

In other words, DEXes offer the ability to quote the price of a cryptoasset in a stablecoin (e.g. ETH/USDT), as opposed to another, non-stable crypto. “With quote and base assets both being on the same blockchain, fast expansion of trading volumes on Ethereum-based DEXs was possible.”

Looking to the longer term, it’s also likely that the growth of DEXes will be driven by their main selling point: the ability to retain custody of your own coins while trading them. This is the view of Glen Goodman, a cryptocurrency analyst and author of The Crypto Trader.

“Any of the biggest exchanges in the world could go bust at any time and take your money with them,” he told Cryptonews.com.

“DEXs solve this problem by letting you trade directly from your own crypto wallet. I think this will be a killer advantage for DEXs in the long run.”

Fast relative growth, but small absolute size

It’s likely that decentralized exchanges will continue growing in the short-term. However, it’s not certain that they’ll come close to truly rivaling centralized exchanges in terms of volumes.

“There is still a long way to go for decentralized exchanges to consistently reach the same volumes of current centralized exchanges,” said Binance Research’s spokesperson. “In particular, the trading of popular cryptocurrencies such as bitcoin, EOS, litecoin, or any other asset not running on Ethereum, is impossible (or only possible via 1:1 pegged assets, such as https://cryptonews.com/coins/wrapped-bitcoin/ or renBTC).”

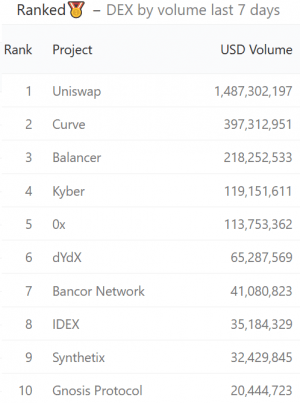

Binance Research holds that, at least for the time being, DEXs volumes are likely to remain tied to the popularity of the underlying set of assets available for trading. This prediction is supported by the current size of the DEX sector, which even with recent growth is still a fraction of the size of its CEX counterpart.

According to Dune Analytics, the 24-hour volume of DEXes was almost USD 449m (as of writing). By contrast, CoinGecko and CoinMarketCap put the 24-hour volume of the entire crypto market at somewhere between USD 83bn and USD 102bn.

This means DEXes account for around 0.5% of the total crypto market, assuming that the above figures are accurate. This is tiny, and there are a variety of reasons why decentralized exchanges continue to lag so far behind their centralized rivals.

“DEXs are still at an early stage of development and some of their user interfaces can be a bit clunky,” said Glen Goodman, who thinks they could eventually be as simple to use as any centralized exchange.

“Customer support can be non-existent, but hey, it’s peer-to-peer trading, so what did you expect?

Goodman also noted that liquidity is very poor on DEXes. For him, this “is a bit of a Catch-22 situation, as people tend to avoid exchanges with low liquidity, and that of course makes the situation worse.”

Binance Research also suggested that smart contract and protocol risk is another factor weighing down DEXes, as are scams. “Recently malicious individuals have been trying to create contracts for tokens with names similar to existing valuable tokens (e.g., creating a fake USDT ERC-20 token).”

Taken together, all of these factors indicate that decentralized exchanges won’t be overtaking centralized exchanges anytime soon. They may already offer a number of advantages, but it won’t be until they make trading simpler and more secure that they become seriously big.

____

Industry talk:

Learn more:

Uniswap Volume Surges as Traders Praise DEX & DeFi Tandem

Should You Trade on a DEX or a Centralized Exchange?

Crypto-Exchange Trends for 2020 and the Next Decade