DeFi Unlocked: How to Earn Crypto Investment Income on Synthetix

In our DeFi Unlocked series, we discuss the most popular decentralized finance (DeFi) protocols to provide you with insight into how you can potentially earn investment income in this new market.

In this guide, we explore Synthetix (SNX), how it works, and how it can be used to earn crypto investment income.

What is Synthetix?

Synthetix is a decentralized asset issuance protocol for synthetic assets built on top of the Ethereum (ETH) blockchain.

Synthetic assets refer to digital tokens that derive their value from the price of an underlying asset. These can be currencies, commodities, cryptoassets or a crypto index in the current version of the platform.

The Synthetix protocol describes itself as a “derivatives liquidity protocol which is the backbone for derivatives trading in DeFi, allowing anyone, anywhere to gain on-chain exposure to a vast range of assets.”

By participating in the Synthetix ecosystem, users are able to gain exposure to assets without necessarily holding them. Instead of signing up to multiple brokers or investment apps, Synthetix users can hold digital tokens representing these assets instead. Additionally, this model offers swapping between Synths, saving money and avoiding middlemen.

Synths are the essential building blocks of the Synthetix ecosystem as they are the tools that track the price of the underlying asset. To create Synths, a user must use the network’s native digital asset, Synthetix Network Token (SNX), as collateral. Through the decentralized application that interfaces with the Synthetix smart contract, Mintr, the locked SNX then create whichever Synth the user has decided to purchase.

SNX acts as collateral, backing the synthetic assets issued by the underlying smart contract. Synths are backed by SNX, which is staked as collateral at a ratio of 750%. It is important to note that Synthetix operates on a multi-asset platform due to the availability of a different range of asset classes.

The five categories currently supported by Synthetix are fiat currencies, commodities, cryptocurrencies, inverse cryptocurrencies, and cryptocurrency indexes.

Fiat Synths include sUSD and sEUR, while commodity Synths include synthetic gold and synthetic silver. Cryptocurrency synths include sBTC, sETH, sBNB, and more. There are also Inverse Synths that inversely track the price of the available cryptocurrencies. Lastly, cryptocurrency indexes sDEFI and sCEX and their inverses are also on offer.

Synthetix leverages oracles to determine the value of all synthetic assets in its ecosystem. The price feeds are currently supplied by both Chainlink (LINK)’s node operators and Synthetix, but plans are underway to rely completely on Chainlink.

When Synths are traded, a fee is charged. This fee is automatically sent to a pool and divided among collateral providers. This is the reward which SNX holders receive in exchange for providing liquidity to the trading protocol.

Why Synthetix?

The pooled collateral model seen in Synthetix allows users to switch between Synths by interfacing directly with the smart contract and eliminating the need for a counterparty. This has been a significant challenge for decentralized exchanges (DEXes) within the DeFi space.

Fortunately, this model solves the liquidity and slippage issues seen on DEXes by leveraging peer-to-contract (P2C) trading and eliminating the need for an order book.

SNX holders are incentivized to stake their tokens in exchange for the fees they receive per trade. The fee typically ranges between 10-100 bps and is always displayed during any trade on Synthetix.Exchange.

Additionally, Synthetix has an inflationary monetary policy from which collateral providers are entitled to receive a portion of the newly minted SNX. This is another advantage for SNX stakers as they receive a portion of new SNX with every minting.

Governance and the SNX tokens

Synthetix initially started out as a stablecoin project named Havven that raised USD 30m during its initial coin offering in 2018. However, the project changed its name and monetary policy, and is now minting new SNX tokens.

As referenced earlier, Synths are created when staking SNX. All Synths are backed by SNX tokens at a 750% collateralization ratio, although this can be changed by the community through voting.

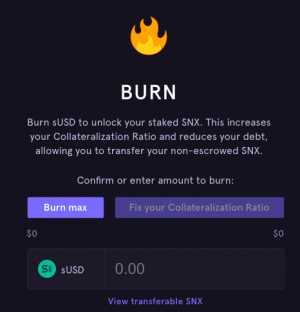

SNX stakers incur debt when they create Synths so to exit the system they must pay back this debt by burning Synths after which their SNX will be unlocked. SNX is available on DEXes like Kyber (KNC) and Uniswap (UNI). Trading on Synthetix.Exchange does not require the trader to hold SNX.

Synthetix is also currently trialling ETH as an alternative form of collateral. However, ETH stakers are not eligible to receive fees or rewards as they take no risk for the debt pool.

How to earn crypto investment income by staking SNX

Synthetix was designed for the trade of Synths. To enable that SNX is needed as collateral. Therefore, SNX collateral providers are rewarded for staking their tokens.

- To start using Synthetix, go to Synthetix.io.

Remember, to mint Synths, you must already own SNX. So purchase SNX on an exchange, and then navigate to the “Stake” section of the platform.

When you click on “Stake” you will be redirected to Mintr.

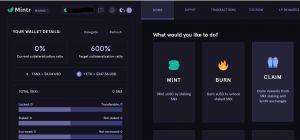

- Once you have connected your Ethereum wallet to Mintr, you will be logged in.

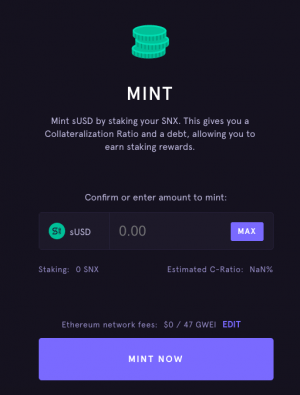

To start earning investment income as a SNX holder, click “Mint” and turn your SNX into sUSD.

Once you have minted your sUSD, you will start earning trading fees for providing collateral to the Synthetix protocol.

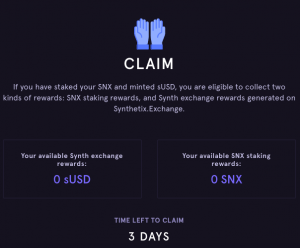

- To cash out your investment earnings, access the Mintr dashboard again, and click “Claim.”

There, you can input how much of your earnings you want to claim.

Lastly, to unlock your staked SNX, burn your sUSD to receive your SNX along with your earned rewards.

- Finally, you will hold your SNX plus rewards earned for interacting with the Synthetix protocol in your personal Ethereum wallet.

The risks

SNX stakers incur a debt when they use Mintr to create Synths. However, due to the exchange rates and supply of Synths within the network, it is possible that the amount of this debt can fluctuate. Therefore, when the user is ready to exit the system and unlock their funds, they may find that they need to burn more Synths.

Moreover, some aspects of the platform are still centralized. Given the early stage of the project, the team has opted to maintain control but has plans to phase out all such systems over time.

Finally, as with all DeFi protocols, there is a level of code risk that investors need to take into account. Synthetix is a relatively new project and there are bound to be bugs in the code. If vulnerabilities can be found and exploited, you could lose all your funds.

While Synthetix is still too complex for the average retail investor, the protocol provides us with a glimpse into the future of blockchain-powered trading, where traditional assets are tokenized and can be bought, sold, and held by anyone across the globe with an internet connection.

_____

Learn more:

How to Earn Crypto Investment Income on yearn.finance

How to Earn Crypto Investment Income on Compound

How to Earn Crypto Investment Income on Balancer

How to Earn Crypto Investment Income on Curve Finance

How to Earn Interest Lending Crypto using Aave

How to Earn Crypto Investment Income on Uniswap