Corrupt OTC Brokers Sent Dirty USD 1.5bn in Bitcoin to Binance and Huobi – Report

Criminals made some USD 2.8 billion worth of illegal transactions using bitcoin (BTC) on cryptocurrency exchanges last year, alleges a new report – with Binance and Huobi overwhelmingly their platforms of choice thanks to corrupt OTC brokers.

The report was compiled by blockchain analytics provider Chainalysis, which said that “illicit cryptocurrency” transactions at exchanges have “taken in a steadily growing share since the beginning of 2019.”

The analytics firm stated that “criminal entities” were increasingly looking to move their funds onto exchanges, with 27.5% of such transactions made on Binance platforms, 24.7% taking place on Huobi and other platforms accounting for the remaining 47.8%.

What is more, a small group of account holders appear to be responsible for most of the illicit activities on both platforms.

The Chainalysis report authors wrote,

“Just over 300,000 individual accounts at Binance and Huobi received bitcoin from criminal sources.”

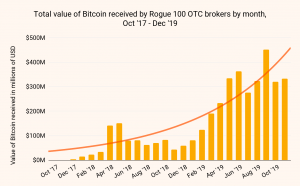

And it seems criminals prefer to make use of over-the-counter (OTC) services. The report’s authors say they have created a sample group of “100 major OTC brokers” it believes “provide money laundering services, based on the fact that they’ve received large amounts of cryptocurrency from illicit sources.”

In the sample group, 70 are Huobi account holders that have allegedly received Bitcoin from illicit sources. And 20 of these accounts received USD 1 million or more worth of illegally acquired Bitcoin in the same time period.

The report alleges that OTC desks have little in the way of compliance requirements and Know-Your-Customer (KYC) protocols, a factor that has led criminals to favor OTC transactions.

“If there were no way for bad actors to cash out cryptocurrency they’ve received through illegal means, there’d be far less incentive for them to commit crimes in the first place. That would mean not only fewer victims affected by crimes, but would also help improve cryptocurrency’s reputation as the industry seeks to work with regulators and traditional financial institutions and drive increased adoption,” Chainalysis stressed and urged exchanges to carry out more extensive due diligence on OTC brokers and other nested services operating on their platform.

“As global capital flows into crypto, we are aware of the growing trend and movements of illicit funds, and we are working with like-minded partners such as Chainalysis to improve on existing systems and address these concerns,” reacted Samuel Lim, Chief Compliance Officer of Binance.

Meanwhile, in December, Chainalysis said that at least BTC 20,000 and ETH 790,000 are still waiting to be dumped on the market by the criminals from the “one of the largest Ponzi schemes ever,” PlusToken, while the thieves have already cashed out c. BTC 25,000 and ETH 10,000, using services such as Huobi OTC.