Steem is a social blockchain and cryptocurrency meant to create and power incentivized online communities and provide immediate monetization opportunities for content creators.

What is Steem?

Launched by Ned Scott and Daniel Larimer, the co-founder of BitShares and the lead developer of EOS, today Steem is one of the most actively used blockchains. It has more than a million users and over 400 apps made for Steem network.

Steem blockchain is designed for social media platforms. Most social media applications use voting systems that include likes, shares or upvotes to sort content. Steem integrates these elements into a unique decentralized platform that grants the ability to pay users in Steem for their activity on the network.

Steem’s whitepaper was published in March 2016. The ultimate goal of Steem is to become the non-censorable monetization layer of digital content which rewards users with cryptocurrency for using the platform. Many already functioning projects are built on Steem.

Source: Busy.org

How Does Steem Work?

Steem and its apps serve a practical way to create content and get paid for it. So how does it all work?

Naturally, you need to register as a network member to start earning Steem. Upon registration, you’ll receive posting, active, owner and memo keys. The great thing about Steem ecosystem is that you can use the same login credentials and posting key to use all Steem applications. After your account is set, all you need to do is to create, submit and publish valuable posts on one of Steem platforms. Then, the community interacts with them, and if people find your input useful, they upvote it. In turn, your post gains more value with every new upvote, and you get paid in roughly seven days.

There are several points to keep in mind:

- The more people engage with your content, the bigger the content exposure and likewise, your rewards will be.

- By voting on their favorite posts, users create a hierarchy of content with the most popular posts entering trending or hot feeds.

- Steemit is meritocratic, meaning that users who have more Steem Power (SP) cast more influential votes, resulting in more significant rewards.

Steem has three types of currency units circulating in its system: Steem (STEEM), Steem Dollars (SBD) and Steem Power (SP). Steem and Steem Dollars are tradeable, while Steem Power is not.

Steem (STEEM)

Steem is the underpinning currency of the network. All the other tokens derive their value from it. Also, it can be traded to other cryptocurrencies using exchanges or be used as a payment vehicle.

To benefit from Steem, users need to convert their Steem into Steem Power (SP) via the process known as “powering up.” Steem can also be converted to Steem Dollars.

Steem Power (SP)

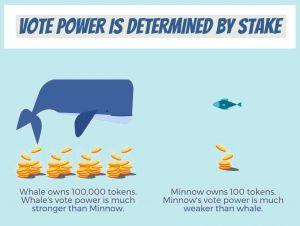

Steem Power is the networks long-term investment currency. Turning Steem into Steem Power equals investing equity in the system. One Steem equates to one user vote. Users with most SP have the most voting influence, so an upvote from a user with lots of Steem Power grants more substantial rewards. Besides, most of the newly generated Steem is allocated to users who hold significant amounts of SP, creating an incentive to hoard it.

In case you want to “power down” by converting your SP back into Steem, the process will take you 13 weeks. Such a cooldown period is a precaution preventing people from suddenly (panic)selling all their Steem Power holdings and crashing the market.

Steem Dollars (SBD)

Steem Dollars represent the network’s short-term debt and are the default reward currency (along with SP). One SBD equals one US dollar. Steem whitepaper indicates that users who hold SBD lend community the value of one US dollar, thus fostering network’s growth. Also, they receive 10% annual interest on Steem Dollar they hold.

If the amount of SBD debt ever surpasses 10% of the Steem market cap, the blockchain will automatically adjust the amount of Steem generated through conversions to a maximum 10% of the market cap. That way the network never experiences a higher than 10% debt-to-ownership ratio.

A user holding Steem Dollars has several options:

- Convert Steem Dollars to Steem. The process typically takes 3.5 days.

- Hold the Steem Dollars and earn 10% annual interest.

- Make a long-term investment by changing the Steem Dollars into Steem Power.

- Trade it on one of the exchanges.

How Does The Steem Network Work?

Steem Launch and ICO

Steem didn’t have an ICO. The developers felt like they have a great project that would market itself. Most Steem was premined before the Beta launch of Steemit and tokens were distributed to early project contributors and miners.

Steem Mining and Witnesses

The network started with the currency supply of 0 and distributed Steem via proof of work. Mining Steem is not possible anymore, as it was removed from the network.

Instead of relying on Proof of Work, Steem uses Delegated Proof of Stake (DPOS) consensus algorithm. In brief, it works like this: every user can vote for up to 30 witnesses, and the top 21 become Steem “members of Parliament” who make all the critical network decisions. Also, the witnesses are responsible for running reliable nodes to keep the blockchain alive and collect rewards for every block mined.

Steem Transactions and Scalability

Steem blockchain is built upon Graphene, the technology behind BitShares. It is capable of processing around 1,000 transactions per second and can achieve around 10,000 or more transactions per second with relatively straightforward improvements to communication protocols and server capacity. To put it into perspective, Reddit’s 8.7 million users in 2015 made around 220 interactions per second, which would amount to 250 transactions per second on a blockchain.

In the whitepaper, Steemit developers claim “a blockchain is best served by not applying usage fees at all.” Steem goes great lengths to reward its users for active participation, and charging transaction fees would be counterproductive. Therefore, the blockchain is free of any transaction fees.

Steem Annual inflation rate

New Steem tokens are created daily and distributed as rewards by design. As a result, the total Steem supply increases by approx. 9.5% a year. The inflation rate decreases by 0.5% every year (or 0.01% per every 250.000 blocks) and will continue to do so until it reaches 0.95%. That should happen somewhere around the year 2037.

The newly generated tokens are allocated the following way:

- 75% fund the reward pool, which goes to authors and content curators.

- 15% of the new tokens are awarded to the holders of SP.

- The remaining 10% is paid out to the witnesses who power the Steem blockchain.

It is often said that the inflationary model of Steem is not sustainable. However, the developers argue that countless real-world examples prove that the quantity of money doesn’t always have an immediate and direct impact on the currencies value.

For instance, during the period from August 2008 to January 2009, the US money supply grew more than 100% a year and continued to grow by more than 20% for the six following years. Besides, Bitcoin’s inflation rate for the first eight years was more than 10% and more than 30% during the first five.

Naturally, Steem is expected to experience constant downward price pressure, but it should be countered by the increasing numbers of new long-term holders, users, and even speculators. The network already has more than 1 million consumers. As their numbers grow, so should the demand for Steem, thus reversing, or at least leveling the inflationary effects.

Source: Stellabelle / Hackernoon.

Steem Projects

At the time, the most popular Steem dapps are:

Steemit. A social blogging platform inspired by Reddit and Medium, except running on blockchain and with real cryptocurrency rewards.

DTube. A decentralized alternative to YouTube.

eSteem. Mobile blogging app for Android, iOS, and desktop.

SteepShot. A decentralized alternative to Instagram.

DSound. A platform that resembles SoundCloud, designed for musicians to share their sounds and get paid in Steem.

Zappl. A decentralized micro-blogging platform and Twitter alternative.

Utopian.io. A platform for contributing and rewarding people who commit to open source projects.

DMania. A decentralized alternative to 9GAG.

Busy.org. A decentralized social network with a unique and feature-rich interface.

Steem Monsters. Digital collectible card trading game.

Actifit. A fitness tracker that rewards your activity with Steem.

A complete list of all Steem projects can be found here.

Where to get Steem?

The simplest way to get Steem is to join the network and contribute by making posts, comments, voting and curating content.

Speaking of trading, Steem is listed on:

Bithumb

Binance

Bittrex

Upbit

HitBTC

Huobi

Poloniex

Vebitcoin

GOPAX

RuDEX

OpenLedger DEX

Exchanges listing Steem Dollars (SBD) are:

Upbit

Bittrex

HitBTC

GOPAX

Poloniex

OpenLedger DEX

How to store Steem and SBD?

There are quite a few options that can be used for a secure Steem token storage.

Perhaps the easiest one is to use the default wallet on Steemit platform, where the tokens can be of most use. Other options include eSteem mobile wallet, Vessel, CLI Wallet or a simple paper wallet.

The current state of the project

Steem is one of the most promising blockchain experiments for the future of media. Its applications are resistant to censorship, replaces advertising with blockchain-based content rewards and offers an easy way for the creators to monetize their work.

The platform continues to evolve and recently has implemented a software upgrade hard fork 20. The update is critical for the next step in Steem evolution – the launching of Smart Media Tokens that will enable any developer or entrepreneur to issue their own tokens on the fee-less and fast Steem network together with Proof-of-Brain distributions.

Criticism of vote bots

Many Steem users have expressed dissatisfaction with the Steem vote bots. Vote Bots are Steem accounts supercharged with loads of SP. The owners of such accounts charge users for their upvotes which are more powerful than the regular ones.

The main criticism of vote bots revolves around the fact that they eliminate the factor of fair play on Steem and consequently it becomes almost impossible to get your post exposed to a wide audience if you’re not buying the votes. Despite the criticism, the vote bots remain a primary way to exchange value on the Steem network.

Similar projects

Synereo – developing solutions that allow monetization of original content anywhere on the web.

Sapien – a decentralized social news platform built on Ethereum.