What’s Happening In the Market? An Optimistic And Pessimistic View

Cryptocurrencies have, since their inception and subsequent leap into mainstream awareness, gathered opinions from opposing end of the spectrum. From those hailing the nascent industry as a game changer for the world as we know it, to those equating it to the infamous tulip bubble, everybody has an opinion.

Brian Armstrong, CEO and co-founder of Coinbase, US-based cryptocurrency exchange, thinks people are needlessly worried about the current dip: “It can be scary the first time you see it, but to us who have been in the industry for many years, it feels like old news,” he said in a motivational message to his team.

“When there is hype, people are irrationally exuberant. When there is despair, people are irrationally pessimistic. Neither is true,” he continues, adding that the truth is in the middle, and that value correlates to transactions per day and not price.

“I want to encourage you all to ignore the price of crypto and the headlines which will inevitably start to come up. Our job is to rise above that, finding our own intrinsic source of motivation, to come in and do our best work, regardless of what other people think,” Armstrong said in an attempt to motivate his team.

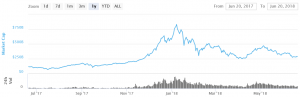

Total cryptocurrency market capitalization:

Meanwhile, Chris Concannon, the president of Cboe Global Markets, owner of the Chicago Board Options Exchange, could be successful in demotivating crypto investors. He thinks they should be laying awake at night, fretting over the market movements, especially in relation to ICOs (initial coin offerings) and regulations. Should the U.S. Securities and Exchange Commission (SEC) decide ICO tokens are unregistered securities, they would be rendered useless, he told in an interview with Business Insider.

Concannon forecasts that, first, the SEC will go after ICO market participants, then, class-action lawsuits against the teams behind ICO projects will surge.

“If you sold someone an unregistered security you are liable to them if they decide to take them to court,” Concannon said.

Who is right – and whether anyone truly is – is anyone’s guess.

Armstrong considers the current slump in the market a good way to clear out weak participants. “It gets rid of the people who are in it for the wrong reasons, and it gives us an opportunity to keep making progress while everyone else gets distracted,” he said.

Meanwhile, Robert Hockett, a professor of financial regulation at Cornell University, told Business Insider that the cryptoverse is moving out of the “Wild West” phase into a “regulatory scrutiny” phase. In the short term we’ll see the rise of funds to launch class-actions and increased litigation, but in the long term, we’ll see a cleansing of the market, according to Hockett.

“It is a legal life cycle of every new asset that becomes highly popular,” he was quoted as saying. “It was true for tulips, junk bonds, and mortgage-backed securities, and now crypto.”