What Does Bitcoin’s Second Largest Difficulty Drop Mean?

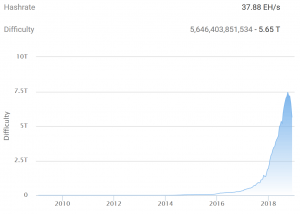

As many Bitcoin miners have turned off their machines, mining difficulty saw its second largest drop in history at -15% on December 3rd. It has helped to increase profitability for those who still run their mining rigs, but strengthened fears of centralization.

The mining difficulty of Bitcoin is adjusted every two weeks (every 2016 blocks, to be precise) to maintain the normal 10-minute block time. This means that if there are many miners competing amongst themselves and propagating blocks in less than ten minutes, the difficulty of the next puzzle will be increased; if there are few miners and it takes them much longer to find a solution, the difficulty is decreased – both times just enough to keep block times at around 10 minutes.

Now, the difficulty might drop another 16% after two weeks, according to estimations by major mining pool BTC.com. In that case, it would almost reach the difficulty levels seen in May/June.

According to previous reports, between 600,000 and 800,000 Bitcoin miners have pulled the plug on their operations in the second half of November. Market analysis firm Autonomous Research estimates that at least 100,000 individual miners have shut down, and advisory firm Fundstrat Global Advisors adds that since early September, about 1.4 million servers have been unplugged, Bloomberg reported on Monday. This flush out took the Bitcoin’s hash rate (or computing power) with it, as it is down 36% from its all-time high this September.

As reported, miners are under growing pressure as the bitcoin price dropped by 80% since its all-time high in December of 2017. In November bitcoin lost 37% of its value, dropping below USD 4,000.

The CEO of China-based crypto mining pool F2Pool Shixing Mao said back in September that the break-even point for Bitcoin mining was between USD 3,891 and USD 11,581, depending on the equipment being used. At that time, BTC traded for around USD 6,400.

However, popular economist and Bitcoin investor Tuur Demeester stressed:

With the mining difficulty down as well, the remaining miners should have an easier job. However, Malachi Salcido, head of Wenatchee, one of the largest North American miners, told Bloomberg that only a select few can afford to stay in the game: miners with scale, very specific business models and extremely low electricity costs, which is the case in Douglas County where his own miners are based. Margins before costs like depreciation and taxes dropped from about 40% to 20% during the slide, but they jumped back up at the company to around 40% as smaller rivals shuttered operations, Salcido said.

However, some fear a 51% attack in case some of the remaining mining companies decide to band together. The community is much more optimistic, though: they remind that the biggest ever drop of -18% back in 2011 brought to a price increase of 150% – from USD 2 to USD 5 in around 60 days.

Although many say that previous patterns are no guarantee for the future – “Just because it happened before, it does not mean it will happen again,” writes Reddit user u/Red5point1 – not all agree with that sentiment. As u/Mowglio points out, “Sure, historical data does not guarantee future results, but it is literally what all scientific analysis is based on. Throwing it to the wind as if it doesn’t matter is one of the dumbest things you can do.”

_____

Watch Andreas M. Antonopoulos, a technologist and serial entrepreneur, discussing whether sudden changes in mining hash power would kill Bitcoin: