Watch Grayscale Bitcoin Trust For BTC Price Clues – JPMorgan

Investments into and out of the Grayscale Bitcoin Trust (GBTC) will be key over the coming weeks for the bitcoin (BTC) price direction, according to US-based major investment bank JPMorgan Chase & Co.

“A failure by the Grayscale Bitcoin Trust to receive additional inflows over the coming weeks would also cast doubt to the idea that institutional investors such as family offices have embarked on a trend of embracing bitcoin as digital gold replacing traditional gold as a long-term investment,” Bloomberg reported, citing a note by the strategists at the bank.

As reported today, Guggenheim Funds Trust has filed an amendment with the US Securities and Exchange Commission via which it’s reserving the right for its USD 5.3bn Macro Opportunities Fund to gain exposure to BTC by investing in the GBTC.

Also as reported, Grayscale Bitcoin Trust experienced USD 719.3m in 3Q20 inflows, while other products accounted for 31% of inflows during 3Q20.

Meanwhile, in a November 27 note, JPMorgan’s strategist also argued that “the previous froth in momentum traders’ positioning has been cleared to a large extent,” adding that momentum signals will continue to deteriorate unless BTC recovers quickly.

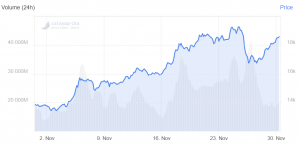

Last week, BTC dropped from above USD 19,000 to below USD 17,000 and it returned over USD 18,000 this past weekend.

At pixel time (11:20 UTC), BTC trades at USD 18,591 and is up by 2% in a day, erasing its losses over the past week. The price is up by 34% in a month and 152% in a week.

BTC price chart:

____

Learn more:

Who Invests In Bitcoin More? Competition Among Multibillion Funds Is Now On

The Bitcoin Playbook: Double-Digit Rally -> Double-Digit Selloff -> Pump Again

This Is The Main Story in Bitcoin Now According to Pantera Capital CEO

3.4m Bitcoin Available As BlackRock’s CIO Says BTC to Replace Gold

Deutsche Bank Strategist Bullish on Bitcoin, But JPMorgan Boss Still Unmoved