Use Bitcoin, Gold, and Bonds as a Hedge Against Inflation – BitMEX

With central banks and governments around the world injecting massive amounts of liquidity into financial markets, the threat of future consequences in the form of inflation is keeping many in the crypto community up at night, with major crypto derivatives exchange BitMEX now advising clients to seek protection for their portfolios.

BitMEX Research said that they no longer view “volatility-related bets” – as recommended by the same team back in 2019 – as the most effective way to protect an investment portfolio against financial market risks and inflation.

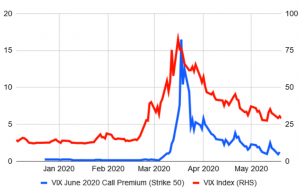

The “volatility related bets” recommended in 2019 mainly consisted of call options on the VIX – an often-used measure of volatility in the stock market – as well as put options on exchange-traded funds (ETFs) backed by corporate bonds. The idea then was that in the event of a financial crisis, stock market volatility will likely increase, leading to a pay-out from the VIX call option, and corporate bonds would decline, leading to a pay-out on the ETF put options.

Following the COVID-19 induced financial market crash, however, BitMEX’s research team has concluded that both VIX call options and corporate bond ETF put options are “too expensive to offer reasonable protection.”

Instead of options contracts, the assets suitable to function as protection now, according to BitMEX, are:

- Index (inflation)-linked government bonds

- Hedge funds focused on volatility

- Gold, and

- Bitcoin

Among these, the exchange said that inflation-linked government bonds could offer the most effective protection, serving as a “main pillar” in a portfolio. It followed up by explaining that this is a position that could offer some protection whether the inflation narrative turns out to be correct or not:

“If we are wrong with our inflation thesis, Bitcoin and gold could decline in value. However, in a deflationary environment, bond yields may decline and go negative and therefore the yield component of the linkers may offer a degree of protection.”

In the article, the research team also warned that we could soon be in a situation where, despite high unemployment and a weak real economy, the stock market is at record highs thanks to central bank stimulus. If that lasts, the article warned, “governments may eventually yield to political pressure and adjust monetary policy such that it is more accommodative to workers, rather than investors.”

“In that scenario, as we have said before, we think there will only be one clear winner: inflation,” the article concluded by saying, before reminding readers that an old mantra among gold bugs and bitcoin maximalists now may be more valid than ever: “take physical delivery of your gold” and “not your keys not your Bitcoin.”

___

Learn more:

QE Won’t Trigger Hyperinflation, says World’s Hyperinflation Expert

Investors Turn to Gold as Inflation Threat Looms, Is Bitcoin Next?

This is Why This Investor Prefers Stocks Over Bitcoin and Gold