USD 9K Bitcoin Led Crypto Rally as Exchanges Saw Massive Volumes

Both bitcoin (BTC) and the broader crypto market saw another strong day today that brought the price of bitcoin past the USD 9,000 level, after also recording gains across the board yesterday. The gains came as sentiment in the market improved even more after bitcoin recovered all of its losses from March, and established itself above key technical levels.

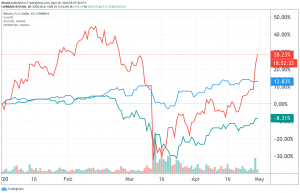

Today’s price surge was led by bitcoin, which was up by more than 18% to USD 9,200 as of press time Thursday morning (06:00 UTC). Meanwhile, other major cryptoassets like ethereum (ETH), bitcoin Cash (BCH) and litecoin (LTC) followed suit with gains of about 13%, 12%, and 10%, respectively, over the same period. However, later, the market started correcting its gains and BTC moved below USD 9,000 again.

Today’s gains came on a day where gold was nearly unchanged from the day before, and US S&P 500 stock futures pointed to a stock market open a mere 0.1% higher than the close yesterday.

“We are viewing the incredibly volatile trading range since 2018 as a longer-term basing/consolidation profile that has bottomed near its long-term uptrend (200-week moving average) and will likely resolve the bigger multiyear pattern to the upside over the coming two to four quarters,” Rob Sluymer, Managing Director of Technical Strategy at Fundstrat Global Advisors, told Bloomberg.

Rich Rosenblum, co-head of trading at GSR, stressed that this latest run past USD 8,000 is as much about positive macro sentiment as it is about the upcoming halving.

“This clearer path forward helps explain why stocks and bitcoin stabilized over the last seven days, along with today’s burst,” he told Bloomberg.

Meanwhile, Meltem Demirors, Chief Strategy Officer of CoinShares, expects that BTC will see more trading activity around the halving — most likely ‘buy the rumor, sell the news’.

“Our portfolio companies are reporting high volumes of inbound from firms looking to access Bitcoin markets, but the volume is largely in derivatives,” she told Bloomberg.

The surge in the crypto market also led to problems for crypto exchange Coinbase Pro, which said it experienced “partially degraded service” on the Bitcoin network specifically as large numbers of users rushed to buy bitcoin and other cryptocurrencies, according to a notice published by the exchange.

Besides Coinbase Pro, Binance also reported that it had experienced massive trading volumes of USD 11 billion in 24 hours on its exchange, which CEO Changpeng Zhao said is higher than anything they’ve seen since January 2018, at the peak of the crypto bull market.

___