UNI Token Crashes Despite Uniswap’s Rise as Largest DeFi Protocol

Despite Uniswap climbing to become the largest decentralized finance (DeFi) protocol by total value locked (TVL), its newly issued UNI token crashed in the market today along with many other DeFi tokens.

As of press time (12:02 UTC), UNI traded at USD 4.35, having gone down 23.35% over the past 24 hours. And despite the token soaring more than 186% from the launch price of USD 3 last Thursday, to a high of USD 8.6 the day after, the early excitement among traders now seems to have cooled off.

Further, the losses over the past 24 hours also positioned UNI as the day’s worst performing token among the top 50 cryptoassets by market capitalization, currently closely followed by Aave (LEND) and yearn.finance (YFI).

UNI price chart:

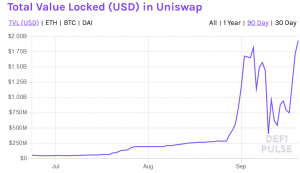

Despite the UNI token having lost nearly 50% of its value from its high last Friday, however, the Uniswap protocol continues to gain ground in the DeFi landscape. As announced by DeFi Pulse last Friday, the protocol has now secured the position as the largest DeFi protocol by total value locked (TVL), ahead of competing platforms Aave and Curve Finance (CRV).

The reshuffling of the DeFi ranking comes as the total value locked in the space as a whole reached a new all-time high yesterday of USD 9.77bn. The record follows a correction in the amount of capital locked in DeFi protocols earlier in September, which saw the TVL fall from USD 9.6bn on September 2, to a low of USD 6.8bn on September 9.

Along with UNI, LEND, CRV, and several other DeFi tokens, however, the Ethereum network’s native token ETH also saw heavy selling today, dropping by 8.1% over the past 24 hours to a price of USD 348.

Meanwhile, bitcoin (BTC) fared better than most DeFi-related tokens, with a 24-hour loss of 3.2% to USD 10,604 as of press time.