The Road to USD 25K is ‘Easy’: Double Bitcoin Users, says Tom Lee

To hit USD 25,000 per bitcoin (BTC), we need to find a way to double the current number of active BTC users, according to co-founder and the Head of Research at Fundstrat Global Advisors, Tom Lee.

In an interview with CNBC today, Lee argued that BTC will hit USD 25,000 by 2022, which is the number Fundstrat established two years ago as a five-year view for the coin. “It’s quite easy to achieve,” says the analyst. According to the company’s estimates, today less than half a million people “own and use bitcoin widely today,” and if that number turns into a million, the price will get to USD 25,000.

“Cryptocurrencies are network value assets, meaning, the more people that hold it, the greater the value. In fact, it’s a log function, right? So if you double the users, you get a quadrupling of value. And to go to USD 25,000, you essentially need a 4x rise – a little bit less than that – which means you need to double the number of people who hold bitcoin,” Lee explained.

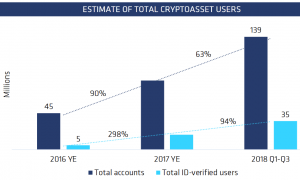

Meanwhile, European digital asset management company, CoinShares Group, in their recent report estimated that, a year ago, at least 139 million user accounts have been created at crypto service providers, representing an estimated minimum of 35 million ID-verified users.

In either case, Lee said that the long-term future of Bitcoin is “very bullish.” It’s the early days for digital assets, he explains, and over time it will become institutional and an asset class. “Once we hit that,” says Lee, “it’s actually another hockey stick [-like price rise].”

He explained that what we’re seeing here is a log / utility function, and as an example for comparison he took the price return of the FAANG (Facebook, Amazon, Apple, Netflix, and Google) stocks since their IPOs (initial public offerings). “70% of the return is explained by the growth of the global internet in that period of time,” he says, concluding that “it was a log function of the internet’s growth, and that’s how cryptocurrencies are going to work.”

Meanwhile, anonymous investor and Twitter user Plan₿, known for his insights into the stock-to-flow ratio, said recently that that the exponential growth in bitcoin’s price will continue, and that it will be fueled by BTC’s scarcity dynamics. “Before Christmas 2021, Bitcoin should be, or should have been, above USD 100 K; if not, then all bets are off and it [the stock-to-flow model] probably breaks down.”

Furthermore, Lee said back in June that BTC is just at the beginning of its bull run, that it will easily surpass its all-time-high, and that it can reach as high as USD 40,000 in an unspecified future. In another interview, he also stated that if equities rise, bitcoin will follow – and all-time-highs may be coming soon.

In a separate interview with Block TV, published today, Lee said that “There is a lot of tailwind building in 2020…Incrementally the ball is moving forward and that’s bullish.”