The Crash II: the Road Back to ATH Just Got Longer, but Hope Remains

As the overall crypto market is seeing a another huge wave of selling, all top 100 cryptocurrencies by market capitalization are down by more than 70% from their all-time highs (ATH) (well, except stablecoins.)

Since its all-time high in December 2017, bitcoin is now down nearly 77%, ether – 90%, ripple – 88%, litecoin – 91%, according to OnChainFX data.

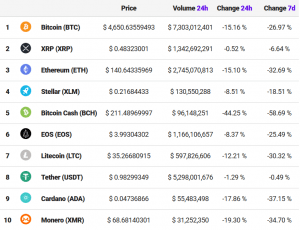

Now, the price of the number one cryptocurrency, bitcoin, is down 15% over the past 24 hours. At the time of writing, the only coins in the top 100 that are in the green are a couple of USD-pegged stablecoins, with many major coins being down between 10% and 20%.

Top 10 coins: (UTC 06:40 AM)

The losses overnight follow a similar sell-off from Wednesday last week, when bitcoin also shredded off more than 10%.

As has been the trend over the past few days, Ripple’s XRP has held up great in the sea of red numbers with a 24 hour decline of just below 1%. According to some commentators, Ripple may be getting some of its stability from being a very different cryptocurrency, as it aims to work within the current banking system rather than replacing it.

UPDATED (UTC 09:20) Ripple price was stable earlier during the day, but later buyers gave up and sellers took control below the USD 0.460 support.

Another possible explanation is that the drama following the Bitcoin Cash split has affected the rest of the crypto space, and in particular other proof-of-work-based assets like bitcoin. Bitcoin Cash was one of the hardest-hit coins last night, falling more than 40%.

“Gigantic” opportunity

As the crypto market hits rock bottom once again, some still see opportunities in the space. According to Spencer Bogart, partner at the crypto-focused investment firm Blockchain Capital, there is still a “gigantic” opportunity in the crypto space, and in particular in projects that are related to bitcoin, or “programmable money,” as Bogart calls it.

“I still believe that programmable money in a multi-trillion-dollar idea. Right now, we’re in a bear market, but we’re coming off one of the biggest bull markets of all time,” Bogart told Bloomberg on Monday.

Meanwhile, Stephen Palley, Anderson Kill partner, reacts to Bitcoin tumbling below the USD 5,000 mark by saying he doesn’t see a connection or causal relationship between recent SEC (The U.S. Securities and Exchange Commission) activity and the price of cryptocurrency.

The community

At the same time, the cryptoverse met another crash with emotions, attempts of inspiration, insights and jokes, of course. Take a look:

Emotions

____

____

____

____

____

____

Inspiration

____

____

____

____

____

____

____

Insights

____

____

____

____

____

____

____

Ameer Rosic, an entrepreneur, investor and one of the co-founders of BlockGeeks, an online blockchain educational platform, has referred to his previous tweet by saying: “Not 80% but close! Doesn’t take a rocket scientist to see that this was going to happen.”

____

Meanwhile, Marco Sanori, president and chief legal officer of Blockchain, a cryptocurrency wallet, showed the bright side of the bitcoin adoption: confirmed bitcoin transactions are growing, while cost per transaction are dropping.

Jokes

____

____

____

____

______

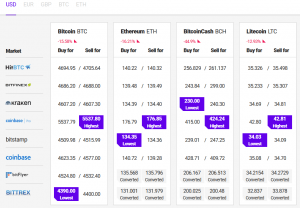

Find the best price to buy/sell cryptocurrency: