Surging ‘Bitcoin Active Supply’ May Point to Coming Rally – Report

Bitcoin (BTC) may be due for yet another price rally fuelled by a recent increase in on-chain activity on the network, according to a new report from Singapore-based cryptoasset management firm Stack Funds.

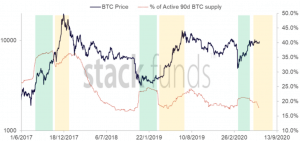

The firm explained that it is a strong rise seen in the 90-day “percentage of Bitcoin active supply versus current supply” that has caught their attention, and which they believe may point to a coming rally for the number one cryptoasset.

And for those that are not familiar with it, the report says this metric represents “a unique native unit that is transacted at least once in the past 90 days,” while also adding that this is a useful metric to look at in order to understand “sentiment cycles” among BTC holders.

Specifically, the report found evidence of “steep surges” in the active supply prior to the price rallies in both 2017 and 2019, as seen in the green areas of the chart below. And according to the report, these surges have tended to peak between 60 and 90 days before a new price rally have started in the bitcoin market.

“Alongside our first point, it is apparent that investors are accumulating the digital asset with expectations of a potential price increase,” the report said.

The report went on to say that the same is now again happening with bitcoin, given the spike in the active supply seen in late March this year.

“As statistics have shown, a potential run-up in bitcoin prices can be expected, which has yet to materialize, leading us to believe that the preceding rise in bitcoin prices could happen sooner rather than later,” the firm concluded.

Meanwhile, Willy Woo, a popular BTC analyst, also said recently that if his new model is right, the next bull run could be right around the corner.

At pixel time (11:46 UTC), BTC trades at USD 9,115 and is down by 1% in a day and a week. The price dropped by 5% in a month and 21% in a year.

___

Learn more:

New ‘Red Dot’ and Criticism Hit Bitcoin S2F Model

Bitcoin Whale Population Growth Might Be A Mirage

‘Real’ Bitcoin Free Float Supply Figures May Be off by 22% – Report