Stop Overpaying Bitcoin Transaction Fees

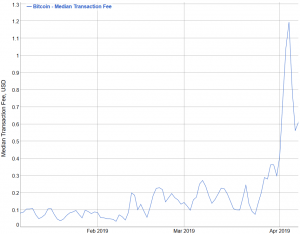

With the price of cryptocurrencies recently rallying, they’re also gaining more traction, and many more people are making transactions and thus spending transaction fees. Of course, due to the law of supply and demand, transaction fees get more expensive – but there are ways that you can make sure that you don’t overpay them, especially if you’re not in that much of a hurry.

Transaction fees are included with your bitcoin transaction in order to have your transactions processed by a miner and confirmed by the Bitcoin network. Simply put, they’re payment to the miner for including your transaction into a block. Since there is only 1 MB of space for transactions within a single block, the more you are willing to pay – and thus outbid other users – the more likely you are to have your transaction picked up by a miner.

Of course, this means that there is a competition among users of the network to make sure their transactions are going through as soon as possible, even if it means overpaying. Bit Consultants, a Bitcoin education and consultancy organization, suggests that users are needlessly overpaying – more than would be strictly necessary to have your transaction included in the next block.

However, you could be overpaying for transactions even if you’re not doing it on purpose: wallet developers are often incentivized to make their users pay the highest transaction fees in order to evade customers complaining about their transactions not going through.

Most cryptocurrency wallets have the option of adjusting the fee when sending a transaction, but there is a drawback: you risk having to wait longer for your transaction to be included in a block. “Spenders willing to wait a bit longer can still save money,” Bitcoin Optech, an organization that helps Bitcoin users and businesses integrate scaling technologies, wrote in a recent newsletter, adding, “For example, as of this writing [April 2nd], Bitcoin Core’s fee estimator suggests a fee of 0.00059060 BTC [USD 2.9] per 1,000 vbytes confirmation within 2 blocks but only 0.00002120 [USD 0.1] for confirmation within 50 blocks – saving over 95% for waiting up to an extra 8 hours.”

However, the fee estimator still adds that, “Because of the decentralized nature of the Bitcoin network and the fact that there is sometimes congestion in the available block space (because of the 1 MB limit), the amounts shown here are probabilistic and there are no guarantees that they will work.”

Bit Consultants offers a simple solution: use wallets where you can set a manual fee amount, that support Replace-by-Fee (RBF) and Child Pays for Parent (CPFP) features. Replace-by-Fee is the replacement of an existing, unconfirmed transaction with a new one, identical except for the fee, which is usually higher to boost the chance of it being confirmed soon for when you can’t wait any longer.

Child Pays for Parent (CPFP) is a feature which allows the receiver of a transaction to spend the unconfirmed funds they are expecting. The reason this is helpful is because if you are waiting on a transaction that is stuck because the transaction fees are too low, you can simply send the unconfirmed funds to a different wallet address, with a higher transaction fee. The higher fee will have miners pick up the new transaction and the old as well, and both will be confirmed within the same block.

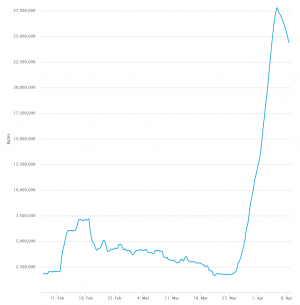

If you’re more tech savvy, Bit Consultants also recommends checking the mempool by yourself. The size of the mempool is the aggregate size of transactions waiting to be confirmed. If it does not have a very big backlog, there is simply no reason for you to pay more than the minimum – your transaction will get picked up simply because there are not enough other transactions to gain precedence.

Mempool size: