Samsung is Not the Only Mega-Company to Exploit Crypto Progress

Samsung is not the only one South Korean giant that has blockchain-related news to share. Increasingly blockchain and crypto-keen South Korean conglomerates are striking partnership deals with domestic fintech companies as they look to fast-track their moves into the sector.

As reported, perhaps the biggest South Korean conglomerate of them all, Samsung, just confirmed that Samsung Electronics’ new flagship smartphone will indeed feature a crypto wallet.

The move comes as a major business model development for Samsung, which had thus far channeled its blockchain-related operations almost exclusively through its IT services arm, Samsung SDS.

The South Korean economy is dominated by chaebol companies, family-run business groups with billion-dollar assets and numerous affiliate companies. Despite the government’s apparently standoffish stance toward cryptocurrency businesses (contrasting starkly with its perceived fervor for all things blockchain-related), chaebol companies are growing increasingly keen to join the fintech fray, with the likes of Hyundai, KT and LG already firmly committed to developing blockchain and/or cryptocurrency business units.

In recent weeks, yet more mega-companies have signaled their intent to join in.

And per Fn News, companies like Kolon, Hanwha and SK are teaming up with existing blockchain startups as part of a strategy aimed at boosting their IT capabilities quickly so they can commercialize products faster.

Telecoms giant SK is working with Haechi Labs on “a smart contract platform based on blockchain technology.” SK wants to commercialize its new product by the end of June this year. The company last year revealed plans for an initial coin offering consultancy and other blockchain-related businesses.

Hanwha is keen to tie in its Galleria shopping and e-commerce franchise with Terra, a blockchain startup that specializes in online banking solutions – potentially allowing customers the ability to make blockchain-powered electronic transactions. The company last year announced its plans to create blockchain-powered insurance solutions.

And blockchain’s newest South Korean player, Kolon, says its residential property subsidiary is working with a company named Coinduck on a project that could enable it to allow tenants to pay rental fees in digital tokens such as cryptocurrencies – with results of a joint pilot expected “by the end of February.”

____

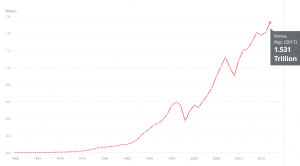

South Korea GDP: