S2F Bitcoin Price Model’s Author Strikes Again With USD 288K Target

A new twist of the popular bitcoin (BTC) stock-to-flow (S2F) model has recently been published by the model’s pseudonymous creator Plan B. And judging from the updated model, S2F believers may now hope that BTC will hit almost USD 300K in a few years.

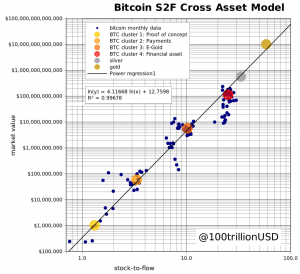

The updated price model, dubbed the Bitcoin S2F Cross Asset Model (S2FX), takes into account not only bitcoin, but two other assets with similar stock-to-flow properties in the sense that they are all mined and held by investors, namely gold and silver.

By dividing bitcoin’s history into separate price clusters based on the dominant “narrative” at the time for what bitcoin really is, the S2F creator came up with the conclusion that bitcoin over time has been widely seen as:

- “Proof of concept”

- “Payments”

- “E-Gold”

- “Financial asset”

Calculating market value and stock-to-flow for bitcoin during these periods, while also doing the same for gold and silver, gave a model of the four bitcoin clusters and gold and silver, which together formed a near-perfect line on the chart, Plan B explained.

According to the author, the model can also be used to estimate the market value of bitcoin during the next narrative phase – or price cluster in the model – for the period between 2020 and 2024. Given a bitcoin stock-to-flow of 56 in 2020-2024, Plan B calculated bitcoin’s market capitalization to be USD 5.5 trillion for this period, compared to a little more than USD 142 billion today.

“This translates into a BTC price (given 19M BTC in 2020–2024) of USD 288K,” the analyst wrote, while pointing out that this is “significantly higher than [the] USD 55K in the original study.”

Last year, Plan B said that “before Christmas 2021 bitcoin should be, or should have been, above USD 100 K; if not, then all bets are off and [the S2F modele] probably breaks down.”

In conclusion, Plan B now wrote that S2FX model serves to “solidify the basis of the current S2F model by removing time and adding other assets (silver and gold) to the model,” while adding that the “phase transitions” used in the model introduce a new way of thinking about bitcoin as it transitions into its fifth phase.

The new work was cheered by some on Twitter, including prominent investors like Real Vision founder Raoul Pal, who noted that the model has great potential for valuing not only bitcoin, but also other similar assets:

Pal himself recently said that BTC price might reach USD 1 million within the next few years.

Plan B’s work has, however, been met with skepticism by members of the community, with for example the well-known Bitfinex trader J0E007 writing on Twitter that “Plan B made a step in the right direction,” although the new model still needs to be confirmed with even more assets before it has his full support.

Previously, Eric Wall, Chief Investment Officer at crypto asset management firm Arcane Assets, has also expressed doubts about the model, claiming that the S2F model is based on flawed logic that “almost no one understands.”

At pixel time (12:54 UTC), BTC trades at c. USD 7,752, and is unchanged in a day. The price is up by 27% in a month and 48% in a year.