Relief to Bitcoin Miners as Double-digit Difficulty Adjustment In Sight

With the second post-halving bitcoin (BTC) mining difficulty adjustment set to occur shortly, miners might once again breathe a sigh of relief after the previous such event also made life easier for players in the highly competitive industry.

This time, difficulty, a measure showing how hard it is to compete for mining rewards, might drop almost two times more than two weeks ago, when it decreased by 6%.

Tomorrow, it might drop by more than 11%, to 13.45 T, or lower than the level seen at the beginning of this year, when BTC traded in a range of USD 7,000 – USD 9,000, according to data (14:30 UTC) by major Bitcoin mining pool BTC.com.

It would also be lower than the level seen after a historic difficulty adjustment following crypto’s Black Thursday in March.

Today, commenting on the adjustment after the release of its revenue figures for May, Argo Blockchain, a BTC mining company listed on the London Stock Exchange, said that the company is well-positioned for any difficulty adjustments, and that the upcoming adjustment will likely improve their margins:

“This week will see another BTC mining difficulty adjustment and we expect a further drop of between 4%-6% in difficulty based on current hashrate and projections. This change is expected to result in improvements to our overall mining margins,” the company’s CEO, Peter Wall, said in a statement.

Meanwhile, crypto mining publication Miner Update argued recently that this djustment will be entirely based on the computing power which miners deploy at the current difficulty level and block subsidy of BTC 6.25.

“The next difficulty adjustment will alter the network to the hashrate deployed over the next ~2 weeks and it will afterward become clear whether users are paying higher transaction fees post halving,” they said.

While the median BTC transaction fee dropped more than 50% since mid-May, it is still around five times higher than it was in April.

Bitcoin hashrate

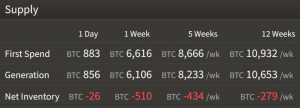

As reported, data from ByteTree shows that miners are now selling more BTC than they generate.

The mining difficulty of Bitcoin is adjusted every two weeks (every 2016 blocks, to be precise) to maintain the normal 10-minute block time. This means that if there are many miners competing among themselves and propagating blocks in less than ten minutes, the difficulty of the next puzzle will be increased; if there are few miners and it takes them much longer to find a solution, the difficulty is decreased – both times just enough to keep block times at around 10 minutes.

At pixel time, BTC trades at USD 9,570 and is down by 6% in a day, trimming its weekly gains to less than 5%.