Otherdeed NFTs Sale Drop by 25%, Pushing Buyers Further Underwater

Most buyers of the hotly-anticipated Otherdeed non-fungible tokens (NFTs) drop are not able to sell their digital land deeds at a profit, due to the high Ethereum (ETH) gas fees they paid during minting, as well as the decreasing demand.

According to NFT data aggregator CryptoSlam, Otherdeed NFTs sales are down by 24.6% over the past 24 hours, with nearly a 45% decline in the number of new buyers.

The floor price of the collection, the smallest amount of money you can spend to purchase an Otherdeed NFT, has also taken a hit, dropping by 9.46% from ETH 3.7 (USD 10,532) to ETH 3.35 (USD 9,536).

Given that the majority of users paid exorbitant gas fees during the mint, the decreasing demand further pushes them underwater.

As per Etherscan data, users paid anywhere between ETH 2.6 (USD 7,356) to ETH 5 (USD 14,147) in gas fees. The NFTs were minted at APE 305 each, which means each Otherdeed cost about USD 5,800 (ETH 2) given Apecoin’s price (USD 19) at mint time.

Subtracting the minting price of ETH 2 from the current floor price of ETH 3.38, it turns out that any buyer who paid more than ETH 1.38 in gas fees is currently in the red.

Notably, some have turned to wash trading in order to artificially increase prices and paint a misleading picture of their NFTs’ value. According to CryptoSlam, Otherdeed wash sales have increased by a whopping 13,203,094% over the past 24 hours.

Launched by Yuga Labs, the startup behind the popular NFT collection Bored Ape Yacht Club (BAYC), Otherdeed NFTs went live on Saturday night. The NFTs are supposed to be “the key to claiming land in Otherside,” Yuga Labs’ upcoming metaverse game.

“Otherdeed is the key to claiming land in Otherside. Each have a unique blend of environment and sediment — some with resources, some home to powerful artifacts. And on a very few, a Koda roams,” according to the verified “Otherdeed” Collection on @opensea pic.twitter.com/AyCYDy631L

— The Bored Ape Gazette🍌 (@BoredApeGazette) April 30, 2022

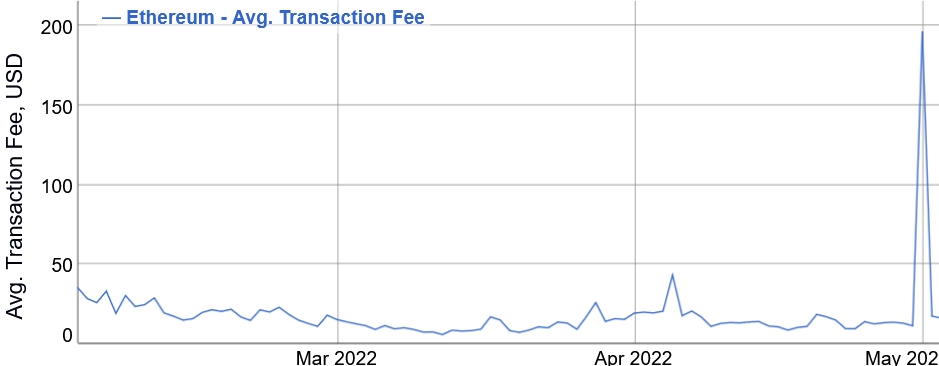

The Otherdeed mint attracted huge attention, clogging the Ethereum mainnet and leading gas prices to skyrocket. The average gwei, or price of Ethereum gas, surged to more than 6,200 over the course of the mint night.

“This has been the largest NFT mint in history by several multiples, and yet the gas used during the mint shows that demand far exceeded anyone’s wildest expectations,” Yuga Labs said. “The scale of this mint was so large that Etherscan crashed.”

Yuga Labs also pledged that they would refund the failed transactions, and even pointed out the need for their own blockchain. “It seems abundantly clear that ApeCoin will need to migrate to its own chain in order to properly scale,” the company said.

Meanwhile, scammers have also managed to steal millions worth of NFTs through phishing attacks impersonating Yuga Labs amid the hype behind the Otherside NFT drop.

There have been several phishing attempts, ranging from fake websites to forged Twitter accounts impersonating the company and its metaverse initiative.

#PeckShieldAlert #phishing PeckShield has detected another batch of forged #OthersideMeta accounts e.g. @OthersideDeeds @0thersideMeta_ @Otherside_yuga @Meta1Otherside @Otherside_meta promoting fake BYAC-LAND minting. e.g. otherside-mint[.]com,otherslde[.]com Do *NOT* be tricked! pic.twitter.com/ScjFM2rdPI

— PeckShieldAlert (@PeckShieldAlert) May 2, 2022

____

Learn more:

– Apecoin to Hit USD 27 by End 2022 – Survey

– ApeCoin Smart Contract Exploited, ‘Well-Prepared Claimer’ Walks Away With USD 380K

– Kraken Enters NFT Game with Waitlist for New Multi-Chain Marketplace

– Elon Musk NFT First to Enter Ukrainian Hall of Fame and You Can’t Buy It

– DeFi Transactions at One-Year Low, NFTs and Games Standing Strong

– NFTs in 2022: From Word of the Year to Mainstream Adoption & New Use Cases