Options Market Keeps Sending Bullish Signs to Bitcoin Investors

After a day of strong price gains that sent bitcoin (BTC) up by nearly 6% over the past 24 hours to breach the important USD 10,000 level, the options market may have even more good news in store for hopeful investors.

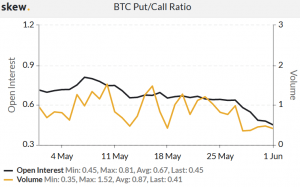

According to data from Skew, a provider of crypto derivatives analytics, the past month has seen a shift in the ratio of traders who are betting on higher prices versus those that are betting on lower prices, known as the put-to-call ratio.

The decreasing put-to-call ratio, both in terms of volume and open interest, may indicate increased bullish sentiment among options traders, as well as a lower interest in hedging against downside risk for players who may hold bitcoins in the spot market.

In options terminology, a call option represents a bet that prices will rise in the underlying spot market, while a put option represents a bearish view on prices. If the conditions are not met in the underlying spot market, however, the options contract will simply expire worthless and the trader will only have lost his premium payment, similar to how an insurance policy works.

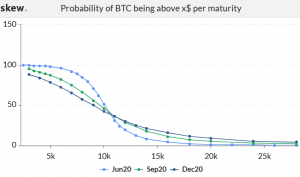

In addition to a shift in the put-to-call ratio, however, the probability that the spot price of bitcoin will remain above USD 10,000 has also increased as of late, with the market for options contracts expiring in June indicating a probability of 51% that bitcoin will be above that level by the expiration date.

Looking at the September contracts, however, the likelihood that prices will remain at the current level is somewhat lower at 46%, the data shows.

In fact, options trading appears to be a segment of the market that has been gaining some traction recently, with exchanges such as Binance launching options trading on its mobile app.

Further, the crypto derivatives exchange Deribit posted on Twitter today that they have seen “multiple option records” on their exchange in May. According to the exchange, 332,817 bitcoin options contracts were traded in May, which is a new all-time high for the exchange.