Large Players, APAC, EMEA Bidders Might Go Shopping for Crypto Projects – PwC

The COVID-19-triggered global financial and economic crisis may affect crypto fundraising and merger & acquisition (M&A) deals, but some players will see this market turbulence as a good time to enter the market, one of the world’s biggest accounting and auditing firms PwC believes.

The pandemic has already created headwinds for a large number of industries around the world, and the crypto industry is not immune to this, according to the 2nd Global Crypto M&A and Fundraising Report by PwC.

As a result, “the number and value of fundraising and M&A [merger & acquisition] deals” may be impacted over the course of the year, they said.

However, PwC expects further consolidation in the crypto industry this year, with larger and profitable firms buying up smaller players.

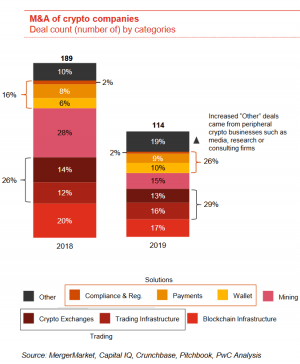

“We expect to see some of the larger players buy firms that offer ancillary services to their current offering,” the firm wrote while offering examples of potential targets such as crypto media, compliance, and crypto research firms.

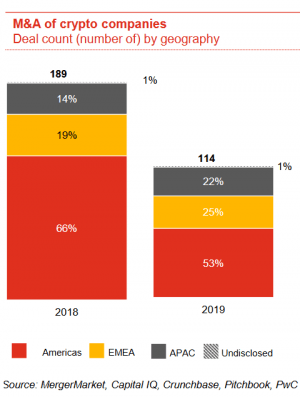

Finally, PwC also said that it expects more investors based outside of North America to get involved in the crypto space this year through M&A’s and funding rounds, with a special emphasis on Asia and other emerging markets:

“In particular, we expect to see more activity from APAC [Asia-Pacific] and EMEA [Europe, Middle East and Africa] based family offices looking at the market turbulence as a good time to enter the market,” the report said.

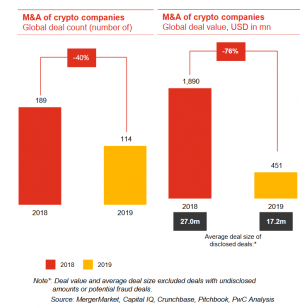

PwC noted that the number and size of fundraisings and M&A’s have already seen a marked decline from 2018 to 2019. Most significantly, the value of the deals that were made in 2019 were down by 40% from the year before, coming in a total of USD 2.24 billion for the year.

“The rise in the price of bitcoin in Q2 and Q3 2019, and the associated interest in “crypto assets” did not yet materialize by way of increased new capital into the industry,” the report explained, referring to capital invested in the form of equity rather than directly into crypto assets.

As reported, last week, major crypto exchange Binance confirmed that it has acquired CoinMarketCap, the biggest crypto market data provider. Both companies did not disclose any other details of the deal, which is said to be valued at up to USD 400 million.

____

Other findings in the 2nd Global Crypto M&A and Fundraising Report:

__

__

__

__

Learn more: This Crisis Is Good For Bitcoin, But Beware of Recession – Luno CEO