How Investors Should Approach Bitcoin, According to Ark Invest

While bitcoin (BTC) is far from a traditional asset that can be analyzed using conventional frameworks, the blockchain still offers many ways of analyzing the asset, Cathie Wood’s Ark Invest said in a newly published whitepaper.

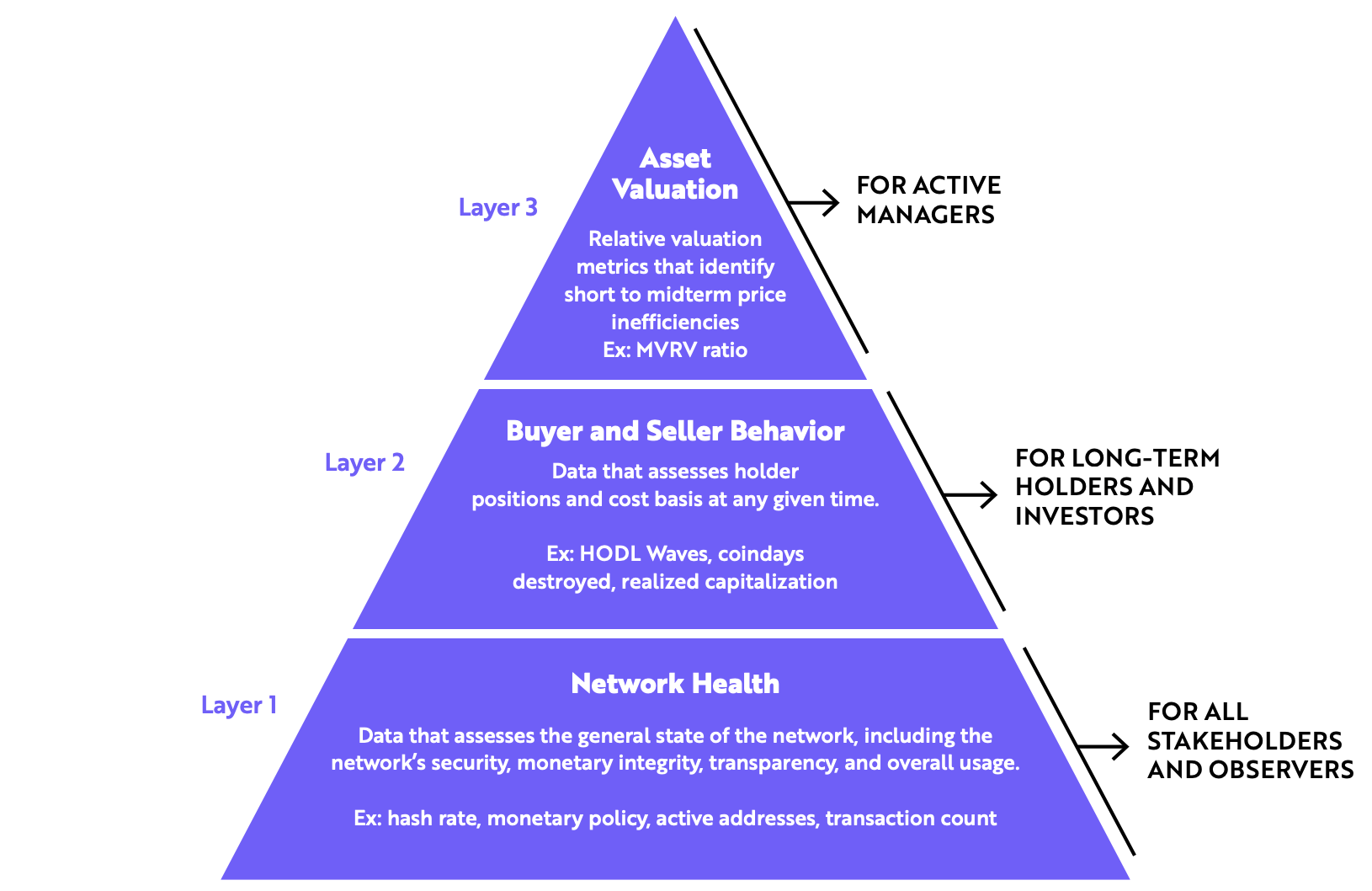

In the paper, titled A Framework to Evaluate Bitcoin, the firm made the case for evaluating the number one cryptocurrency as an investable asset through three layers, with each layer being relevant for a different class of investors:

- assessing the health of the Bitcoin Network;

- assessing buyer and seller behavior;

- valuing bitcoin.

Ark Invest’s whitepaper was written by the firm’s in-house analyst Yassine Elmandjra, in collaboration with the bitcoin on-chain researcher David Puell.

Sharing the paper on Twitter, Elmandjra called it “the ultimate manifesto on the power of on-chain data,” and said it represents the culmination of a year’s worth of work on developing a framework for assessing bitcoin fundamentals.

Layer 1: Network health

Starting with the first layer, the paper said this includes assessing things like the network’s security in terms of hash rate, monetary policy, active addresses, and transaction count.

This layer is useful for everyone interested in observing and learning about bitcoin as an investment, the paper argued, saying it could be seen as “a basic fact sheet” about the network.

“Accessed by any blockchain ‘search-engine’, the data in this layer is raw and straight-forward, requiring little to no manipulation,” the paper said.

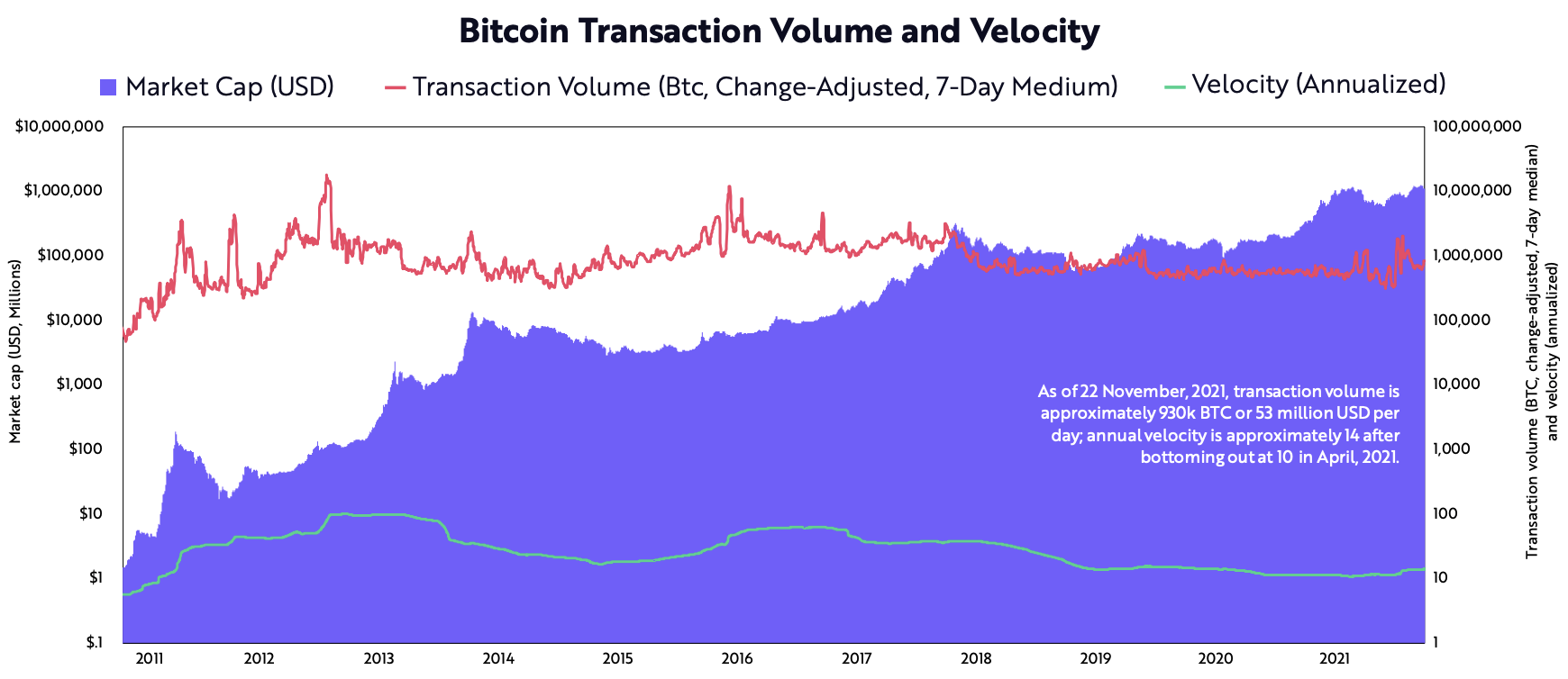

Further, the report also suggested transaction volume as a good measure of the general health of the network. When divided by the circulating coin supply, the transaction volume offers insight into bitcoin’s annualized velocity, the investment firm wrote.

Layer 2: Buyer and seller behavior

As the second layer of assessment, Ark Invest suggested that long-term holders and investors in particular may find it useful to look at what wallet addresses are doing, often referred to as “buyer and seller behavior.”

This could include more complex calculations based on on-chain data such as the so-called “HODL Waves” or bitcoin’s realized capitalization, which values bitcoin using the price when each coin last moved on the blockchain, the paper said.

Layer 3: Asset valuation and trading signals

Finally, the last layer in Ark Invest’s framework uses the first two layers to provide relative valuation metrics that are capable of identifying what the paper called “short- to mid-term inefficiencies in bitcoin’s price.”

This layer is especially useful for active investors and traders, according to the report, explaining that it has the potential to generate direct buy and sell signals, similar to how valuation metrics are used in the stock market.

Meanwhile, speaking more broadly on bitcoin as an investable asset compared to other cryptocurrency networks, Ark’s report said that it is important to note that “no other network rivals Bitcoin’s in transparency.”

This makes Bitcoin “the most ‘analyzable’ and fundamentally-sound network” in the crypto space, the report argued.

It added that it sees Bitcoin’s “auditability, openness, and transparency” as stemming from the fact that it has a simple “UTXO-based accounting system,” a verifiable code “that has been scrutinized more than any other open-source software code,” and network nodes that are “much more cost-efficient than alternative cryptocurrency network nodes.”

Led by the well-known technology investor Cathie Wood, Ark Invest is known as one of the most pro-bitcoin major asset managers today. Speaking during a panel discussion hosted by derivatives marketplace Cboe in early 2021, Wood spoke about bitcoin, arguing that “we have just begun. [USD] 1 trillion is nothing compared to where this ultimately will be.”

____

Learn more:

– Rising Number Of Investors Sell Stocks, Bonds To Buy Crypto – Survey

– Bitcoin Market Cycles Explained

– Here’s What Everyone Missed in The Dorsey, Musk, and Wood Bitcoin Talk

– Crypto in 2022 Will Bring New and Older Emergent Trends to the Fore

– 5 New Blockchain Funds You Could Invest in Today

– How to Invest in Crypto Exchanges: Top 3 Options