Global Gold Survey Tells 5 Important Things About Bitcoin Adoption

There are five points that speak to us about the world’s most popular cryptocurrency Bitcoin (BTC) and crypto in general in a global survey by the World Gold Council (WGC), the market development organization for the gold industry.

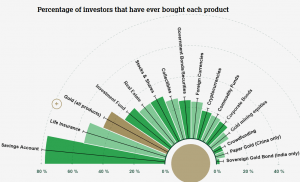

The new consumer research report encompasses opinions of 18,000 people, across the world, including China, India, North America, Germany and Russia. The researchers have discovered that “gold is a mainstream choice – the third most consistently bought investment, with 46% of global retail investors choosing gold products.”

While the report focuses on how to promote gold and bring new audience to its world, all these can be theoretically applied to the Cryptoworld as well, as many Bitcoiners are trying to establish the “Bitcoin is a digital gold” narrative. Moreover, the fact that this nascent technology found a place in a major gold-focused survey speaks for itself. Possibly, an ad campaign ‘Drop Gold,’ launched by cryptocurrency asset management firm Grayscale in May, has also made its part.

Here are the five things in the survey that tell something important about the adoption of Bitcoin and other cryptocurrencies.

1. Investment loyalty

The report finds that consumers and retail investors are confident in gold across the world, more so than in their local currencies, with:

- 67% of all retail investors believing that gold is a good safeguard against inflation and currency fluctuations

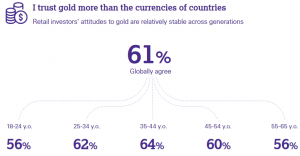

- 61% trusting gold more than fiat currencies

- 65% believing it won’t lose its value over the long-term.

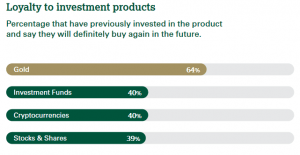

Also, people that have had an interaction with a product are more likely to buy it, the report finds. 40% of cryptocurrency investors said that they will definitely buy it again, which is the same share as in the case of investment funds, while stocks & shares are slightly less attractive.

Moreover, the report showed that more people invested in cryptocurrencies than commodity funds and corporate bonds.

2. Lack of trust

It seems that traditional fiat currencies are facing a serious problem of trust, which can help to an alternative form of money – cryptocurrency. Moreover, as recently reported, 29% of surveyed Americans believe that the U.S. dollar is still backed by gold.

Also, turning now to those who’ve never purchased a product offered as an option in the survey, we know that people have fears when approaching a new product that would require them separating from their money. The level of this fear and the luck of trust subsequently produced varies across generations, but finding a way to ease people’s concerns would bring more of them to the industry. “People need to trust in how the industry operates. They need to trust the process of buying and selling in a way that fills them with confidence,” the report says.

48% of potential investment consumer and 28% of all potential jewelry consumers cite lack of trust as an obstacle, while more than 25% of those who never invested in gold but are thinking about it, expressed concerns about buying fake or counterfeit products. Though scam concerns are shared in the Cryptosphere, Bitcoin is impossible to counterfeit.

3. Lack of knowledge

Related to the previous entry, those who’ve just joined the game are likely to lack knowledge and experience, which can produce the above-mentioned fear and concerns and prevent them from buying the product – in our case, Bitcoin. Spreading awareness and focusing on successful education will contribute to the growth on trust, and this is something that crypto community has been hard at work on since BTC’s inception. “Awareness of specific investment products, their relative affordability and what drives their prices could be better communicated,” says the report, discussing gold. “Correcting misconceptions and filling these gaps would generate market growth.”

66% of potential gold buyers globally say they lack the necessary knowledge to actually buy it. “Greater awareness of gold needs to be created through TV, print and social media; quality education is required on the benefits of owning gold; and, while it is not a mainstream issue now, the next generation of potential gold buyers need to know more about the industry’s ethical credentials.” As Generation Z (born between 1996-2010) is becoming older, it is likely that ethics and environmental impact will become far more important in their purchase decision-making than it has been the case with prior generations, including millennials, which is again a lance in which BTC beats gold, despite heated debates about the environmental impact of the Bitcoin mining.

4. Generational differences

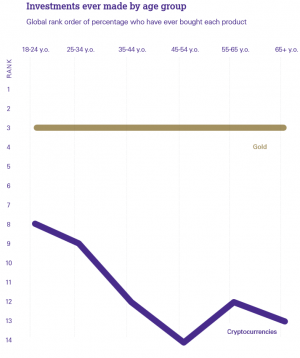

“Awareness of gold does not translate into future buying,” says the report. It turns out that millennials share similar view of gold with the older generations, which is not necessarily surprising given that this generation was born in-between two massively technologically different generations. Younger Gen Zs are showing far less interest in purchasing gold than their predecessors.

Younger generations are getting increasingly savvy with everything digital / virtual related, cryptocurrencies included. For example, a significant gateway to the Cryptosphere is gaming. We can say that the generations born after or a few years before the creation of blockchain are growing up with a larger familiarity of digital assets – a first-time phenomenon in the world’s history.

The emotional connection of Gen Z to gold is lessening, but their “live-for-today, risk-taking attitude is most evident in their exposure to other investments, rather than in the exclusion of gold,” explains the report, “and one asset stands out as featuring more highly in their portfolios than those of older investors: cryptocurrencies.” The researchers found that, while gold is skewed towards long-term needs, cryptocurrencies are “significantly skewed towards short-term and speculative needs.” 22% of Gen Zs see the role of cryptocurrencies as short-term returns, while 26% see it as speculative and high risk, says the report.

Nonetheless, the report shows Gen Z investing even more in crypto than millennials.

5. Technological innovation

“Digital engagement is key to gaining a competitive advantage; potential gold investors want ease of purchase and gold jewellery consumers report that security, trustworthiness and convenience can be major hurdles to purchasing online,” says the World Gold Council, adding that 40% of retail investors name ease of purchase as a crucial requirement when buying gold.

There aren’t many “pioneering, tech-savvy players in the gold market,” but if the Cryptoworld has anything, it’s continual innovation. And this is particularly important for millennials, but even more so for Gen Z. “China’s young consumers are growing up in a more technologically advanced society and have an attitude towards gold jewellery that is less traditional than that of older generations,” says the report, and we can safely say that it’s unlikely that future generations will be less digital. If anything, they’re likely to be more so.

“Though Gen Zs are more likely to be digital natives, it is not simply that they view gold as old-fashioned in comparison to cryptocurrencies. For them, it is not an either/or, it is something of a different value, both in financial and emotional terms,” the Council concludes.

____

Meanwhile, as reported, recent developments in global traditional markets and bitcoin’s moves complicate the narrative that the price of the most popular cryptocurrency benefits from safe haven capital flows.

__

Learn more:

Gold Investors Eyeing Bitcoin on its Way to USD 100,000 – Plan₿

The Gold vs Bitcoin Debate: Anthony Pompliano vs Peter Schiff

Do We Need Both Gold and Bitcoin?

‘Gold Can’t Compete With Bitcoin As Form Of Money’