Crypto Market Sentiment Takes Another Step Up

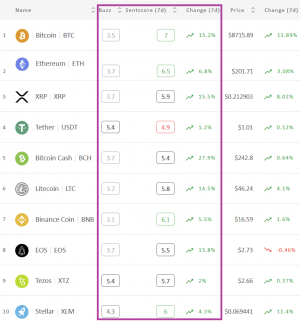

The crypto market sentiment has made another, relatively large step upwards over the course of the past week. The combined moving average 7-day market sentiment measure, sentscore, for the top 10 coins continued its rise from seven days ago, climbing from 5.37 at the time to today’s 5.88 – that way being just 0.12 away from the positive zone, as shown by crypto market sentiment analysis service Omenics.

The market’s good weekly fortune continues, as all coins – including the last week’s lonely, red wolf Tether (USDT) – are green today. Furthermore, following two coins’ entrance into the positive zone, now the market has three coins with or above the score of 6: Bitcoin (BTC), whose sentscore has climbed from 6.2 to 7/10 in a week, and Ethereum (ETH), whose score saw a rise from 6.1 to 6.5, are joined by a last week’s winner, Stellar (XLM), which also had a score increase from 5.7 to 6. The rest of the coins have scores above 5, and only one compared to last week’s three, Tether, has a score below 5, but it too is sitting on the verge of it.

Now looking at the daily scores, instead on the last seven days – we see mixed results. While four coins are seeing their sentscores increase, six have dropped. Nonetheless, like last Monday, five out of the ten coins are in the positive zone. Also, the combined sentscore for these 10 coins over the course of the last 24 hours is 5.95, compared to last Monday’s 5.86.

Sentiment change among the top 10 coins in the past week*:

Interpreting the sentscore’s scale:

– 0 to 2.5: very negative

– 2 to 3.9: somewhat negative zone

– 4 to 5.9: neutral zone

– 6 to 7.49: somewhat positive zone

– 7.5 to 10: very positive

Going back to the weekly views in search for winners and losers, we find Bitcoin (BCH) at the absolute top, having a rise in its sentscore of nearly 28%. The second-placed XRP‘s score is up by 15.5%, and it’s closely followed by Bitcoin’s 15%. We can also note that Litecoin (LTC) and EOS are not far behind and also boast double-digit jumps.

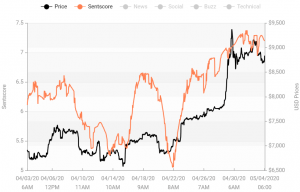

BCH’s highest scores this week are 7.4 in news and 6.1 in technicals, as well as 5.7 in social. However, its lowest are 3.7 in buzz and 2.6 in fundamentals. Similarly, XRP has high scores in news, technicals, and social (6.8, 6.7, and 5.6, respectively), while it got lower scores in fundamentals and buzz, though only the latter is negative (4.5 and 3.7, respectively). Lastly, Bitcoin is an oft-discussed coin but one that rarely makes the winner or the loser list with its sentscore rise/drop percentage. This time we get to look under its ‘hood’ too, finding it has three quite high scores: 8.8 in fundamentals, 7.3 in news, and 7.1 in technicals. It also has the neutral sentscore of 5.1 in social, as well as the negative score of 3.6 in buzz.

Daily Bitcoin sentscore change in the past month:

On the other side, we find no losers per se, so we’ll look into those whose scores went up the least, between 1% and 2%, these being Tether and Tezos (XTZ). Much like last week, Tether’s strongest aspect this week is news (7.6), followed by buzz (5.4), technicals (4.5), and social (4.1), while its weakest aspect is fundamentals (3.6). Meanwhile, Tezos has two positive scores, 7.6 and 7.1, in technicals and news, respectively. It also has two neutral scores – 5.4 in buzz and 5.2 in social, and a negative score 2.9 in fundamentals.

Finally, let’s take a look at the week’s scores of the 29 coins that stand outside the top 10 list and which are also tracked by Omenics. Unlike last week’s ten coins whose scores dropped, now there are only three. Furthermore, two are in the positive zone – Cardano (ADA) with 6.1 and Nano (NANO) with 6.4, the latter of which is up from last week’s 6. Twenty-two, compared to last week’s ten, have scores above 5, four have scores above 4, and only one – Komodo (KMD) – remains in the negative zone.

___

* – Methodology:

Omenics measures the market sentiment by calculating the sentscore, which aggregates the sentiment from news, social media, technical analysis, viral trends, and coin fundamentals-based upon their proprietary algorithms.

As their website explains, “Omenics aggregates trending news articles and viral social media posts into an all-in-one data platform, where you can also analyze content sentiment,” later adding, “Omenics combines the 2 sentiment indicators from news and social media with 3 additional verticals for technical analysis, coin fundamentals, and buzz, resulting in the sentscore which reports a general outlook for each coin.” For now, they are rating 39 cryptocurrencies.