Crypto is a ‘Fantastic Hedge’ Against Bubble in Bonds – Pantera’s CEO

Investing in crypto is a “fantastic hedge” against a bond market that will get destroyed once the US Federal Reserve stops its asset purchases, Dan Morehead, CEO of the crypto investment firm Pantera Capital, wrote in a recently published note.

According to Morehead, the Fed’s actions since the onset of the pandemic has fuelled a historic bubble in the bond market that will sooner or later — implode.

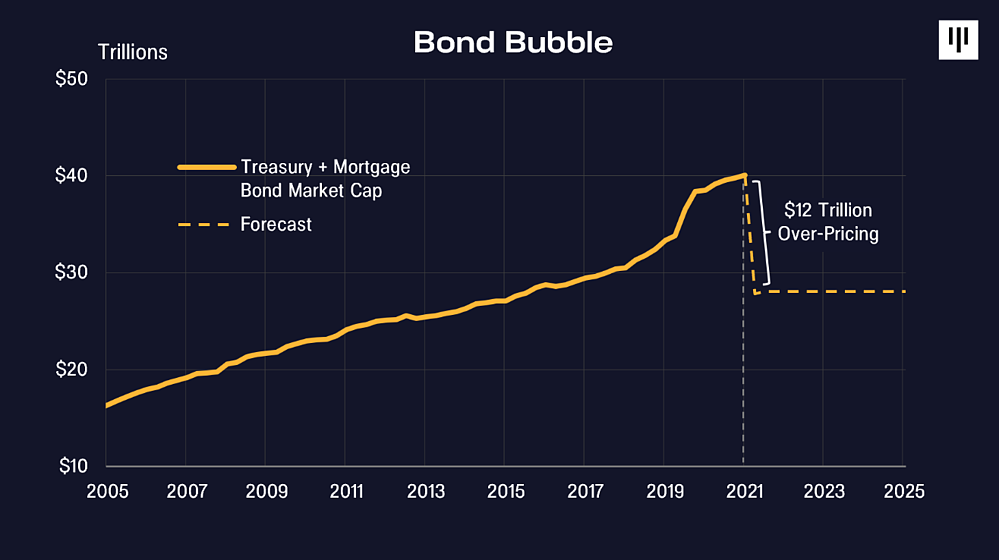

“Bonds investors are going to get absolutely destroyed when the Fed stops manipulating the bond market,” Morehead warned before explaining that “if real rates were no longer manipulated,” they would return to their 50-year average.

Per the CEO “bond market prices would fall 30 percentage points, which is “against the maximum possible upside of 13. What if they only go halfway back to normal? USD 6 trillion of market cap evaporating!”

Morehead added:

“Buying crypto with only USD 3 trillion market cap seems like a fantastic hedge.”

And while Morehead made it clear that bonds are in a bubble, he said that stocks “may sound overpriced,” although in reality they are “inexpensive relative to the bubble that is the bond market.”

He went on to quote a Goldman Sachs research note from November which said that stock valuations seen in relation to US Treasury yields “would still register as attractive compared with historical averages.”

Further, Morehead, a long-time macro investor who is also the chairman of the crypto exchange Bitstamp, suggested that governments around the world should “stop obsessing about Bitcoin (BTC),” and instead take a closer look at their own actions.

“The biggest Ponzi scheme in history is the US government and mortgage bond market – 33 trillion-with-a-T dollars – all being driven by one non-economic actor with a dominant position who is trading based on material, non-public information,” the outspoken CEO wrote.

He added that the bitcoin market is “way too big to be manipulated,” while reminding readers that the digital asset trades on a huge number of exchanges and markets in countries all around the world.

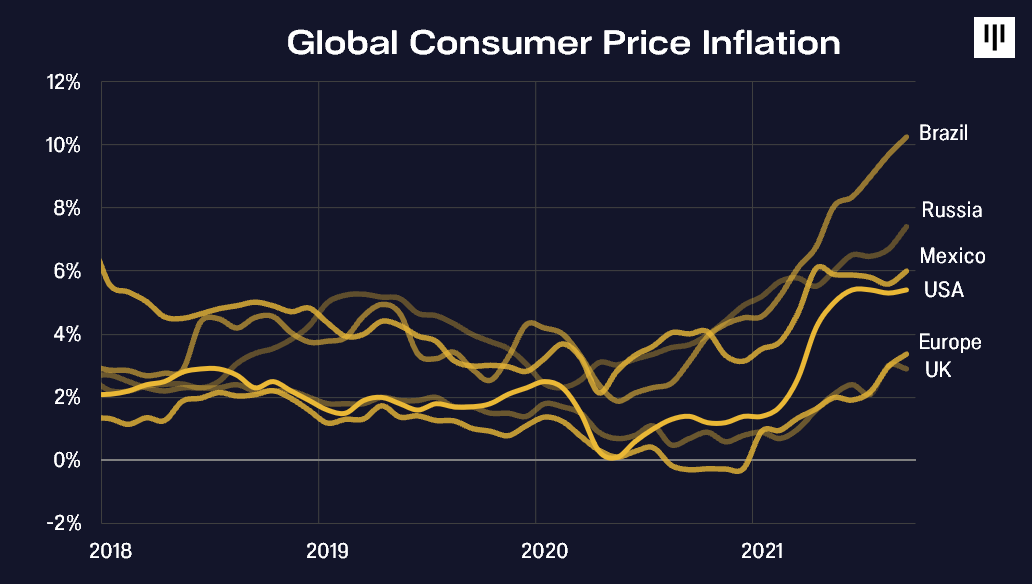

Lastly, Pantera’s CEO argued that inflation is real and that it is “everywhere,” while citing Joseph Carson, former chief economist at asset manager AllianceBernstein, as saying that inflation is “much worse than official statistics show” if older methods of measuring inflation are used.

“The 6% increase in inflation in the past year would be 10%-plus using 1970s methods, since house prices are up nearly 20%,” Morehead quoted the economist as saying.

____

Learn more:

– ‘Paper Money’ Hits All-Time Low Against Bitcoin & Other Hard Assets – Pantera’s CEO

– Bitcoin Was This Cheap Only 20% of Its History – Pantera CEO

– Inflation Is Here & Bitcoin Will Hit USD 115K ‘Ahead of Target’ – Pantera

– Bitcoin Decouples from Stocks as Bullish Sentiment Returns

– French Central Bank’s Blockchain Bond Trial Brings First Results

– El Salvador’s Bitcoin City, BTC Bonds Plans Met With Mixed Reaction