Crypto Exchange Kraken Makes Japan Return After Two-year Absence

Major American crypto exchange operator Kraken is set to return to Japan after an absence of over two years – under the umbrella of its Tokyo-based Payward Asia subsidiary.

The San Francisco-based firm was forced to exit Japan back in April 2018, citing rising business maintenance costs. However, even while it was preparing its exit, the exchange giant claimed it was open to a return at some unspecified point in the future.

The company set up Payward Asia in mid-September the same year.

Overseas firms have struggled to make inroads into the Japanese market, which is dominated by relatively small but fast-moving domestic firms.

Regulatory permission is also a major stumbling block for many firms. The regulatory Financial Services Agency (FSA) strictly prohibits overseas firms from targeting Japanese customers without an operating license. Such permits are almost impossible to obtain unless companies have a base in Japan.

Furthermore, the FSA has stepped up its policing of exchanges periodically, tightening regulations almost every six months since the permit system was introduced.

In a blog post, Kraken stated that its Payward Asia subsidiary had cleared all necessary regulatory services, obtaining its permit on September 8. The company said the platform was slated for launch “around the middle of September,” adding it would return with an exact opening date.

The firm wrote,

“Kraken feels 2020 is the best year to restart the business in Japan because of the healthy market environment, among other reasons.”

The Payward Asia platform will initially handle five tokens namely bitcoin (BTC), ethereum (ETH), XRP, bitcoin cash (BCH), and litecoin (LTC).

Kraken added that it also hoped to add crypto-to-crypto exchange services soon, and “will strive to add other assets and services supported by Kraken outside Japan to the product offering as soon as possible.”

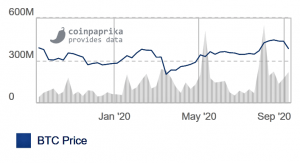

Trading volume on Kraken:

___

Learn more:

Four Crypto Exchanges Rake In 90% of Bitcoin Trading Volume

Is Coinbase Another Step Closer to Opening in Japan?

Japanese Regulator Hints at ‘New Laws’ for Crypto Industry