Can You Guess What the Top On-Ramp for Crypto is in Asia and Oceania? Here’s the Answer

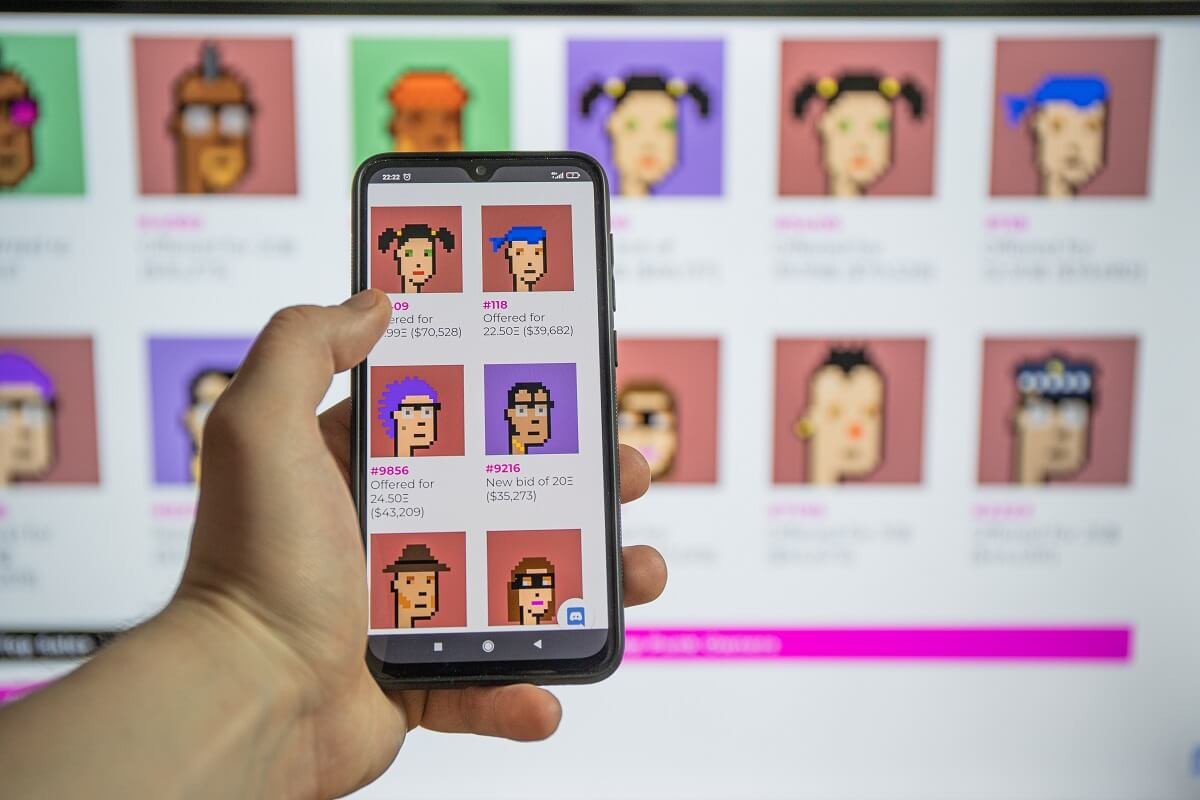

Non-fungible tokens (NFTs) are the biggest on-ramp to the cryptocurrency market among countries in Central & South Asia and Oceania (CSOA) according to a new report.

Blockchain intelligence firm Chainalysis said in a new report that the Asian region received $932 billion worth of crypto from July 2021 to June 2022, thanks largely to NFTs.

The study found that web traffic from IP addresses tied to countries in the region to cryptocurrency services was majorly NFT-related. In Q2 of 2022 alone, 58% of CSOA IP addresses accessing crypto services visited NFT-related websites. Another 21% was to the websites of play-to-earn blockchain games – which are “intimately related” to NFTs as most in-game items are NFTs.

According to Chainalysis, the finding is not entirely surprising as the region is an innovative hub for blockchain-based entertainment. Several game-centric blockchain developers including Polygon, Immutable X, Axie Infinity, and STEPN operate out of countries in the region.

Similarly, on a per country level, countries in the region including Vietnam and the Philippines are among global leaders in blockchain gaming adoption. Meanwhile, the third most popular driver of grassroot blockchain adoption in the region was remittance.

On a global scale, the CSOA region emerged as the third largest crypto market while seven countries in the region, Vietnam, the Philippines, India, Pakistan, Thailand, Nepal, and Indonesia, made the top 20 crypto markets index.

Regulations still a drawback for broader crypto adoption in the region

Despite the success of the crypto market in the region, the industry still faces strict regulatory regimes that could have hampered its progress. The report highlighted India and Pakistan as examples of countries where regulations have stifled the growth of the crypto market in the region.

Earlier this year, the Pakistani central bank and government proposed to ban cryptocurrencies in the country. Since then, up to three committees have been set up to deliberate on the recommendation without reaching any decision so far.

In India, the government has long had a crypto-averse stance having previously proposed to ban the asset class. The government introduced a 30% tax regime for crypto gains in April that has seen crypto exchanges’ trading volumes drop amidst outcry that there are no regulations to guide the industry.

According to a Bloomberg report, these protests from the market have not been paid any heed by the Indian government which is now using the police to issue threats of arrest to crypto investors.

The less than favorable regulatory climate in several other countries in the region has taken a toll on the region’s ranking causing it to fall in Chainalysis’ global crypto adoption index from 2021.