Brace For Higher Bitcoin Volatility and Returns in October – Kraken

As bitcoin (BTC) finished with its worst-performing month, better returns could be expected in October, according to researchers at crypto exchange Kraken. They also noted that the so-called ‘smart money’ is not entirely reflected in the price of the world’s most popular cryptocurrency.

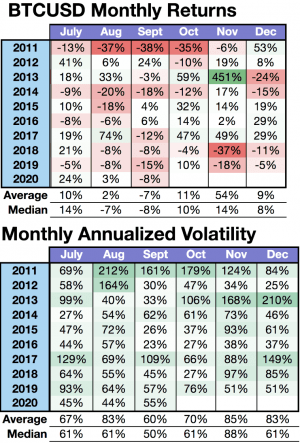

Kraken Intelligence, the exchange’s team of in-house researchers, has released its Bitcoin Volatility Report for September 2020, finding that September, among other poor results, ended with a 15% month-over-month (MoM) decline in spot trading volume for a total of USD 36.4bn; it’s the fourth negative-yielding month on 2020, and the worst monthly return since last March, though it’s 7.6% MoM loss was the second weakest negative return for 2020.

However, the report had some good news for the current month, estimating better returns in October now that “bitcoin’s worst-performing month” is behind us.

The researchers argued that,

“If the past is any indication of the future, one should brace for [October] to outperform [September], just as it has for 8 of the past 9 years, and return around +11%. Do note that relative to the average monthly return, bitcoin has underperformed 6 of the past 9 months.”

It added that September’s annualized volatility of 55% fell exactly between September’s 10-year average and median reading of 60% and 50%, respectively.

Yet, the researchers also noted that, with bitcoin coming off what is the least volatile month of the year on average, as well as October usually being 10 percentage points more volatile than September, “one ought to expect incremental market volatility to surface” with the beginning of this year’s final quarter.

Meanwhile, Kraken Intelligence found that ‘smart money‘ is not fully reflected in bitcoin’s price.

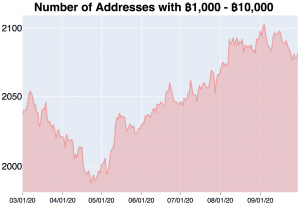

They noted that growth in the number of addresses holding between BTC 1,000 and BTC 10,000 (currently USD 11.37m – USD 113.7m) hasn’t slowed over time, which is, they said, “a trend unique to this tranche.”

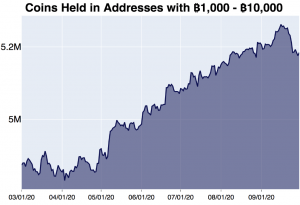

This growth in the number of addresses is accompanied by the growth in the total number of coins held in wallets holding BTC 1,000 – BTC 10,000. Some 28% of all outstanding bitcoins sat in these wallets at the very end of September, and BTC 310,000 (USD 3.53bn) have been accumulated by “smart money” market participants since March 1.

In addition to the uptrend in the 7-day moving average of Bitcoin’s hash rate and 7-day moving average of daily active addresses, the report said that:

“The ever-growing number of addresses and coins held in said addresses indicates that new and existing whales have yet to take their foot off the break and cease what has been a 7-month accumulation spree. Both trends seem to suggest that “smart money” demand remains alive & well.”

__

Among other findings, the researchers said that as of the end of September, 68 days passed since bitcoin dipped into the so-called “suppressed pocket” (15% – 30% volatility), and “although history does not have to repeat,” there is one month left in what is typically a 3-month long volatility cycle where price and volatility surge following BTC’s dip into the pocket.

At pixel time (11:35 UTC), BTC trades at USD 11,268 and is down by 1% in a day, trimming its weekly gains to 5.5%. The price is also up by 9% in a month and 35% in a year.

___

Learn more:

Coin Race: Top Winners/Losers of September and 3rd Quarter 2020

Bitcoin Realized Cap Soars, Analysts Divided on Near-Term Outlook

4 Reasons Bitcoin May Hit USD 1-5 Trillion Market Cap in 10 Years

Brace For More Bitcoin Flash Crashes In This Bull Market – Hut 8 Founder