Bitcoin Still Leaving Exchanges, OTC Deals May Play Part in It

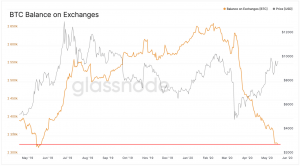

Following crypto’s infamous Black Thursday on March 12, the amount of bitcoin (BTC) held on exchanges has continued to decrease rapidly, and has now reached levels not seen since June last year. Recent “large” over-the-counter (OTC) deals may have also played a part in the drawdown.

The current decrease in the bitcoin balances held on exchanges is “the largest and most prolonged” such downtrend in bitcoin’s history, bringing the level down to a 1-year low, according to blockchain analytics firm Glassnode.

This trend might imply a longer-term outlook as investors expect that BTC will increase in price following the halving, while another partial explanation may be lack of trust in exchanges, the firm said in their latest report. However, it believes that withdrawal for hodling purposes seems to be having a greater effect than the lack of trust.

This theory is also supported by a “continued increase in the number of BTC whales,” in addition to “continued hodler accumulation over the past 2 months,” the report said.

Also, last week, crypto market analysis firm Coin Metrics noted that the amount of BTC held by BitMEX and Bitfinex has reached new lows following the March 12th crash. Last week, Bitfinex held BTC 93,800, down from BTC 193,900 on March 13th. BitMEX’s BTC supply stood at BTC 216,000, down from a peak of BTC 315,700 on March 13th.

Paolo Ardoino, Chief Technology Officer of Bitfinex, told Cryptonews.com that large OTC orders may have played a part in the significant reduction in on-exchange balances:

“We did have a series of rather large OTC deals, where the coins were taken off the platform and that led to the reductions of coins held in our cold wallet. We act as an exchange and we can also act as a party to OTC deals,” Ardoino said.

BitMex did not respond to a request for comment.

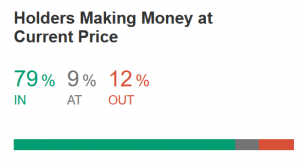

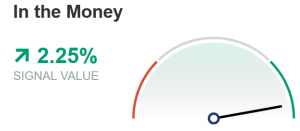

Meanwhile, a large majority of bitcoin holders are currently seeing gains on their accounts in fiat terms, with 79% of bitcoin wallets being “in the money” today, according to analytics provider Into the Block. This is normally seen as a bullish sign for any asset, and signals that investors are likely to keep their holdings in anticipation of further price gains.

In addition, there has also been a marked increase in the number of wallets being in the money compared to previously, which has further boosted the overall sentiment among bitcoin holders.

As of press time on Tuesday (10:26 UTC), bitcoin was up over 1% over the past 24 hours, trading at a price of USD 9,779. Today’s gains comes after several days of strong performance for the number one digital asset, with a 7-day price gain of nearly 12%.