Bitcoin Mining Difficulty Sees Historic Drop, Even Larger Might Be Coming

After the second-largest Bitcoin (BTC) mining difficulty drop, the next one might be even bigger and provide even stronger relief to miners.

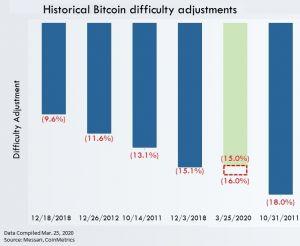

As predicted, Bitcoin mining difficulty (a measure telling us how hard it is to compete for mining rewards) has just dropped – but instead of 5.8% estimated six days ago, it dropped 15.95%. This is the second-largest drop in its history. It now stands at 13.91 T, compared with 16.55 T recorded on March 9 when both BTC mining difficulty and hashrate hit new highs.

BTC mining difficulty’s fall seems far from over. Major Bitcoin mining pool BTC.com estimates that the next adjustment, expected to occur in two weeks, would see the mining difficulty go down by another 16.03%. If this were to happen, this percentage would take the place of the second-highest in history, sitting behind -18.03% recorded on Halloween 2011. Also, if that drop were to come true, the mining difficulty would stand at 11.68 T, where it hasn’t been since mid-September 2019.

Furthermore, the computational power of the Bitcoin network, known as hashrate, fell as expected below 100 EH/s, now standing at 94.89 EH/s. In comparison, it went up to 118.40 EH/s during the previous adjustment on March 9. That is a 19.85% drop in 17 days.

The ongoing Covid-19 pandemic has had a massive effect on the BTC price, and this 50% downwards movement then had a massive effect on miners and pushed many of them into making losses.

However, blockchain infrastructure company Blockware Solutions said that it’s not necessarily the case that miners shut down their rigs right away. Rather, due to contractual obligations and failed treasury management miners often operate at a loss, which forces them to sell more BTC than they mined, which then depletes bitcoin treasury and brings additional sell pressure to the market. They eventually go bankrupt and have to close the doors.

Analysts’ suggestion that “there is a price floor in bitcoin created by the breakeven price of a bitcoin miners’ cost of production” is inaccurate, according to Blockware Solutions. “In fact, selloffs in bitcoin tend to accelerate as price gets closer to the miners’ cost of production. There is a consistent sell pressure on the price of bitcoin, which stems from miners. Price support is actually established by miner capitulation and a net reduction in hash power on the network – favorable difficulty adjustments,” they concluded.

Meanwhile, crypto-mining publication Mining Update said that with the market volatility and potential pandemic-caused obstructions to credit and financing, even those miners who were able to run successful operations at higher electricity prices may end up in a similar situation as a “zombie” Bitcoin miner – one living from paycheck to paycheck, as Charles Edwards, co-founder of digital asset management firm Capriole Investments defined them.

Finally, the pressure on miners also comes from the incoming mining rewards halving in May.

“The key nuance skeptics fail to grasp when thinking about Bitcoin mining, is that the set of Bitcoin miners consists of numerous independent entities with their own cost structures and balance sheets. Miners don’t rise and fall as one, they rise and fall as individuals. Mining is a competition, and the miners that are least competitive simply just lose,” Ryan Watkins, an analyst at crypto researcher Messari, said.

He warned that “mining death spiral fears” to re-emerge again.

“We could see another dramatic decrease in hashrate due to the upcoming block reward halving and continued uncertainty about the coronavirus. Such a scenario may damage the halving narrative (which is nonsense anyways), but is far from damaging Bitcoin. The Bitcoin blockchain will keep trucking along producing blocks every 10 minutes – a beacon of stability in unstable times,” he stressed.

Learn more:

How Will Bitcoin Halving Affect Its Security?